04 Jul, 2022, Blog

Author: Delisted Stocks Team

04 Jul, 2022, Blog

Author: Delisted Stocks Team

HDFC Securities Limited (HSL) is one of the leading full service brokerage firms in India. It is a subsidiary of HDFC Bank. The company primarily provides broking services to all kinds of investors and traders active across various asset classes, such as equity, gold, debt, and real estate.

HDFC Bank holds 96 per cent stake in the company. The rest of the stocks are with employees and some individual investors. There are ample reasons for you to buy some of the unlisted shares of HDFC Securities, including its strong growth.

Recent Earnings

The Covid-19 pandemic came as a boon for the company, along with the entire capital markets industry. For the quarter ended March 31, 2022, HSL's total income grew by 16 per cent to Rs 509.7 crore on a high base, as against Rs 440.7 crore in the same period last year. Profit after tax for the quarter was at Rs 235.6 crore, as against Rs 244.5 crore, down slightly. For FY22, HSL's total income grew by 42.2 per cent to Rs 1,990.3 crore. Net profit for the year was Rs 984.3 crore, a growth of 40 per cent over Rs 703.2 crore in the previous year.

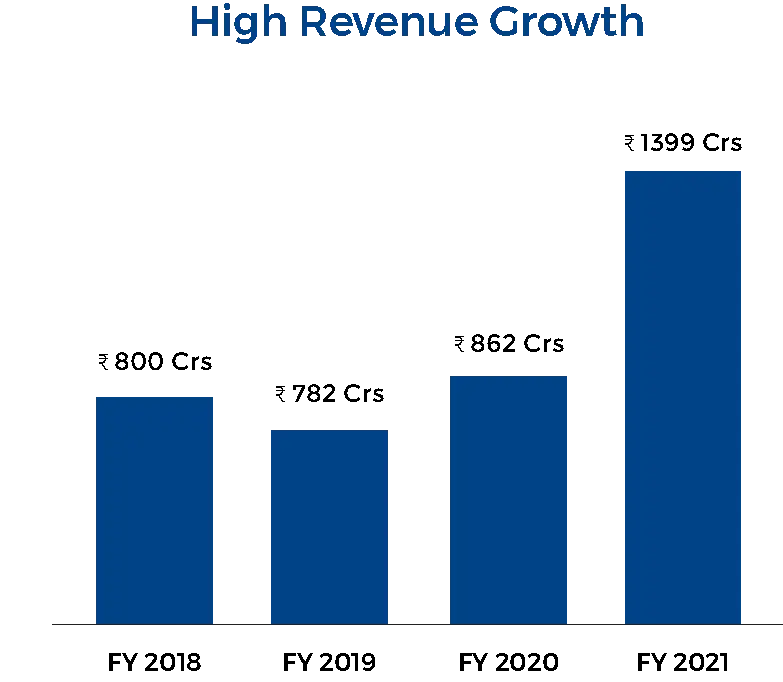

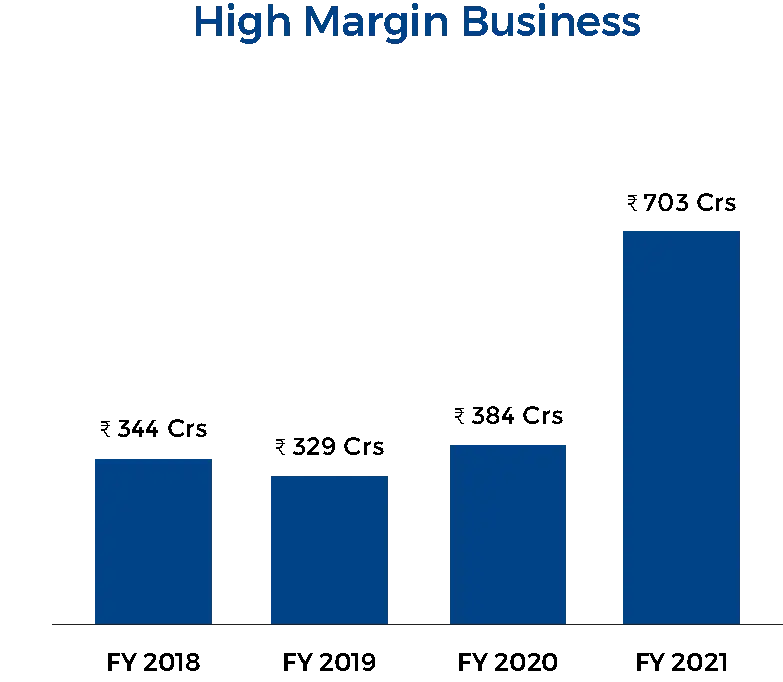

Though the growth is likely to slow down, as projected by CRISIL, it will still be attractive given how the financialization of savings is happening in the country. In the last four years, Business growth has been high with PAT CAGR at 24 per cent. Revenue CAGR in the period stands at 29 per cent.

Tech Adoption

The company has taken strides in technology adoption in recent years. In FY21, the company had over 10 lakh transacting customers, featuring in the top 5 of all broking houses in India. It said more than 10 lakh customers of the company were using digital channels to trade now.

The brokerage generated from the mobile application in FY21 was 50% of the total brokerage earned as compared to the 32 per cent last year. The company has also made onboarding digital which has led to increased face of user base growth.

Next Gen Products

The company has many products that make trading easy and are popular among its tech-savvy clients as well:

Basket investing: A basket of stocks in which the investors can invest in one go. Similar to smallcases.

Global investing: Provides access to the global market, primarily the US.

EQ optimizer: A tool that does an instant x-ray of an investor’s portfolio and makes recommendations on whether it is aligned with their goals.

MF Optimizer: It uses advanced algorithms to help investors analyse their mutual fund investments.

ProTerminal: It is an advanced platform that gives traders, researchers, and analysts comprehensive news, trends, and predictions.

Institutional and retail research: It caters to the requirements of clients and provides in-depth coverage on sectors and stocks.

Upper Hand Over Peers

In recent years, the broking industry has become crowded with a number of new and old players including Zerodha, Angel One, Upstox, gaining market share.

However, HDFC Securities has an upper hand in form of the client base of HDFC Bank, which can cross-sold broking products. It also provides 3-in-1 broking accounts which give customers a seamless trading experience.

It has also launched zero brokerage plans to compete with discount brokers.

Premium Valuation

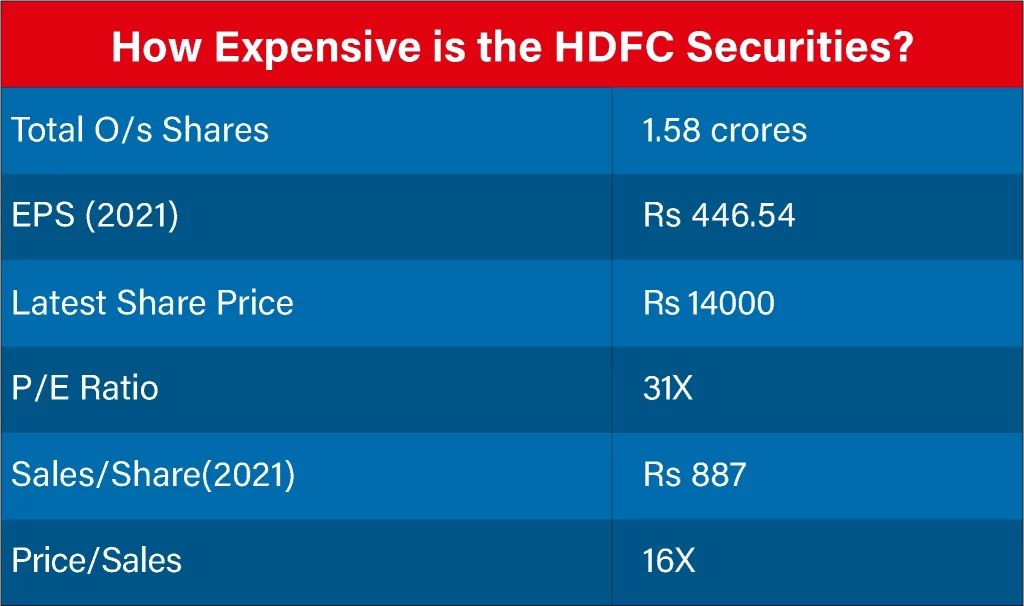

HDFC Securities stock has been a consistent compounder in the recent years, by more than doubling in the last two years. The stock trades in the range of Rs 13,000-14000, and is fairly valued. AT FY22 EPS, the stock trades at 22 times its earnings. In comparison, Angel One and Motilal Oswal trade at 16-17 times. ICICI Securities trades at 10 times.(check the latest share price of HDFC Securities here)

The premium pricing of HSL shows investor confidence in its growth and marquee backing. Investors can wait for a dip and invest in the stock. One thing investors should keep in mind is that it is a high dividend-paying stock. In FY21, it paid dividends at a mouthwatering Rs 318 per share.

Risks

Among key risks are likely slow growth in the next few years and any inability to cope with fierce competition in the broking industry.

Read our Other Blogs: