18 Oct, 2022, Blog

Author: Delisted Stocks Team

18 Oct, 2022, Blog

Author: Delisted Stocks Team

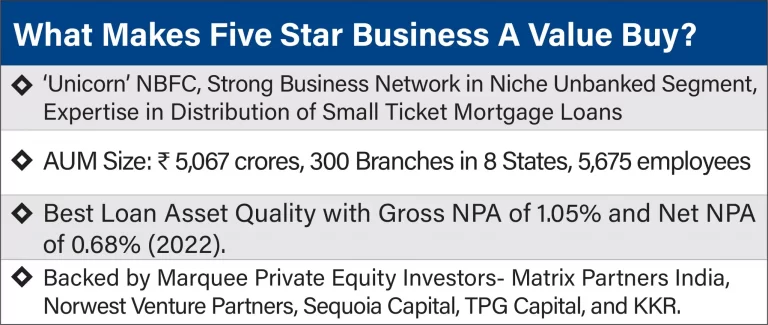

Five-Star Business Finance Limited (FSBFL) is a non-deposit-taking NBFC, registered with RBI. Five Star provides business and mortgage loans to borrowers in need of funds for their business and personal needs, after due diligence and backed by the collateral of non-movable property. It also provides secured financing solutions to micro-entrepreneurs and self-employed individuals, predominantly in the semi-urban markets. It also lends small housing loans which are given for construction, takeover, home repairs, and improvements. The company also lends mortgage loans that are given to meet their personal needs. All these loans are collateralized and secured against the residential property of the customers and are given targeting the middle and lower middle-income segment in urban, semi-urban, and fast-growing rural geographies.

Five Star Business Finance passionately believes in the fact that “un-banked” does not necessarily mean “unbankable”. In a country as large and as diverse, it takes efforts to access, understand and extend appropriate and responsible credit services to this segment. Over the last three decades, Five Star Business Finance have been working as a specialized financial services company in addressing the needs of this segment, funding the people who were perceived to be non-fundable.

The businesses that they work with can be touched and felt in our everyday lives and are businesses that create real impact on the ground. Their customers include all the way from small shop owners, flower vendors, maids, masons to small and medium enterprises that form the backbone of India’s economy.

Services Provided by Five Star Business Finance:

Five Star Business Finance provides Small business loans to meet borrower requirements for commencing new businesses, expansion of his/ her existing businesses and to settle any unorganized dues he/ she has taken to further their businesses. The loans are given based on the company’s evaluation of the borrower household cash flows coupled against the security of the borrower’s house collateral. The typical loan ticket ranges between Rs 1 lakh to Rs 10 lakhs for a tenure between 24 and 84 months. The repayments are to be made on a monthly equated basis.

Vision: Reaching the Unreached through suitable credit solutions

Mission: Provide appropriate credit solutions to the hitherto unreached segment of the market by developing a niche underwriting model, built towards evaluating the twin strengths of the borrowers’ intention to repay and ability to repay, with the ultimate objectives of increasing customer satisfaction and maximising stakeholder returns.

Unlisted Shares of Five Star Business Finance during FY 2020:

Key Accomplishments and Business Highlights of Five Star Business Finance during FY 2020:

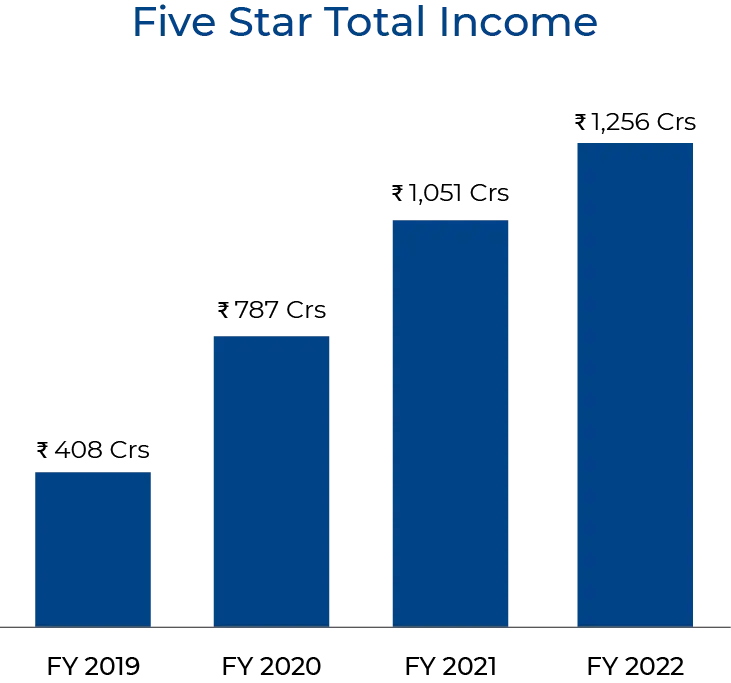

Disbursed an amount of about 2,400 Crores to about 79,000 borrowers, resulting in an increase in the borrower base from around 73,000 to more than 140,000.

• Increase in Assets under Management (AUM) from INR 2,113 Cr to INR 3,892 Cr, registering a growth of over 84%.

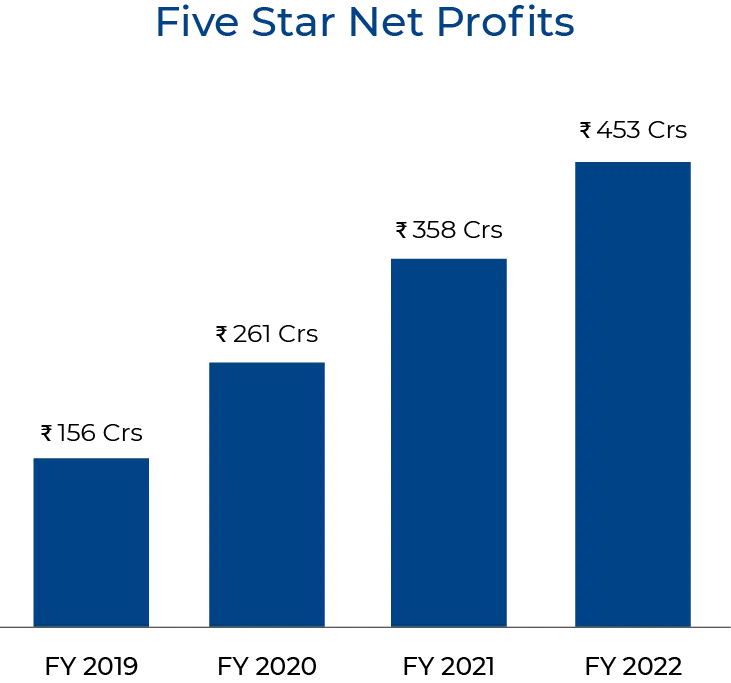

• Profit After Tax increased from about INR 157 Crores during the previous year to about INR 261 Cr INR during the year.

• Gross NPA of 1.36%; while this is higher than what would have materialized in the absence of COVID-19, this is still one of the best asset qualities among companies operating in this borrower segment.

• Provided employment incrementally to almost 2,000 staff and closed with a staff headcount of about 4,000.

• Incremental debt availment of INR 1,800 Cr during the year (as against INR 636 Cr in the previous year), despite the adverse sentiments that existed towards NBFCs during the year.

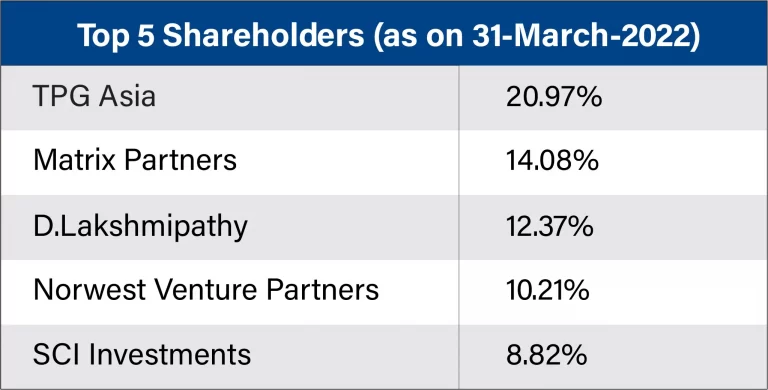

• Additional equity capital of INR 315 Cr was infused by TPG Capital, reinforcing their confidence in the company.

Five Star Business Finance provides Small business loans to meet borrower requirements for commencing new businesses, expansion of their existing businesses and settling any unorganized dues they have taken to further their businesses.

The loans are given based on Five Star Business Finance management’s evaluation of the borrower's household cash flows coupled with the security of the borrower’s house collateral.

The typical loan ticket of Five Star Business Finance ranges between Rs 1 lakh to Rs 10 lakhs for a tenure between 24 and 84 months. The repayments are to be made on a monthly equated basis.

Five Star Business Finance’s Geographical Presence:

Five Star Business Finance has an extensive network of 268 branches as of September 30, 2021, spread across 8 states. Tamil Nadu, Andhra Pradesh, Telangana and Karnataka being our key states. Such key states collectively accounted for approximately 85% of the branch network by number.

Underwriting Model of Five-Star Business Finance:

Five Star Business Finance has a two-layered underwriting architecture comprising a field credit team that is “on the ground” and closer to the customer (the “Field Credit Team”); and a file credit team that remotely reviews loan applications and undertakes credit decisioning (the “File Credit Team”). Five Star Business has implemented a comprehensive and robust credit assessment, risk management and collections framework to identify, monitor and manage risks inherent in their line of business.

Financing sourced by Five Star Business Finance

Five Star Business Finance secures financing from diversified sources of capital, including

term loans;

proceeds from loans securitized;

proceeds from the issuance of NCDs;

issuances of principal protected market-linked debentures;

proceeds from loans assigned from banks,

financial institutions,

mutual funds, and other domestic and international development financial institutions.

Industry Overview

The sector has been plagued with worsening asset quality, which has reached 17.5% in fiscal 2019 as compared to 7.2% in fiscal 2015. This has led to the gradual reduction of the share of industry credit in the overall banking sector’s credit. CRISIL Research expects the growth to stay low in this sector on account of the cautious approach taken by lenders.

Conclusion:

The company has a presence across locations and is one of the leaders in the segment, which has benefited the Five Star Business Finance Limited share price.

The overall market size is growing which will benefit the company.

The company is expected to deliver good growth which may give good returns to the shareholders of the company.

Tell us in the comments section below whether you would like to invest in Five Star Business Finance unlisted shares.

Read our Other Blogs:

Investing In This Beer Company Won’t Give You A Hangover

4 Tips for Unlisted Shares Investors to AVOID Another Paytm !!!