26th Nov,2022

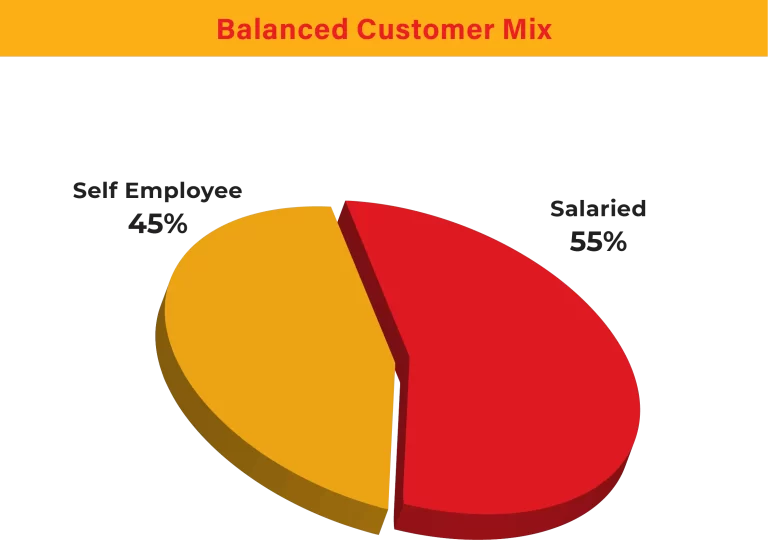

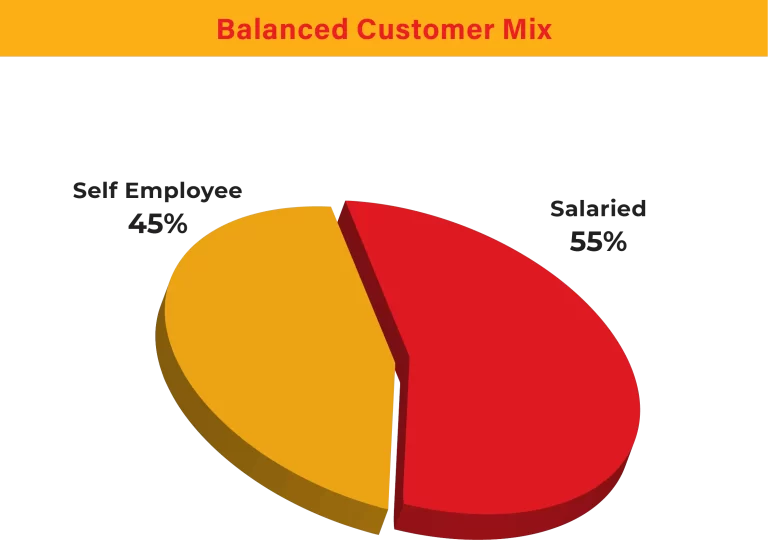

Motilal Oswal Home Finance Limited (MOHFL) which was formerly known as Aspire Home Finance Corporation Limited, is the company that basically offers housing loans to its customers in the low and middle-income groups and was incorporated in October 2013. It is a part of the Motilal Oswal Group. Motilal Oswal Home Finance Ltd. The target customers of the company include lower and middle income class families, self-employed, cash salaried category where formal income proofs and credit reports are not easily available, and the repayment capacity of such families are appraised based on their cash flows and internal score cards.

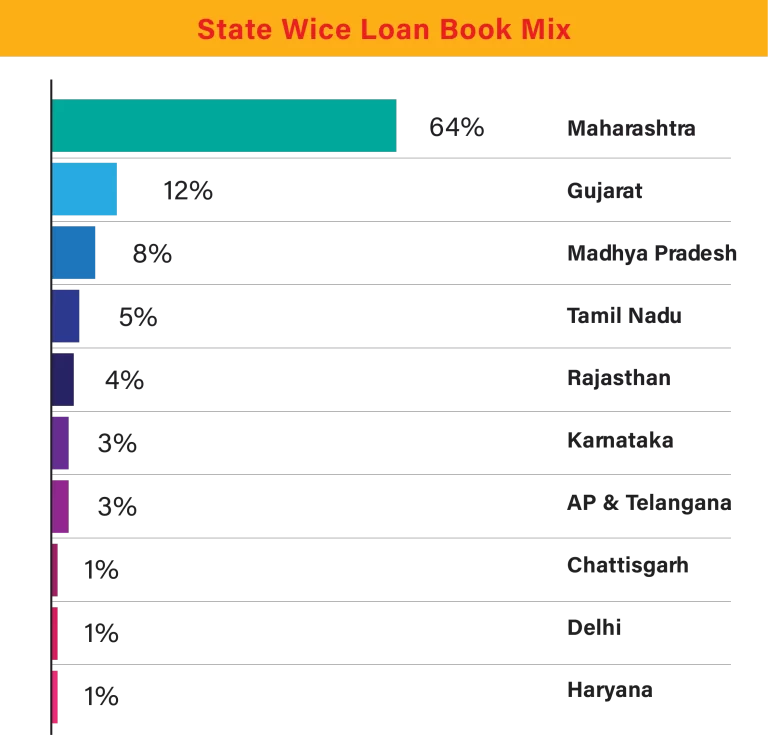

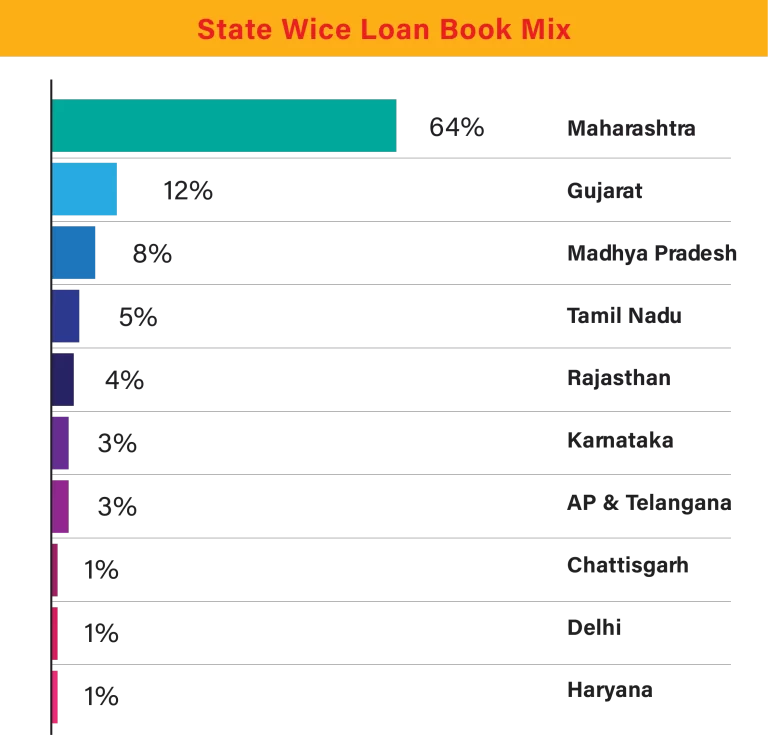

Motilal Oswal Home Finance Limited (MOHFL) have its headquarters in Mumbai and as of December 2019, it had a network spread over 550 cities and towns comprising 2500+ Business Locations operated by our Business Partners and us and 20,00,000+ customers. MOHFL is the housing finance arm of Motilal Oswal Financial Services Ltd. MOHFL holds a network of 104 branches specifically in the states namely Andhra Pradesh, Chhattisgarh, Gujarat, Haryana, Delhi, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, and Telangana.

Overview

In the present era, MOHFL is a well-diversified financial services firm offering a wide range of financial products and services such as Private Wealth Management, Retail Broking and Distribution, Institutional Broking, Asset Management, Investment Banking, Private Equity, Commodity Broking, Currency Broking, and Home Finance. It also has a diversified client base that includes retail customers (including High Net Worth Individuals), mutual funds, foreign institutional investors, financial institutions and corporate clients.

Research is the solid foundation on which Motilal Oswal Home Finance Limited Unlisted shares advice is based. Almost 10% of revenue is invested in equity research and it hires and trains the best resources to become their advisors. At present we have 25+ research analysts’ researching over 250 companies across 20 sectors. From a fundamental, technical and derivatives research perspective. Along with this, Motilal Oswal research reports have received wide coverage in the media.

