07 Feb, 2022, Blog

Author: Delisted Stocks Team

07 Feb, 2022, Blog

Author: Delisted Stocks Team

Cricket is not just the most popular sport in India, but for many, it is a religion. Every match that India plays—whether ending up winning or losing—evokes emotions.

And, every match sees transactions of millions of dollars in terms of advertisement, broadcasting, match fees and betting,-meaning the business potential of cricket is huge.

In this business side of cricket, there is perhaps no better institution than the Indian Premier League (IPL). This is the sporting event, held annually, which attracts hundreds of cricketing stars and newbies from across the world, and with it a truck load of money.

Being an investor, if you are thinking how you can get a piece of this business opportunity, there is only one easy answer.

The only way is to own shares of teams that participate in the IPL, and the best and perhaps only option for you right now is Chennai Super Kings (CSK).

Why, you ask? Well, read on…

Kings on the field

As Baba Ranchoddas in the movie 3 Idiots says: Do not run after success, try to achieve excellence. Success will come running after you.

CSK has proven its excellence on the cricket field so many times that success has become its middle name.

In the cricketing world, it is often said that the IPL is a tournament where the rest of the teams compete to figure out who will play CSK in the finals. It has played nine finals out of 14 editions of the event, winning four.

There was just one edition where it did not finish in the top four.

Please note that it did not play in two editions because of a ban. It has the highest winning percentage in the tournament (59%).

The overwhelming success on the field has made CSK one of the most followed brands in cricket. And, as in most cases, where there is a following, there is money—CSK is no different.

Superior Investor Returns

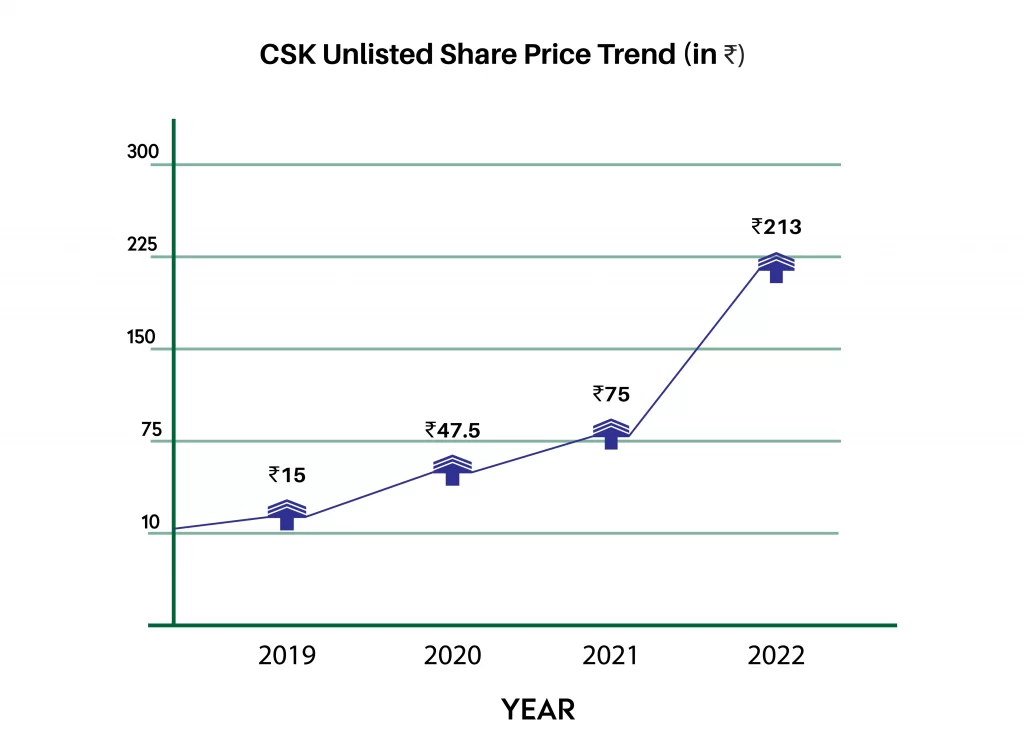

With its exploits on the field, shares of the Chennai Super Kings have also surged manifold in the last few years.

CSK Unlisted Share Price is currently trading at around ₹ 200. This compares with just ₹ 15 three years back—meaning it has multiplied investor wealth by over 13x during this period. (check the latest price of CSK here)

The share price of CSK has more than doubled in the past few months and quadrupled in the last two years.

CSK also recently became the first Indian sport unicorn, i.e., a company with over $1 billion valuation. It is currently valued at ₹ 7,600 crores, higher than its parent India Cements which is valued at around ₹ 7,000 crores.

Only choice

The problem with IPL teams is that even if you, as a retail investor, want to invest in other franchises, you just cannot.

CSK is the only team whose shares are currently available in the unlisted market for retail investors to gain exposure to IPL and cricket.

The recent attained ‘unicorn’ status, first in the sports industry, adds to its charm.

Attractive Valuations

If you want to know the CSK Share Price or Planning to buy CSK shares, but think why bother given it has already surged so much, you may be missing a golden opportunity.

Recent deals in the IPL, reflects why share price of CSK may continue its rally.

The Sanjiv Goenka-led RPSG Group bought the Lucknow franchise (Lucknow SuperGiants) for ₹ 7,090 crores, while CVC Capital acquired the rights for the Ahmedabad franchise for ₹ 5,625 crores.

So if these teams, which are yet to play a single game, can be valued at such lofty valuations, CSK, being the most successful team on the block and with a positive track record, definitely deserves premium valuations.

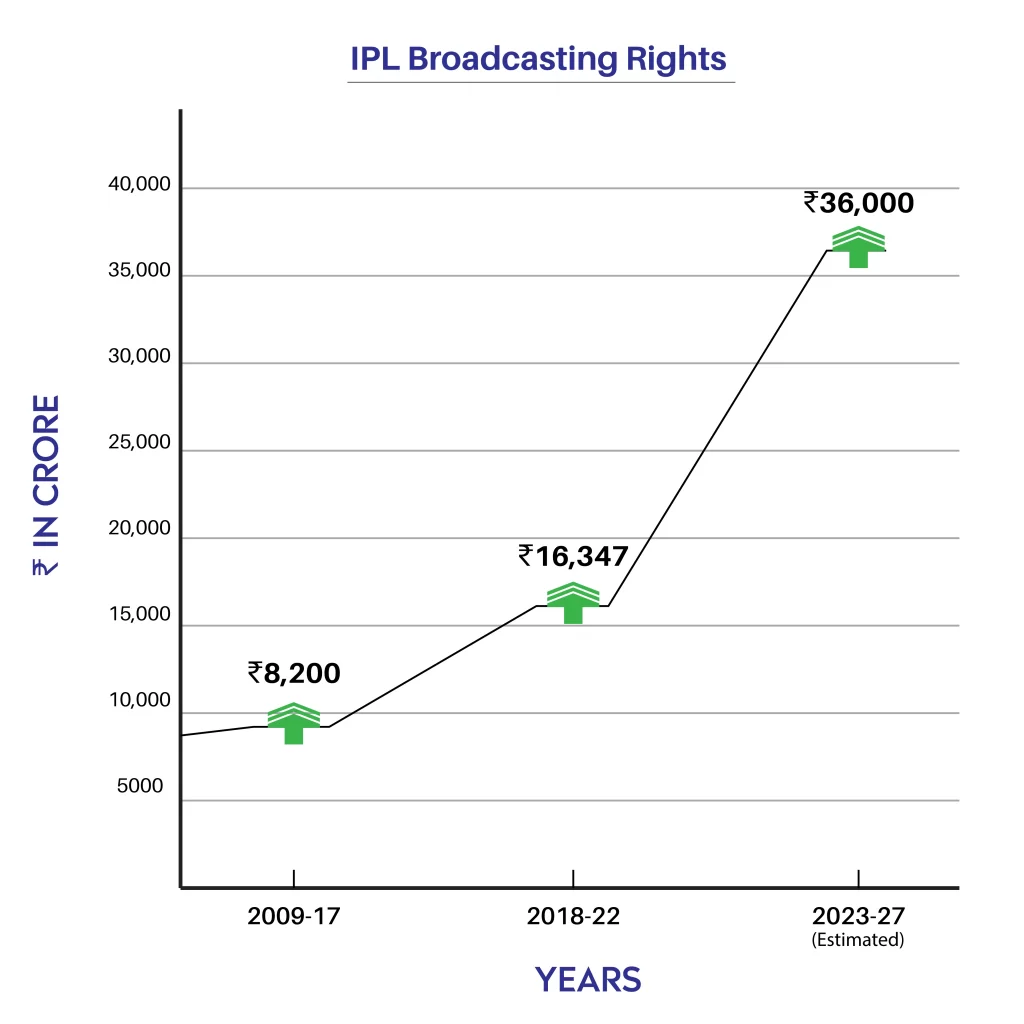

Moreover, every time the Board of Control for Cricket in India (BCCI) renews the broadcasting rights deal for the IPL, the bidding war only gets intense.

Star India had bought IPL's media rights for the 2018-22 cycle for ₹ 16,347 crores. Before that, Sony Pictures Networks held the media rights for 10 years, for which it had paid ₹ 8,200 crores.

The next deal is likely to see even bigger numbers as there will be more matches per year now.

CSK is sure to benefit from the constant rise in value of IPL media sponsorship rights, say analysts.

Smart money moving in

There is an adage on Dalal Street: Follow the smart money.

It basically means if you are trying to find value investment, always look for where reputed investors are investing.

The logic behind this is that as they have a better understanding of the market and businesses, they are less likely to make an error.

CSK also boasts some of the most successful investors behind its back.

India Cements is its largest shareholder, owning 30% stake. Life Insurance Corporation (LIC) holds another 6% in the company. Radhakishan Damani holds about 3% in the firm.

If these names are still not enough, then there is a long-term association with Mahendra Singh Dhoni, who still remains one of most loved cricketers in India. His brand value adds to CSK’s charm.

Call us at +91-8368304039 or email us at ops@delistedstocks.in to invest in the CSK brand.