31 Mar, 2022, Blog

Author: Delisted Stocks Team

31 Mar, 2022, Blog

Author: Delisted Stocks Team

API Holdings, the parent company of PharmEasy and Thyrocare Technologies, has received the Sebi’s nod to float its initial public offer (IPO). The company plans to raise Rs 6,250 crore from primary market investors by issuing fresh shares to them.

It will join a number of startups that have landed on Dalal Street recently including Zomato, Paytm, Policybazaar and Nykaa.

However, given the market conditions and the plight of startup stocks after being listed, some of you might wonder if it makes sense to invest in API Holdings IPO.

The company plans to use the IPO proceeds for prepayment or repayment of all or a portion of certain outstanding borrowings availed by the company and subsidiaries, to fund organic growth initiatives, and pursue inorganic growth opportunities through acquisitions and other strategic initiatives.

Though the company is relatively new but in a short span it has established a business that is enviable. It has not just acquired some of the profitable businesses but also attracted marquee investors.

And, what is more, none of them are selling shares during the IPO, which reflects their trust in the company.

Below are the five reasons why you should invest in the API Holdings (PharmEasy) shares:

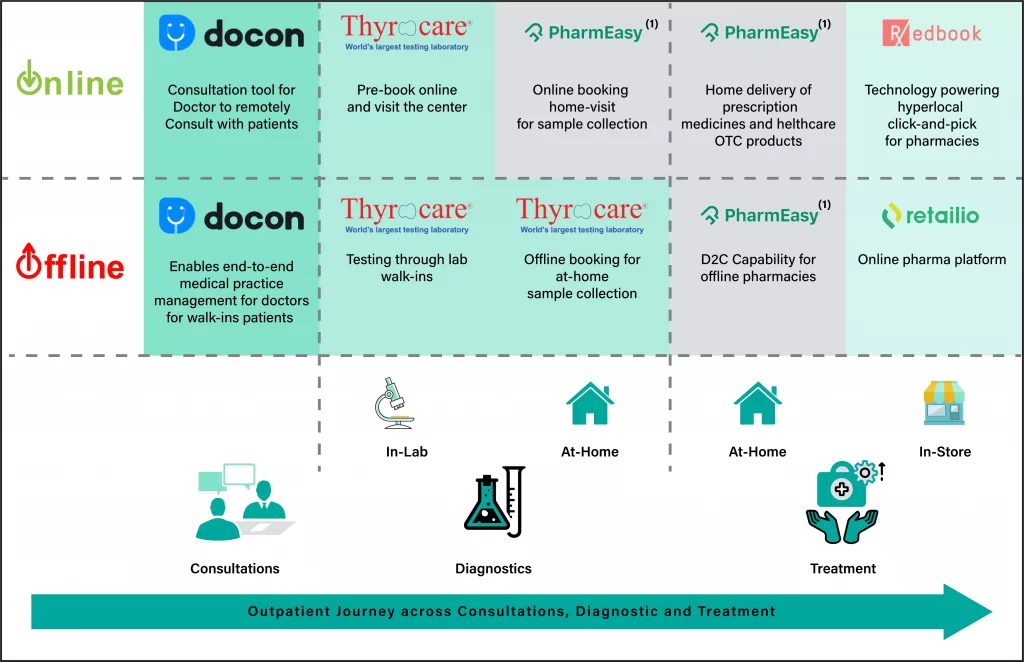

Horizontally Integrated Business model

API Holdings is a holding company that owns and manages PharmEasy, Docon, Thyrocare Technologies, Aknamed and Retailio brands. The company claims to be the largest digital healthcare platform based on gross merchandise value (GMV) of products and services sold for the year ended March 31, 2021.

The company is trying to create its presence across the entire healthcare vertical- consultations, medical diagnostic and treatment. The company, either through its acquisitions or starting businesses from scratch, is a major player in medical diagnostic services, software services, teleconsultation, and online pharmacy, including B2B and B2C.

Market Leader

The company in its IPO prospectus said its pro forma GMV was Rs 7,865 crore during fiscal 2021 and Rs. 3,026 crore, for three months ended June 30, 2021. This latter data includes the GMV contribution from its acquisitions of Ascent, Medlife, Aknamed and Thyrocare as these were acquired on April 1, 2020.

The company boasts of 87,000 pharmacies, 3,200 active wholesalers, 4,600 prescribing doctors, 900 hospitals, 2.5 crore registered users, 24 lacs active users, 1.07crore digital prescriptions a year, 5.65 lakh daily clinical investigations and 3.4 million e-consultations a year, largest so far in the industry. The company provides access to 97% of the Indian PIN codes for its vendors and suppliers and claims 79% repeat orders.

The business outlook looks very bright as the penetration of online players in the healthcare system is still at a nascent stage compared to developed markets of USA and China.

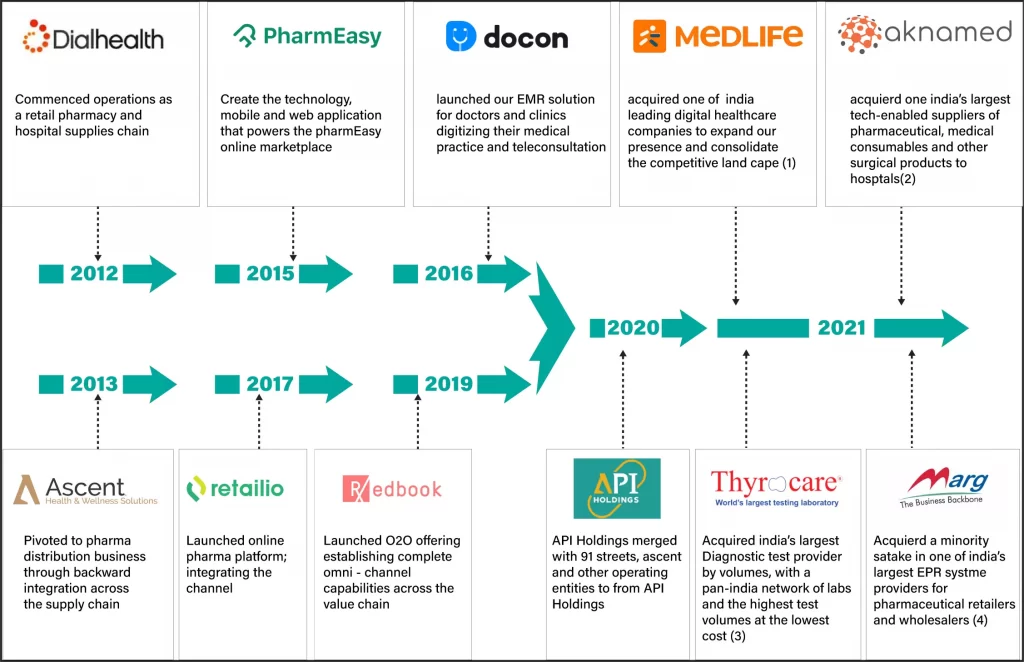

Growth fueled by Strategic Acquisitions

In the last few years, the company pursued scaled acquisition of complementary businesses, to expand its product offerings in the digital healthcare segment. That has helped its business portfolio grow manifold and the company funded these acquisitions by raising funds from institutional investors.

It acquired Docon (June, 2016), provider of EMR, teleconsultation and clinic management services to doctors and clinics, Medlife (January, 2021), leading online pharmacy retailer, Thyrocare (September, 2021), India’s largest medical diagnostic company, Aknamed (September, 2021), India’s largest pharmaceutical and medical products supplier to hospitals, Marg ERP (October, 2021), India’s largest ERP provider for pharmacies and wholesalers.

Among the key competition for PharmEasy and allied businesses are some deep-pocketed names like Reliance Industries-backed NetMeds, Tata-backed 1mg, Amazon Pharmacy and Apollo Health. The proceeds from IPO will provide it with warchest to fight the competition efficiently.

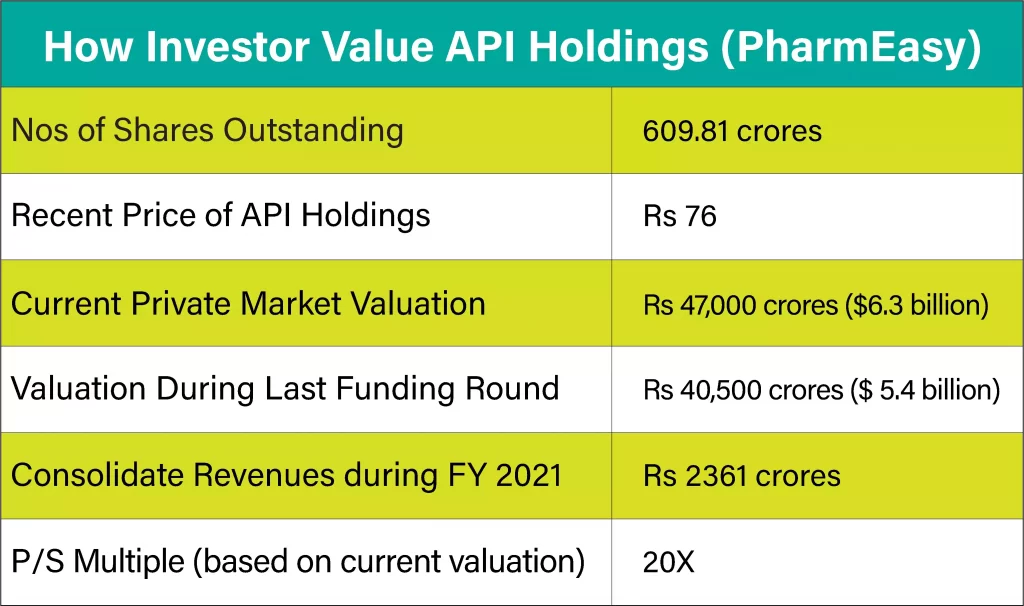

Steadily Growing Valuation

The company has seen various debt and equity funding rounds led by investors like Naspers Ventures, Temasek, TPG Growth, Lightstone Fund, CDPQ (Canadian pension fund), JM Financials and TIMF Holdings.

Going by the current price in the unlisted market at Rs 76, API Holdings is currently valued at Rs 47,000 crore or around $6 billion. This is at the same level of its November 2021 valuation when it raised $350 million from a host of investors at the similar valuation. [Click here to know the latest market price of API Holdings (PharmEasy) unlisted shares]

It generated sales of Rs 3.87 per share during FY21. That implies, investors are currently willing to pay Rs 19-20 for every rupee of sales it generated during FY21. Keep in mind that this may exclude revenue figures of its latest big-ticket acquisitions of Thyrocare and Aknamed.

In comparison Apollo Hospitals Enterprise Ltd, listed healthcare services provider and owner of Apollo Pharmacy, is trading at a price to sales ratio of 4. Other healthcare stocks like Sun Pharma, Dr Reddy Laboratories and Dr Lal Pathlabs are trading between 4-15 times their sales.

API Holdings is commanding premium valuation from the investors due to its tech-driven & scalable business model, market leadership position in respective business segments, well-integrated business model, and growth-minded management.

On Road to Profitability

Due to its consistent focus on business growth, the company reported losses during the last three years, according to the draft prospectus. During FY20, FY21 and first three months of FY22, API Holdings reported losses of Rs 335 crore Rs 640 crore and Rs 324 crore, respectively.

Though keep in mind that this data may not reflect profits of Thyrocare Technologies, the acquisition of which was announced in June 2021. The lab operator is a profitable company (FY 2021 profits: Rs 113 crores) and will likely cushion losses from API Holding’s other ventures.

Key Investment Risks

Among key investment risks of investing in API Holdings is the delay in path to profitability. The company is currently focussing on scaling up the business and capturing higher share of healthcare spend of its users, which may delay profits for it. Though the company got SEBI approval to bring out its IPO in February, the timing of its listing is yet not clear as the market has remained volatile.

Read our other blogs: