20th May, 2022

Le Travenues Technology, which operates travel platform Ixigo, is likely to launch its initial public offer (IPO) soon. The company has already obtained market regulator SEBI’s approval for the same. Though news reports had reported about its plan to launch the IPO in February of this year, bad market conditions led to delays.

Now, again when the market has slightly normalised, and the travel industry in which the company operates, has revived following the devastating pandemic, it could be the best time to grab the unlisted shares of Ixigo.

Below are some of the key reasons explaining why any growth investor should consider buying its shares:

About the Company

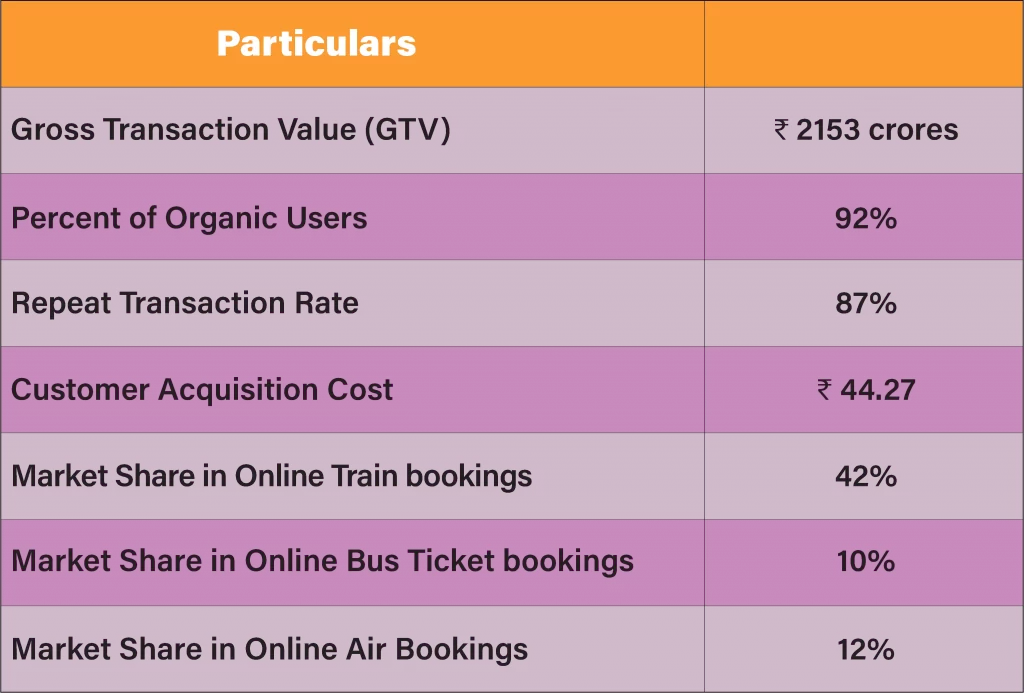

The company operates brands like Ixigo, ConfirmTkt and AbhiBus—catering to travellers of flights, trains and buses, respectively. It claims to be the largest Indian online travel agent (OTA) in the train bookings segment in fiscal 2021.

Its bus-focused app, AbhiBus, was the second largest bus-ticketing OTA in India, with around 10 per cent market share in fiscal 2021.

The company claims itself to be the third largest flight OTA in India with a market share of 12 per cent.

Growth: Let the numbers talk

Ixigo claims to be the second largest OTA in India in terms of total gross transaction value (GTV) in fiscal 2021. Taking into account the operations of Confirm Ticket and AbhiBus (both of which are acquisitions) its combined GTV was Rs 2153 crores in FY21.

The company said it had the highest app usage among OTAs with 3.75 crore users and it was the fastest growing OTA in terms of app downloads, with 37 lakh monthly app downloads in March 2021, which was more monthly downloads than all other OTAs combined in that month.

Some of the other growth numbers are: 41.59 per cent CAGR in transactions during FY19-21; 87 percent repeat transaction rate, 93 per cent bookings from Tier II and Tier III cities; 6.5 crore registered users. The company says it has a deep penetration in the ‘next billion user’ market.

Its focus is also largely there, which shows it has a great growth potential going ahead, given the untapped potential of the market.

Charting Growth

The total Indian travel market has grown at a CAGR of 10 per cent between 2015 and 2020 and was worth approximately Rs 3.90 lakh crore in 2020. The market size is expected to grow by 7 per cent and reach Rs 5.01 lakh crore by 2025.

The OTA industry increased from a gross booking revenue of Rs 28,400 crore in 2015 to Rs 97,800 crore billion in Fiscal 2020, at a CAGR of 28 per cent. While COVID-19 pandemic has impacted the industry, it is expected that the Indian OTA industry will reach Rs 1.8 lakh crore billion in 2024.

“Based on our large and loyal user base, our comprehensive travel utility and technology based transactional offerings, our experienced management team and our ‘next billion user’ focused strategy, we believe that we are well- positioned to capitalize on the burgeoning Indian travel market,” the company management says in its IPO prospectus.

Acquisitions

Apart from growing organically, the company has also managed to grow inorganically as well. The company in 2021 acquired Confirm Ticket, a train-utility and ticketing focused business, and AbhiBus, which is focused on online bus ticketing.

Thanks to the acquisition, the company claims to be a profitable one on a consolidated basis– a rarity among tech based startups.

Robust Financial Performance

The company said its total revenue income from operations have grown at a CAGR of 83.26 per cent between FY19 and FY21 and were Rs 42 crores, Rs 112 crore and Rs 138 crore during fiscal 2019, 2020 and 2021, respectively. The company’s net profits would come in at Rs 7 crore.

The company has not yet provided financial data for FY22 either partially or wholly in its prospectus.

Peer Comparison

The company competes with the likes of Makemytrip, Yatra, Cleartrip, Goibibo and Redbus. Among listed companies in India, EaseMyTrip is perhaps the closest competitor the company has.

EaseMyTrip had reported Rs 106.69 crore revenue in FY21. Its net profits, though, were much higher than Ixigo, at Rs 62.30 crore, reflecting the high profit and operating margins in the industry.

If Ixigo is able to trim down its expenses, the potential is immense for shareholders.

IPO Details & Key Investors

The Ixigo IPO comprises a fresh issue of shares worth Rs 750 crore and an offer-for-sale (OFS) of equity shares worth Rs 850 crore by existing shareholders. This will take the total issue size to Rs 1600 crore. The company plans to use the proceeds from fresh issue of shares for organic and inorganic growth initiatives, and general corporate purposes.

As part of the OFS, SAIF Partners India IV will offload shares worth Rs 550 crore, Micromax Informatics shares worth Rs 200 crore and co-founders Aloke Bajpai and Rajnish Kumar worth Rs 50 crore each.

Currently, SAIF Partners holds 23.97 per cent stake in the company, Micromax 7.61 per cent, Aloke Bajpai 9.18 per cent and Rajnish Kumar 8.79 per cent. Besides them, SCI Investments holds 16.2 per cent, Gamnat 9.89 per cent and Fosun 3.69 per cent.

Valuation & Risks

EaseMyTrip is currently valued at Rs 7,775.72 crore. Going by the current unlisted share price of Ixigo, which hovers around Rs 190-200, the company is valued at around Rs 7,000 crore.

(Click here to know the latest share price of Ixigo unlisted shares)

EaseMyTrip trades at a price-to-sales multiple of 73 at the above stated market cap. In comparison, Ixigo shares – including the impact of its acquisitions – trades at a multiple of 38 times. This makes Ixigo unlisted shares mouth-wateringly cheap.

Though, before you buy Ixigo unlisted shares, you should know some risks.

The company is yet to show meaningful profit-making capabilities unlike EaseMyTrip. It also trades at thin margins, which might make its life difficult if there are other Covid-19 like contingencies.

Moreover, other risks include dependency on contract with IRCTC, heavy competition, etc.