2nd May, 2022

Delhivery is likely to launch its initial public offer (IPO) in the June quarter. The company had filed its draft red herring prospectus (DRHP) in November last year and received the approval from Securities and Exchange Board of India (SEBI) early in 2022.

Delhivery is the largest and fastest growing fully-integrated logistics services player in India by revenue as of fiscal 2021. In the last three years, its business has grown at a compound annual growth rate (CAGR) of 48.49 per cent. The company covers over 17,000 PIN codes and has 20 per cent market share in the e-commerce delivery segment. The company says it has over 21,000 active customers. The Covid-19 pandemic came as a boon for the company that helped it grow its business manifold.

The company has also not shied away from acquiring other businesses to grow. Among the businesses it has acquired are Aramex India Private Limited, US-based Primaseller Inc., FedEx Express Transportation and Supply Chain Services (India) Private Limited, TNT India Private Limited, and perhaps the most important Spoton Logistics Private Ltd.

SoftBank and Carlyle-backed Delhivery plans to raise Rs 5,000 crore through fresh issue of shares while the IPO will have an offer for sale (OFS) component where some of its existing investors will sell shares worth Rs 2,460 crore. This takes the total expected size of the IPO to Rs 7,460 crore.

Below are 5 reasons why buying in Delhivery unlisted shares ahead of the IPO makes sense:

High Growth Opportunity

Indian logistics market presents a large addressable opportunity, with direct spends on logistics of $216 billion in FY20 and is expected to grow to $365 billion by FY26 at a CAGR of 9.1 percent – and Delhivery plans to have a big pie of that growth.

Moreover, now with government focussing on logistics, the company growth in the segment will be driven by strong underlying economic growth, a favourable regulatory environment, growth of domestic manufacturing, rapid growth of the digital economy and improvements in India’s transportation infrastructure.

The segments of the industry in which its major business lies — express parcel delivery, express PTL and warehousing, and supply chain services – are likely to outpace the overall growth in the industry. Organized players like Delhivery are expected to benefit from the continued growth of e-commerce and the emergence of new business models such as D2C, social commerce and eB2B, which rely heavily on 3PL express delivery.

IPO Details

The company plans to raise Rs 5,000 crore while existing shareholders will sell shares worth Rs 2,460 crore crore via OFS. In the OFS, among those selling part of their holdings are CA Swift Investments, Deli CMF Pte. Ltd., SVF Doorbell (Cayman) Ltd and Times Internet Limited. Besides, founders Kapil Bharati, Mohit Tandon and Suraj Saharan will also offload their shares.

The company plans to use the net proceeds for funding organic growth initiatives, funding inorganic growth through acquisitions and other strategic initiatives and general corporate purposes.

News reports have said the company was seeking a valuation of around $6-6.5 billion for its listing, though that may seem a little far-fetched now as the market sentiments have deteriorated now. But still given the growth prospects and company’s leading position in the market, it may find enough takers even at a slightly premium valuation.

Finances

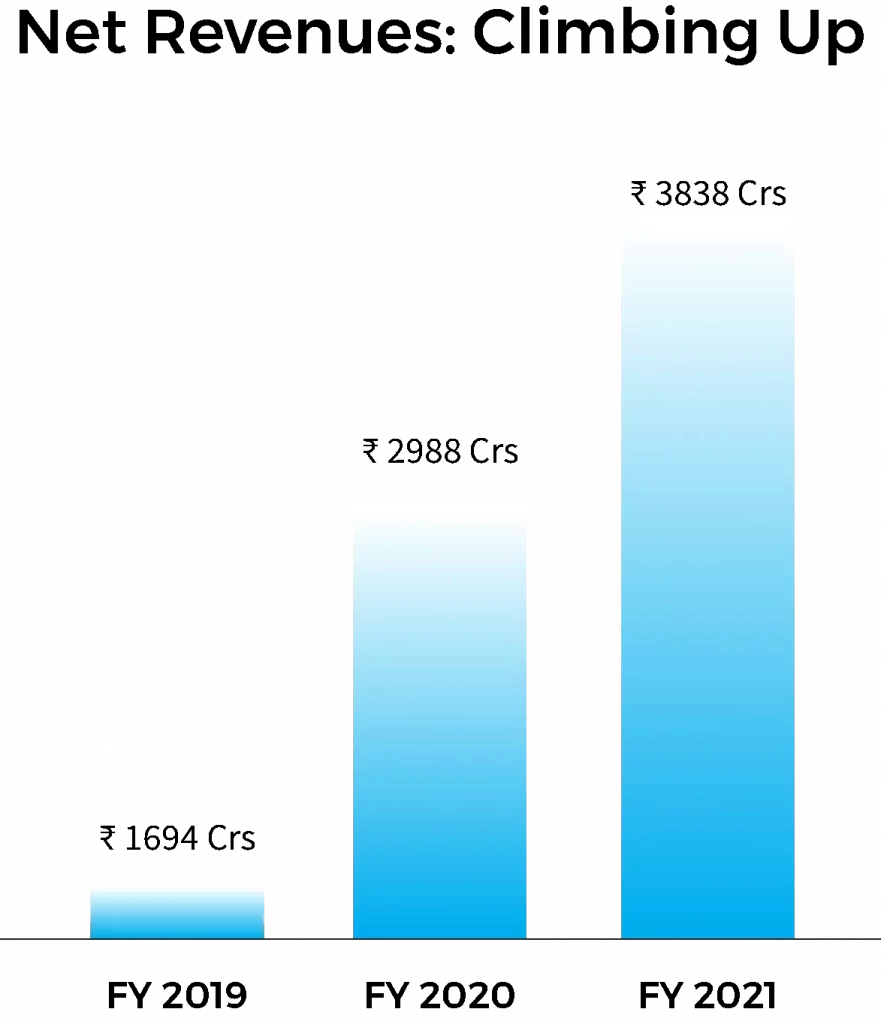

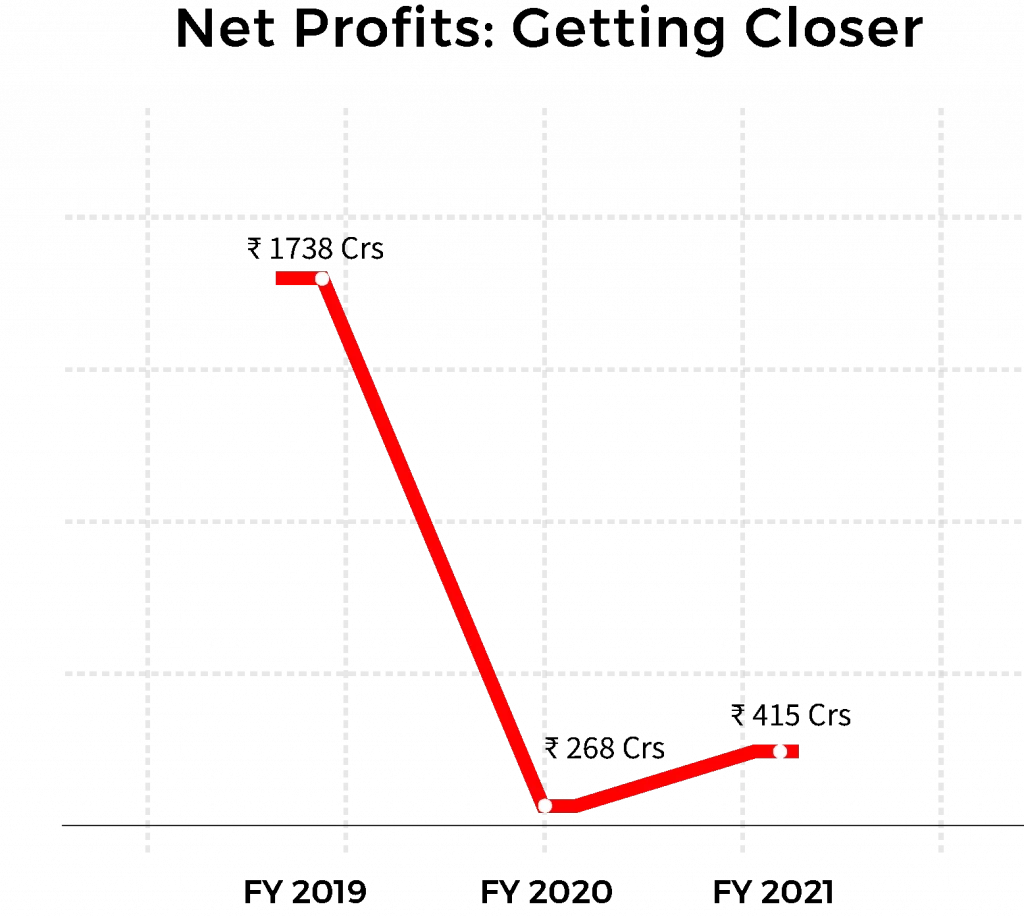

The company has reported losses in the last three years, though that has come down substantially as its business picked up. Revenues have more than doubled from FY19 to FY21 while losses stood at one-fourth of the level in FY19.

In the last three fiscal years FY21, FY20 and FY19, revenues stood at Rs 3,838.29 crore, Rs 2,988.63 crore and Rs 1,694.87 crore, respectively. Losses were at Rs 415.74 crore, Rs 268.93 crore and 1,783.30 crore, respectively.

Valuation & Risks

Currently, unlisted shares of Delhivery trade around Rs 700-750. At this price, investors are paying around Rs 11 for every rupee of sale it is making at on a standalone basis. Including Spoton, the ratio comes down to around 9. In comparison, Blue Dart Express trades at five times its sales, Mahindra Logistics one times and TCI Express at about eight times. (Find here the current share price of Delhivery)

So, apparently the market is already paying a premium for market leading growth of Delhivery. Though, if the prices come down a bit, say around 8 times its sales, then definitely buying Delhivery’s unlisted shares makes sense.

To be fair, the current prices are not too expensive, given how TCI Express is valued, though post listing gains may be limited for you if you buy now.

Among key risks to this assessment is inability to make a profit in near future, drop in revenue growth, loss of any of its major clients and inability to perform amid increased competition.

Read more blogs here: