4th June, 2022

If you have ever ridden a motorcycle in India, you must have heard of Studds. The name is almost ubiquitous with helmets in the country, given its popularity and trust of its users. The brand name is owned by Studds Accessories.

The company is the world’s leading helmet manufacturer and commands one-fourth of the market share in India. Its products are also exported to motorcycle lovers in at least 45 countries. Besides helmets, the company also makes other accessories like jackets, gloves, side boxes, top boxes and goggles.

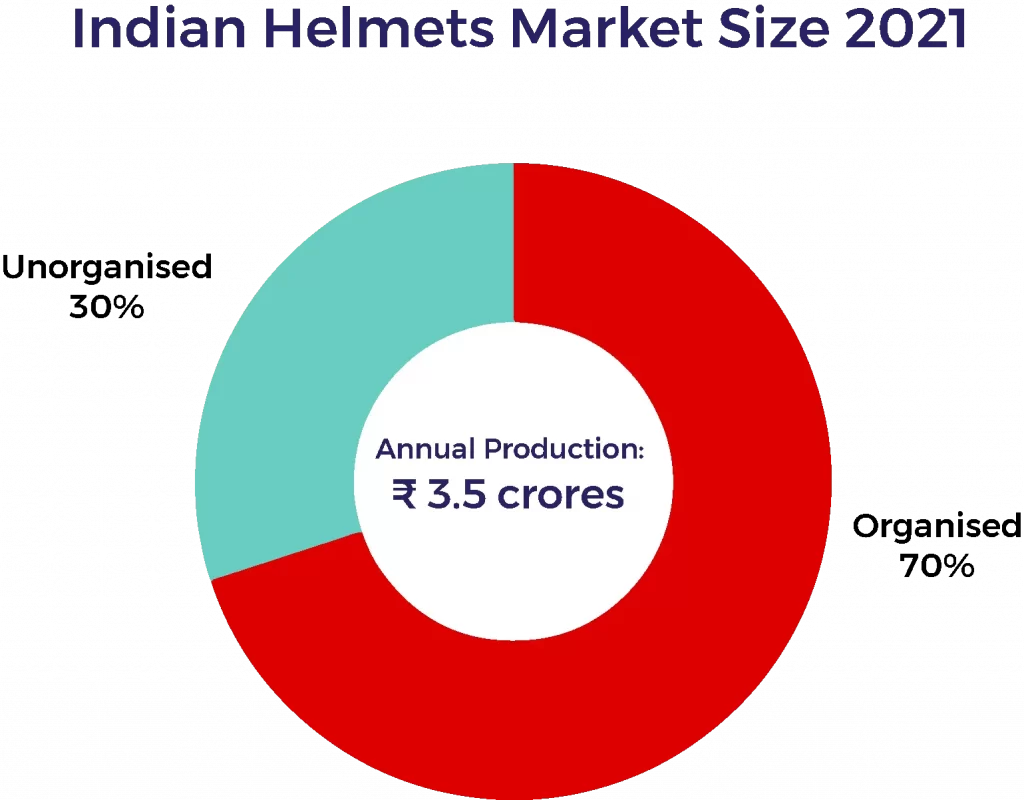

Market Overview

India is the largest market for 2-wheelers as well as one of the world’s most competitive for helmet manufacturers with 35 million units produced each year. The market is expected to grow at a compound annual growth rate (CAGR) of 25 per cent as per certain estimates.

Moreover, regulations that make helmets mandatory even for kids, and prohibit non-ISI certified helmets on the road, will lead to rapid growth for organised players in the market.

Where Does Studds Stand?

Studds Accessories, which started its journey in 1973, makes about 7 million helmets every year. It has four factories – all located in Faridabad — equipped to deliver over 13 million helmets per year.

It also has one subsidiary SMK Europe Unipessoal LDA based in Portugal, which markets helmets under the premium SMK brand.

During the pandemic, the company saw a crisis and an opportunity. While the sale of helmets plunged, it started making face shields and face masks. As the pandemic has ebbed, things are normalising for the industry and the company.

Studds is a relatively debt-free company. It is expanding its retail presence through dealerships and exclusive brand outlets and aims to double its exports presence in the coming three years. It also plans to expand its factory output to maximum possible, cornering 40 per cent of the market.

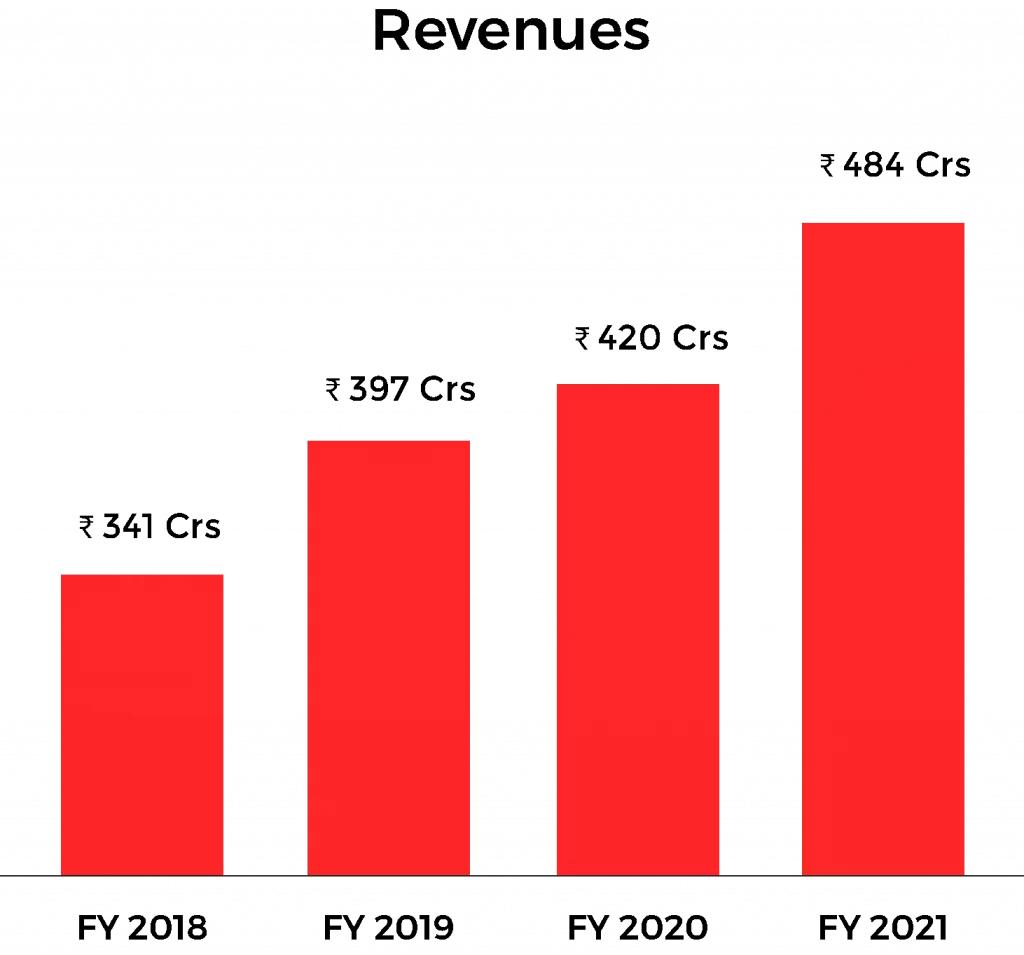

Financial Performance

Studds Accessories is a profitable company with a history of paying regular dividends. Between fiscal 2018 to 2021, the revenue of the company has grown at a CAGR of 12 per cent from Rs 309 crores to Rs 479 crores.

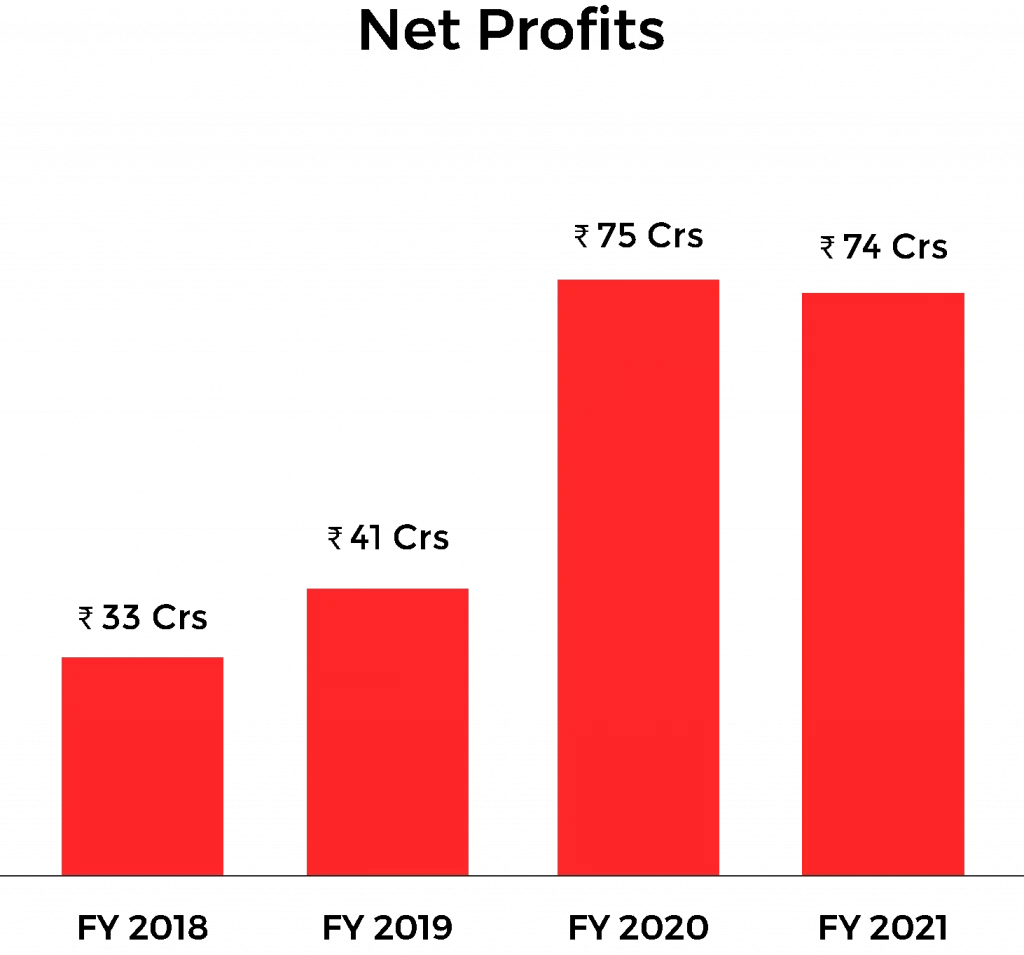

The profit after tax or PAT has grown at 22 per cent per year from Rs 33 crores to 74 crores, despite the impact of the pandemic. The net worth of the company has zoomed at a yearly rate of 25 per cent in this period.

The return of capital employed (RoCE) for the company is at a high 38 per cent – among the highest in the industry — while return on equity (RoE) is also at an impressive 25 per cent, also in the top rungs.

Peer Comparison

There are no listed peers of the company. Some of its biggest competitors are Vega Auto Accessories, Steelbird Hi-Tech India and Sai Group that makes Aerostar helmets.

Price and Valuations

The unlisted shares of Studds Accessories trade in the range of Rs 1200-1300 apiece. At this price, the price to earnings (PE) ratio comes out to be 36.29. This, though is higher compared to the auto ancillary industry PE of 23.84, but it is still much lower than the likes of Motherson Sumi, SAR Auto, Minda Industries, Subros and Autoline Industries that are trading at a PE of 60-200 times despite growing at a much slower rate and delivering inferior returns on capital or equity. (Click here to know the latest share price of Studds Accessories Ltd)

Conclusion

With such a presence in the market, and an impressive growth trajectory supported by favourable regulations, it makes sense to buy shares of Studds Accessories. Though they are only available in the unlisted market as it is yet to list on exchanges.