The consistent efforts in respect to Motilal Oswal Home Finance Limited Unlisted shares is basically towards quality equity research that have reflected in an increase in the ratings and rankings across various categories in the Asia Money Brokers Poll over the years. Motilal Oswal Home Finance Limited (MOHFL) have also been awarded as the Best Performing Equity Broker (National) at the CNBC TV18 Financial Advisor Awards for five years in a row & got inducted in ‘Hall of Fame’ at the 10th Financial Advisory Awards 2019.

Motilal Oswal Home Finance Limited Merger and Acquisition

On September 30, 2019 Phoenix ARC Private Limited acquired a Pool of Non-Performing Assets of Rs.5400 million from Motilal Oswal Home Finance Limited for Rs.2600 million.

Motilal Oswal Home Finance Limited Business Model

- Motilal Oswal Home Finance Limited (MOHFL) offers home (purchase/resale), construction, home improvement, and home extension loans.

- The company also provides residential (retail) services include property search, market intelligence, and finance assistance; commercial services include property market research, project planning and execution, deal negotiations, legal advisory, tenant sourcing, and corporate advisory for space requirements (leasing); and consultancy services include due diligence on real estate transactions, strategic advisory for real estate portfolios, and due diligence on real estate transactions (land, projects, portfolio, and retail).

Motilal Oswal Home Finance Limited Products & Services

The Products:

- Home Loans

- Construction Loans

- Home Improvement Loans

- Pradhan Mantri Awas Yojana (PMAY)

- Home extension loan

Other Services offered by the company include:

- Property Services – sale/rent/resale etc.

- Loan against property

Motilal Oswal Home Finance Limited Industry Statistics

- Housing Finance Companies (HFCs) serve as an alternative financing channel to the real estate and housing sector and are a part of the non-banking financial companies (NBFC) sector. HFCs play an important role in the Indian financial system by complementing and competing with banks, specializing in credit delivery to home buyers.

- The non-banking housing finance market in India is fragmented with over 80 HFCs. However, the top four players command over 70% of the market share.

- The asset size of the NBFC sector (including HFCs), as on March 31, 2020, is Rs.51.47 lakh Cr.

- As per ICRA’s report, the total outstanding housing credit as on December 2020 stood at Rs. 22.10 lakh Cr. Out of the total outstanding credit, Housing Finance Companies (HFCs) and Non-Banking Financial Corporations (NBFCs) contributed around Rs. 7.2 lakh Cr.

- Over the last five years, the Indian home loan portfolio has grown twice its size. The emergence of housing finance is a major business in the country, the demand for housing loans was rapidly increasing in recent years.

- Demand for residential properties has surged due to increased urbanization and rising household income. India is among the top 10 price appreciating housing markets internationally.

- During the period 2016-2020, the housing demand by buyers of top 8 cities in the High income group(HIG) category was 2.04 times the supply in the High income group category. While the housing demand by buyers of top 8 cities in Middle income groups was 2.23 times the housing supply in the Middle income group.

- Residential segment contributes 80% of the real estate sector. Housing launches across top eight Indian cities increased 23% y-o-y in 2019 to 0.22 Lakh units.

Motilal Oswal Home Finance Limited Future Prospects

- Housing loan rate is low in India when compared with developing economies, presenting opportunities for the growth of the home loan market in the country. Moreover, government push towards affordable housing coupled with acute shortage of housing is further expected to drive India home loan over the next five years.

- India's home loan market is anticipated to grow at a brisk rate of around 22% during 2021-2026 on account of increasing urbanization and affordable mortgage rates.

- As per ICRA, over the medium and long term, it is expected the industry to grow in the range of 7-8% driven by growth in affordable housing space and easing out of liquidity concerns. As per CRISIL report, India’s Mortgage Penetration Expected to touch 15% by 2024 from currently 12.4%.

- The Indian age demographic has two-thirds of our population below 35 years of age, and the share of population in the age group 0-14 is 26.16%. Share of the working age population (15-65 years) is 67.27%, which indicates a very positive future outlook for the Indian housing sector.

Tell us in the comments section below whether you would like to invest in Motilal Oswal Home Finance Ltd unlisted shares.

Read our other blogs: