- Buy & Sell

- Company Overview

- Registered Office

- Board of Directors

- Key Business Highlights

- Ratios

- Financial Highlights

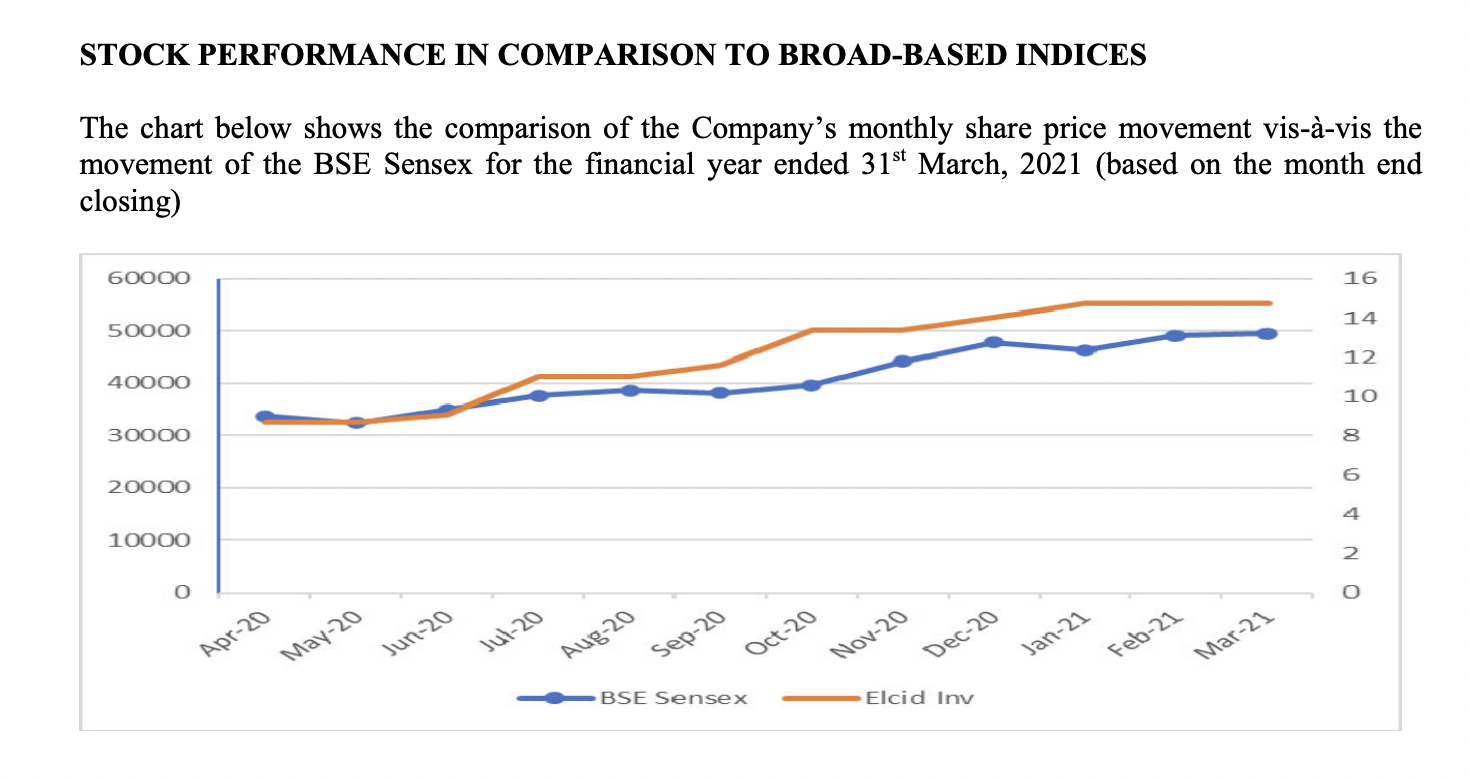

- Financial Charts

- Share holding Patterns

- Peer Comparison

- Media Updates

N/A

Elcid Investment Limited Unlisted Shares

Elcid Investments Ltd. was incorporated in the year December 03, 1981. The Company is fundamentally a speculation organization and its business pay shows up out of ventures held by the organization. As of 31 March 2019, the Company had two subsidiaries viz. Murahar Investments and Trading Co. Ltd. and Suptaswar Investments and Trading Co. Ltd.

| Symbol | Elcid Investment Limited Unlisted Shares |

|---|---|

| Face Value (₹): | 0 |

| ISIN: | INE927X01018 |

| Demat Status: | NSDL & CDSL |

| Lot Size: | 2 Shares |