27 Apr, 2022, Blog

Author: Delisted Stocks Team

27 Apr, 2022, Blog

Author: Delisted Stocks Team

Sin stocks’ like those of tobacco and alcohol companies have long been the darling of many investors’ portfolios. And while many of these companies are generally considered to be slowdown-proof, the reduced slowdown in the economy keeps them vulnerable.

So yes, post the 2019 covid crisis, the liquor manufacturers and breweries might have left many investors high and dry in the market; but this one brewer has created quite a stir with its unlisted share ever since it became available in the market.

Yes, we’re talking of the B9 Beverages, whose unlisted shares have rallied more than 20 percent!

But, on the contrary, shares of some listed players like Pioneer Distilleries, Empee Distilleries, Jagatjit Industries, GM Breweries, Associated Alcohols, Winsome Breweries, and Ravi Kumar Distilleries have eroded over half to one-fourth of investors' wealth in the official market to date.

But, what’s causing the sudden uproar in B9 Beverage's unlisted share prices?

What makes it the perfect option to get started?

First, let’s check out how it started!

Bira 91, founded in the summer of 2015 in New Delhi by B9 Beverages, has swiftly become the vogue among urban millennials thanks to its great beers, strong draught network, and distinctive identity.

The brand aspires to disrupt the global beer business using 21st-century technology and its joyful monkey mascot. The brewer's taste has been designed to keep in mind with the urban drinker in mind — beer addicts who like to have fun with their beverage rather than taking it too seriously.

Moving ahead with its movement across the globe, Bira 91 jumped across the Atlantic to launch its campaign in the United States in 2017.

By entering Singapore in 2018, the brand began its larger growth story in the Asia Pacific region.

Moving to 2019, Bira beer signed a five-year sponsorship contract with the International Cricket Council.

This move marked the bira brand as India’s first beverage company to sign a worldwide sponsorship arrangement with cricket's governing body. As a result, they competed in the 2019 ICC World Cup in England.

According to sports marketing experts, Bira 91's sponsorship deal is worth $5-6 million each year.

Because India will host two significant events in the future, including the Cricket World Cup in 2023 and the T20 World Cup in 2021, the relationship will benefit the business immensely.

Coming out of premium and expensive craft beer category, Bira 91 has now assembled a strong portfolio of both craft beer and mass-market brands (BOOM) to corner scale and market share. As a result, it has emerged one of the fastest-growing beers globally.

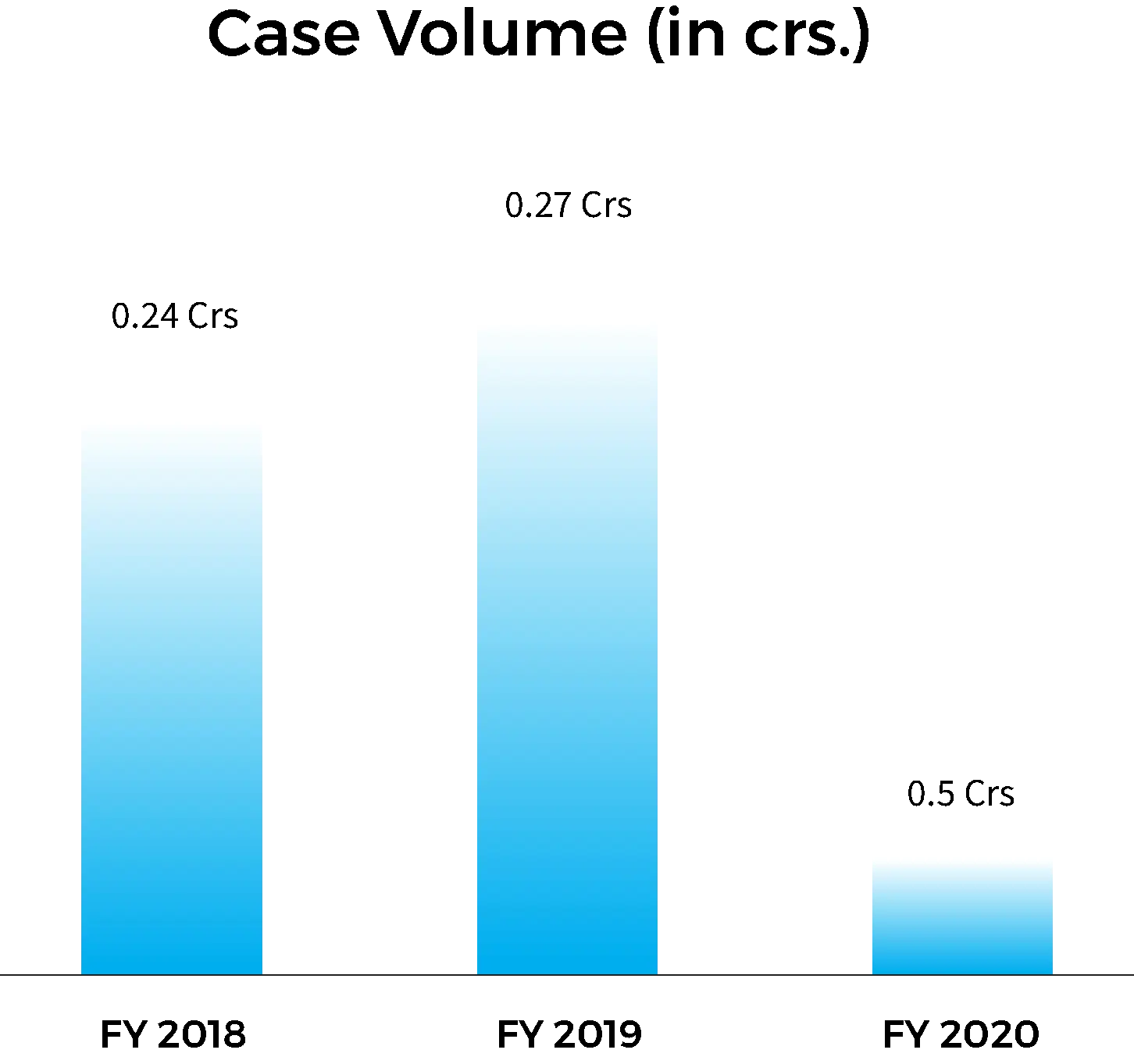

Bira 91 has risen to the top 25 craft beer brands globally in terms of sales volume in less than three years, making it the world's fastest-growing beer brand (growing 5x in 2017).

Now, B9 Beverages is all set to open its fifth local brewery. This move is set in motion to meet the rising demand for more delicious tipples in the nation ahead of a projected initial public offering.

Bira's new proposed unit's capacity can be increased to 1 million hectoliters (1 hectoliter = 100 liters), more than doubling the company's current capacity of 2 million hectoliters.

Bira, the country's fourth-largest brewer, ranks among top 5 beer brands in the country (by volume) behind Kingfisher, Tuborg, Budweiser and Haywards and top 4 in terms of revenues (behind Kingfisher, Tuborg, Budweiser).

According to CEO Mr. Ankur Jain, Bira is expected to be profitable at an operational level within six months, with annual revenues of $170 million.

Performance: Not just froth but also substance

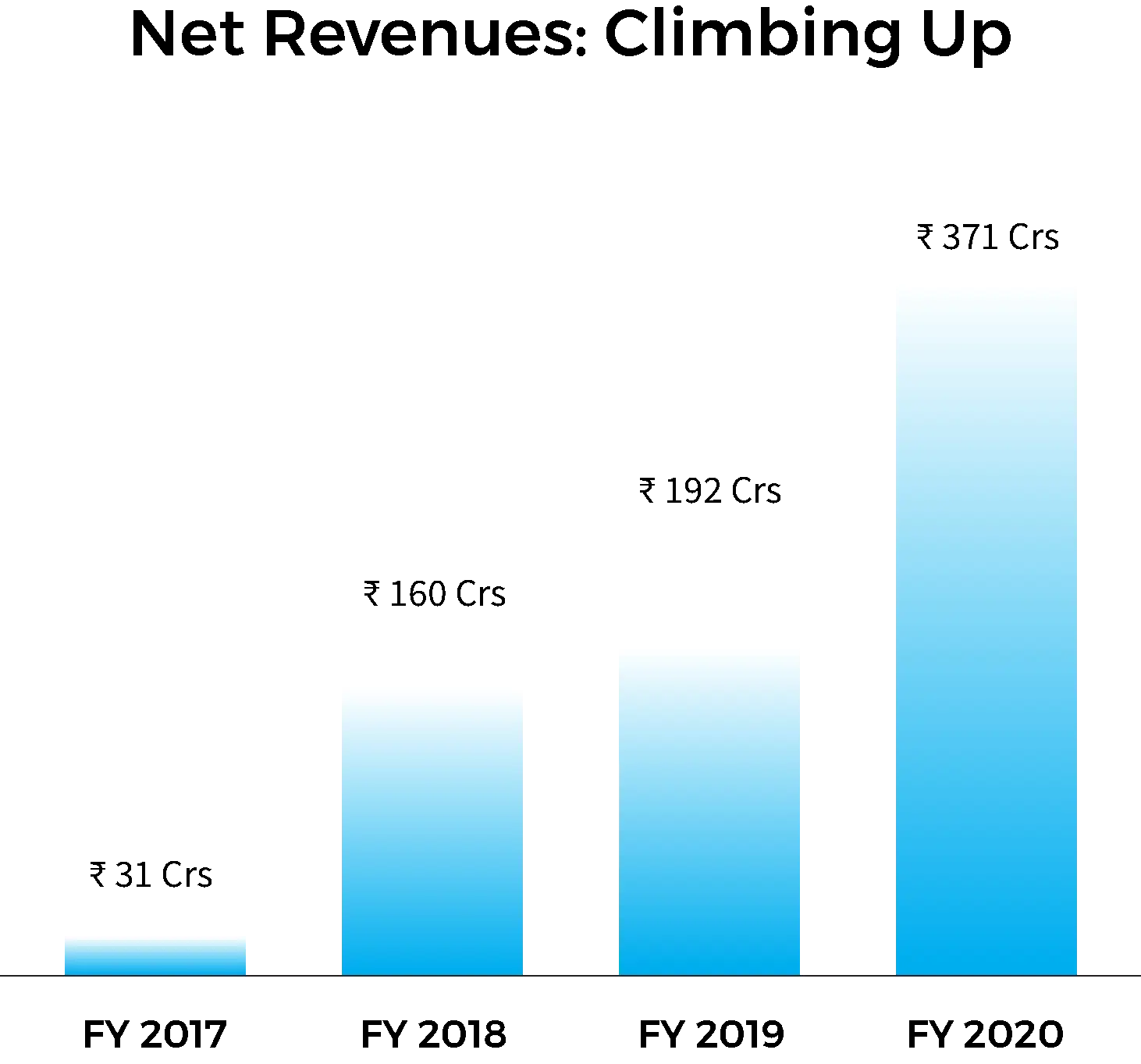

B9 Beverages' revenues increased from Rs 4 crores (FY16) to Rs 31 crores in FY17 and Rs 160 crores in FY18, according to data suggested by Entrackr.

However, for those years, the firm recorded a net loss of Rs 12 crores, Rs 55 crores and Rs 101 crores, respectively. Moving ahead to year 2020-21, the company claims to have earned revenues of Rs. 455 crores with net loss of Rs 417 crores.

The company claims to have 3.02 million shares outstanding with a face value of Rs 10 apiece, giving it a total market capitalization of almost Rs 2,500 crore at the current market price of Rs 840.

Given the movement that it currently has, many investors might be under doubts about their investments. However, we suggest you stay relaxed! Wonder why?

Because the B9 Beverages is still a new brewery at large and its future expansion plans are in a complete roll, the company is all set to operate within the central stage of the Indian brewing scene.

Valuation (Up & rising)

Sequoia Capital and Safina Capital from Belgium are the key investors in Bira 91. As per Crunchbase, Bira 91 has received about $210.5 million so far, with celebrities, film producers, Flipkart CEO, and Sequoia Capital among its backers.

The company also counts Zomato co-founder Deepinder Goyal, Snapdeal's Rohit Bansal and other Bollywood celebrities including Farhan Akhtar, Ritesh Sidhwani among its investors.

Bira 91 last raised $50 million in May 2018, valuing the company at Rs. 1,470 crores. Bira Shares were valued at Rs. 400 per share at the time. They secured 30 million dollars from Sixth Sense Ventures in 2019, valuing 1722 dollars.

Currently hovering at a price of Rs 840, Bira is getting at a valuation of Rs 2500 crs currently, and as per market rumors, the company may come out with an IPO at 4x of the current valuation by 2024. (Click here to know the latest share price of Bira)

Trick or Treat?

Given the uncertainty regarding the profitability of the business, it might look like a risky investment bet at first. And investors who are still acquiring Bira’s unlisted shares, it looks like a trade for the experts!

Therefore, we suggest you track company’s performance for some time and have a strong understanding of its demand and supply. Once you know where this unlisted share is going, you might want to invest your money with this fast-growing brewery company.

Read Our Other Blogs:

5 Reasons to Buy this Fastest Growing Healthcare Stock

Invested in Unlisted Shares? Know your Taxes

Multibagger opportunity? All you need to know before investing in OYO unlisted shares