16 Sep, 2022, Blog

Author: Delisted Stocks Team

16 Sep, 2022, Blog

Author: Delisted Stocks Team

Company Overview

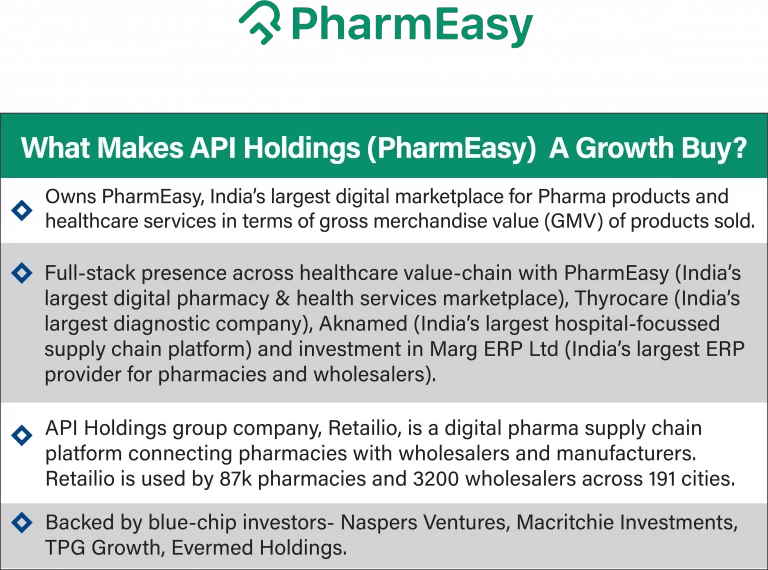

API Holdings Limited is the largest digital healthcare platform (based on GMV of products and services sold for the year ended March 31, 2021) which through custom-built technology platform and supply chain capabilities, operates an integrated and end-to-end interconnected network business serving the healthcare needs of stakeholders.

The company has received SEBI approval for IPO to raise funds by issuance of shares of the company. The IPO is entirely for fresh funds raise and does not have any portion of shares being sold by existing investors of the company.

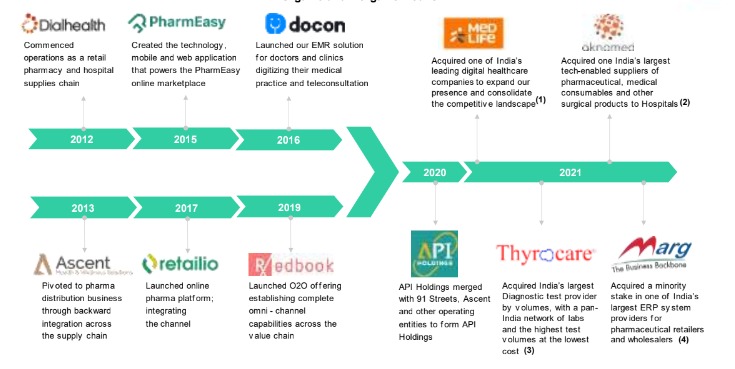

Progress till now

The founders started Dial health, a consumer pharmaceutical delivery service in Mumbai where they realized the supply chain issues. As a result, they founded Ascent in 2013 which distributed pharma products to pharmacies where they built strong supply chain capabilities. After building strong supply chain capabilities in 2015, founders built a pharmeasy marketplace. They acquired docon in 2016 which provides EMR and clinic management service along with teleconsultation offerings. The company built retailio to accelerate technology adoption and to expand supply chain capabilities beyond pharmacies. In 2020, all businesses were consolidated into API holdings to create an integrated digital healthcare platform. In 2021, they acquired medlife, aknamed and thyrocare. They also acquired a 49% stake in Marg.

With these acquisitions, the company now touches every stakeholder involved in healthcare – consumers, doctors, laboratories, and hospitals.

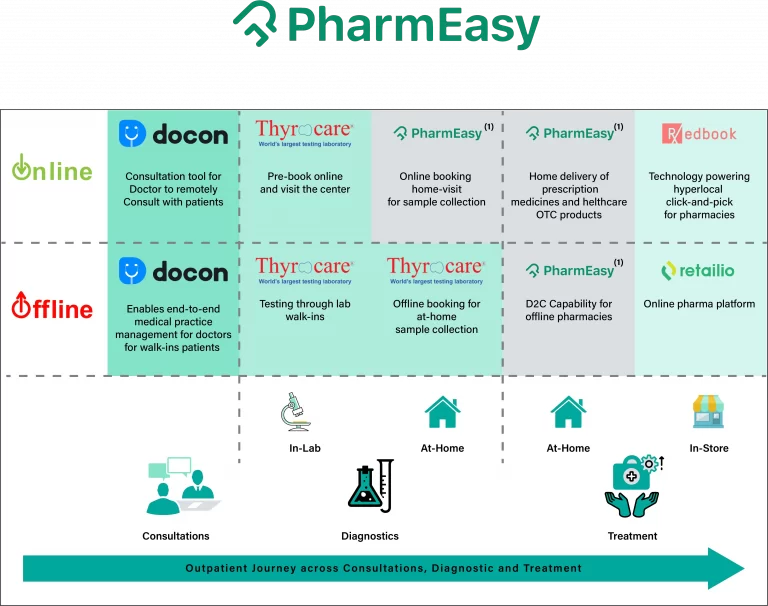

Pharmeasy’s Product Offerings & Value Chain

API Holdings Ltd aka Pharmeasy is India’s largest digital healthcare platform (based on GMV of products and services sold for the year ended March 31, 2022). Pharmeasy operate an integrated, end-to-end business that aims to provide solutions for the healthcare needs of consumers across the following critical stages –

PharmEasy pulls out market listing plan

Indian digital healthcare company PharmEasy's parent firm API Holdings has pulled out of the IPO of DRHP. The company had filed an IPO DRHP with Securities and Exchange Board of India (SEBI).

The company will consider raising funds via rights issue, reported CNBC. API Holdings rights issue will have Compulsory Convertible Preference Shares (CCPS). API Holdings with subsidiaries like PharmEasy and Thyrocare provides health services ranging from radiology tests, teleconsultation, and home delivery of medical devices and products.

Talking about the unlisted shares of API Holding Pharmeasy, it was observed that API Holdings fell at 44% over three months in unlisted market; firm valued at $6.35 crores.

“Currently, the stock is trading at around Rs 76-78 and is valued at Rs 47,565 crores which analysts feel is still expensive. For future reference, the firm will reportedly be valued at $5.4 crores”

Shares of API Holdings Ltd, the parent of online pharmacy PharmEasy, have corrected 44 percent in the unlisted market over the past three months. On February 21, API Holdings received approval from the Securities and Exchange Board of India (SEBI) to launch an initial public offering (IPO).

Shares of API Holdings started trading in the unlisted space in the first week of November at Rs 108-110 each. The shares rose to Rs 140 in a short span of time before starting to correct. The stock then hit a low of Rs 68-70, an analyst said on the condition of anonymity. "The correction can be attributed to the fall in global and Indian new-age stocks amid rising concern on valuations," the analyst added.

PB Fintech and AGS Transact traded at Rs 1,200 and Rs 220 a share in the unlisted market before their IPOs. Their IPO prices were much lower at Rs 980 and Rs 175 apiece, respectively.

API Holdings filed draft papers with SEBI to raise Rs 6,250 crore via an IPO. Unlike other start-ups such as Zomato, Nykaa, Paytm, Policybazaar and Delhivery, API Holdings’s IPO will consist only of a fresh issue of shares and entail no exit by investors. Proceeds of the share sale will be used to repay debt, and fund organic and inorganic growth through acquisitions and other strategic initiatives. API Holdings is also exploring the option of a pre-IPO fundraise via private placement to the tune of Rs 1250 crores, the share-sale prospectus said.

Digital Healthcare Delivery

API Holdings is a big player in India’s digital healthcare ecosystem, owning businesses and brands like Aknamed, Docon, PharmEasy, Retalio and Thyrocare. The PharmEasy brand has a market share of over 50 percent. The firm provides digital tools and information on illness and wellness and offers teleconsultation, diagnostics and radiology tests and delivers treatment protocols, including products and devices. The firm has reported losses in the last two years and the first quarter of the financial year 2022.

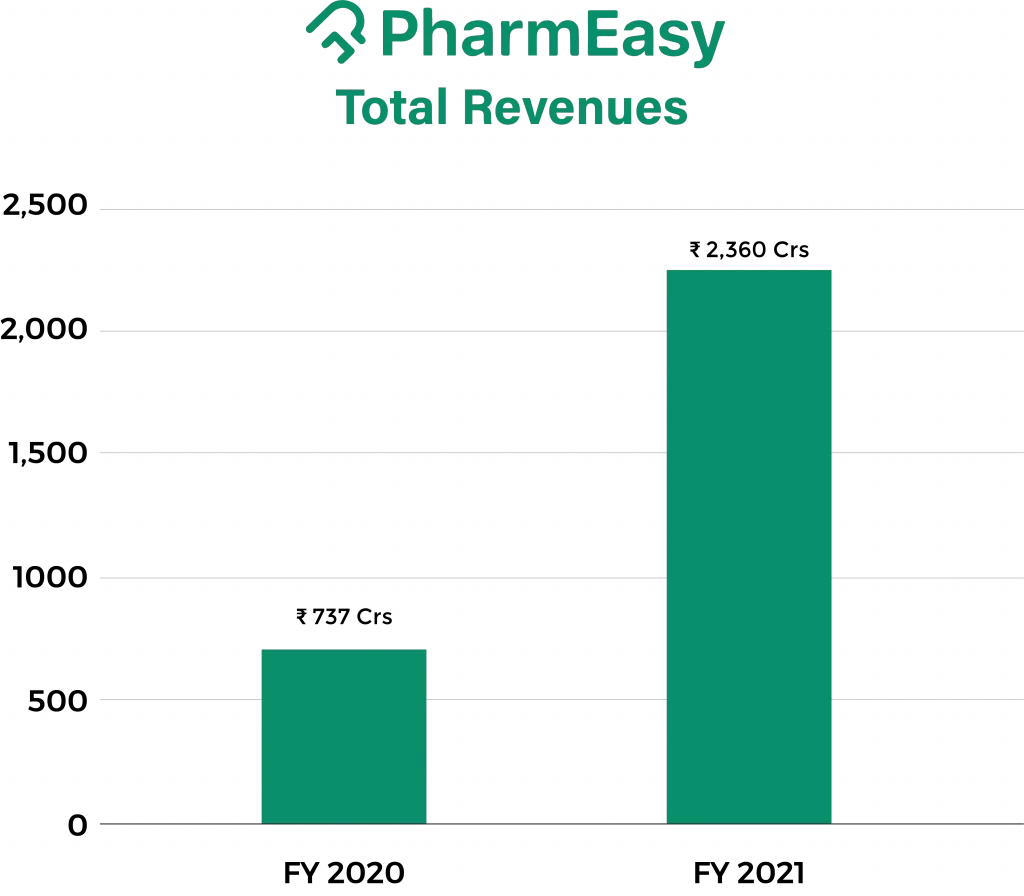

In FY21, its net loss widened to Rs 641.34 crore from Rs 335.28 crore a year ago. Net sales rose to Rs 2,335.27 crore from Rs 667.54 crore. The company’s loss before interest, tax, depreciation and amortisation widened to Rs 569.33 crore from Rs 386.21 crore. In the three months ended June 2021, the firm reported a loss of Rs 313.89 crore on net sales of Rs 1,196.81 crore. In June 2021, API Holdings bought listed diagnostics company Thyrocare for Rs 4,546 crore. API picked up a 66.1 percent stake in Thyrocare for Rs 1,300 a share.

PharmEasy not in pink of health, shares drop 50% in unlisted market

Despite getting the regulatory approval to launch its initial primary offering (IPO), API Holdings, the parent company of PharmEasy, is feeling the heat of a recent meltdown in the unlisted market. Shares of PharmEasy have eroded half of investors wealth in the pre-IPO market dropping down to Rs 70-75 on Tuesday. It was trading at Rs 135-140 almost a quarter ago. During its worst trade, the scrip had tanked to Rs 65, dealers said. The Mumbai-based med-tech player received the green signal from capital market's watchdog SEBI to float its Rs 6,250 crore-primary stake sale. Existing shareholders aren't planning to sell shares. (Click here to know the latest share price of API Holdings (PharmEasy) unlisted shares)

Conclusion

The company has a strong product portfolio and huge distribution network, which has benefited the API Holdings Limited (PharmEasy) share price. The overall market size is growing which will benefit the company. The recent acquisitions have resulted in the company being able to provide end-to-end solutions which are expected to increase the customer base of the company.

Tell us in the comments section below whether you would like to invest in API Holdings (PharmEasy) unlisted shares.