14 Nov, 2022, Blog

Author: Delisted Stocks Team

14 Nov, 2022, Blog

Author: Delisted Stocks Team

The Reserve Bank of India, having considered it necessary in the public interest and being satisfied that for the purpose of enabling the Bank to regulate the credit system to the advantage of the country, it is necessary to amend the Non-Banking Financial Companies Acceptance of Public Deposits (Reserve Bank) Directions, 1998, in exercise of the powers conferred by Sections 45J, 45K and 45L of the Reserve Bank of India Act, 1934 (2 of 1934) and of all the powers enabling it in this behalf, hereby directs that the said directions contained in Notification No. DFC. 118 / DG (SPT)-98 dated January 31, 1998 shall stand amended, with immediate effect.

Non-Banking Finance Companies (NBFC) could be the worst hit in an environment where cost of funds is rising, as the difference between their rates and the benchmark widens in an upwardly inclined rate gradient. Profit margins at NBFCs had recently drawn a raft of investors, and could also shrink as they would not be able to pass the entire rise in financing costs to customers.

Currently at Rs 70,754 crore, deposits held by NBFCs have grown over 40% since the financial year 2019-20. The growth comes despite the number of NBFCs accepting deposits shrinking to 41 in 2021-22 from 271 in 2011-12. The higher rate of interest offered by NBFC on deposits compared to commercial banks is the main reason behind the growth. Even though small finance banks also offer comparable interest rates on deposits, their offerings haven't proven as lucrative. “NBFCs push their fixed deposit products through intermediaries who get commission on deposits, whereas bank officials are more interested in selling life insurance products.

Amid rising interest rates, NBFCs and home financiers (HFCs) are expected to see an increase in their cost of funds. It is believed that Credit costs, which have been rising for the past couple of years, should decline this fiscal year because most NBFCs hold substantial provisioning buffers. It should offset some of the impact of higher interest rates on profitability. Profit margins at NBFCs, which had recently drawn a raft of investors, could also shrink as they would not be able to pass the entire rise in financing costs to customers.

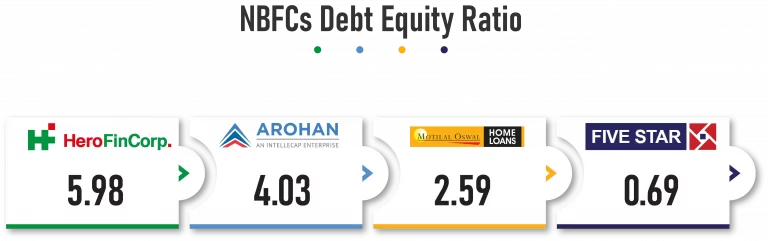

NBFCs are moving toward borrowing for the shorter tenure, unable to pass on the increase to borrowers. Yields on 10-year sovereign bonds have been hovering around 8 % for about a week now having breached the mark for the first time since 2015. Some larger NBFCs are also planning to meet a part of their funding requirements through retail bond issuances during the year where interest rates offered are generally higher by 25-75 bps.

The shift in portfolio mix toward higher yielding non housing loans helped NBFCs to partly offset the pressure on yields in the housing loan segment last year. However, interest spreads may shrink as lenders may not be able to fully pass on the increase in their cost of funds to the end borrowers. However, NBFCs have avenues to earn fee based income and have the potential to earn better returns. To maintain the spreads, NBFCs resorted to short tenure borrowings, which are generally 50-100 basis points cheaper than longer-tenure borrowings.

While the ‘borrow short and lend long’ strategy would work in times of abundant liquidity (because on maturity, one could easily refinance the borrowing), it is believed that it would be tough in times of tightening liquidity. RBI has relaxed the norms for ECBs and this will enable NBFCs to dive. As for passing on the increase in cost to customers (borrowers), CRISIL said the rise may not be to the same extent as the increase in borrowing costs (85-105 basis points), amid intensifying competition from banks. NBFCs should be able to pass on the higher rates to both existing and new clients since lending rates here are primarily floating in nature. Consequently, gross spreads of NBFCs will compress 40-60 bps this fiscal. This squeeze will be offset by the substantial provisioning buffers built over the past two fiscals, which had cranked up their credit costs.

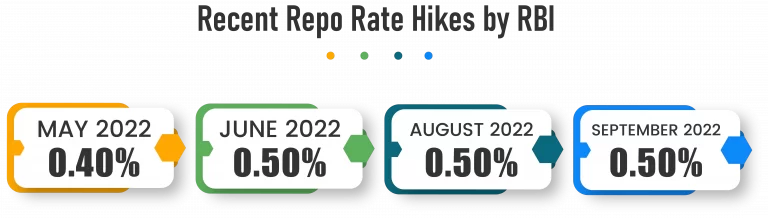

The Reserve Bank of India (RBI) is playing catch-up after ignoring inflationary trends for long. The out-of-turn rate hike of 40 basis points in May has been followed by a 50 basis point (bps) hike in repo in June. The market was expecting this and even more aggressive measures such as hikes in CRR (Cash Reserve Ratio) and SLR (Statutory Liquidity Ratio).

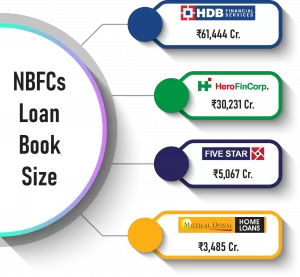

Borrowing costs for non-banking financial companies (NBFCs) are likely to rise by 85-105 basis points (bps) this fiscal with the recent hike in interest rates by the Reserve Bank of India (RBI).According to a Crisil Ratings analysis of NBFCs, Rs 15 lakh crore of debt, or 65 percent of outstanding debt as on March 31, 2022, is due for repricing this fiscal owing to interest reset or maturity. Another Rs 3 lakh crore of incremental debt is likely to be raised to support expected growth in lending. However, overall profitability is expected to remain steady cushioned by a reduction in credit costs.

The interest rate scenario has turned for NBFCs, with the Reserve Bank hiking the repo rate by 90 bps in two tranches. It is also further expected for another 75 bps of hikes, taking the total expected increase this fiscal to 165 bps. Thus the impact of increase in NBFCs will vary based on the mix of fixed and floating-rate borrowings in NBFC portfolios.

Krishnan Sitaraman, senior director and deputy chief ratings officer, Crisil Ratings, said, “Our study shows increases or decreases in MCLR over the past 5 fiscals have not kept pace with the changes in the repo rate. At the same time, interest rates on repo-linked bank facilities do reflect such changes very quickly.”Banks have begun to hike interest rates on deposits in response to the RBI’s rate hikes and in order to shore up funds for lending but that upcycle is unlikely to blunt the allure of high-yielding NBFC deposits. “With the revision in repo rate, NBFCs have already started increasing the interest rate on their loans as well as fixed deposits.

The growth in deposits held by NBFCs also coincides with an increase in bank lending to such entities. Banks’ outstanding credit to NBFCs grew 27.4% year-on-year in July 2022, according to the Reserve Bank of India data.

Tell us in the comments section below whether you would like to invest in these unlisted NBFC companies shares.