06 Dec, 2021, Blog

Author: Delisted Stocks Team

06 Dec, 2021, Blog

Author: Delisted Stocks Team

One common thread connecting the successful investors is that they try to invest in the early stage when it is difficult for an ordinary investor to analyse the investment opportunity seriously. Whether it is crypto, real-estate, or commodity investment, it is early stage investors who make the killing. Today, we will throw light on another such opportunity: Oyo Rooms.

Oyo Rooms is an Indian start-up that has disrupted the global hospitality industry, joining the ranks of Uber, Zomato, Netflix and Zerodha. And it managed to achieve this scale without investing in real estate.

The full form of Oyo is “own your room” and it was started by Ritesh Agarwal, who initially joined Kota to prepare for engineering exams but later dropped the idea of becoming an engineer and came to Delhi in 2011.

At the age of 17, he stayed in various rented accommodations across India and found the pain-point of the small hotel owners of their difficulty to generate sustainable business when the market was increasingly getting online.

In 2012, he got the ₹ 30 lakhs seed funding from Venture Nursery, a venture capitalist to start Oravel Stays and was selected for Thiel fellowship in 2013, started by Paypal founder Peter Thiel. And, the rest is history.

Initially, Oyo started out as an ‘online aggregator’ of the fragmented, unbranded and underutilized hotels to sell them under its own OYO brand. But since 2016-2017, Oyo has pivoted from ‘aggregator’ model to ‘asset-light’ and ‘franchisee’ based model under which it enrols hotel partners as franchisee. It still sells its franchisee partner’s rooms under its own OYO branding with focus on delivering ‘standardised services’.

Broadly, Oyo earns from its share in room reservation fees, listing of storefronts on its platform, value added services to hotel partners, Oyo Wizard paid membership fees, and advertising on its Oyo rooms platform.

Another growing revenue potential for Oyo is providing crucial technology services to its franchisee partners like online revenue management, operations management, payment gateway, channel management etc. which enable it to charge more commission from its franchisees. Due to this, average Oyo revenue share in the gross booking amount ranges from 20-35%.

The core market of Oyo rooms is India, South East Asia and Europe. Oyo Rooms has a total 157,344 storefronts listed on its online platform from these markets. During fiscal 2020, the average gross booking value (GBV) per hotel was ₹ 4,44,649 and ₹ 47,926 for home stays.

Oyo runs its loyalty programme under the brand Oyo Wizard which has emerged as the 2nd largest loyalty programme in India with 92 lakh members. Due to the large and growing size of its loyalty programme, Oyo is able to get 68% of the repeat business from OYO wizard members.

As part of its business strategy, Oyo Rooms has now come out with the other differentiated and premium accommodation offerings focussing on specific clientele. The percentage of Oyo’s premium storefronts in India stands at 20.6% as at June 30, 2021.

Oyo’s brands in premium segment of short-stay accommodation market are:

Due to its focus on expanding its business, it is yet to deliver a profit. Moreover, thanks to the pandemic induced restrictions and its consequent impact on the tourism industry, Oyo consolidated revenues fell 69% to ₹4,157 crore during fiscal 2020 and the company reported a net loss of ₹ 4,102 crore.

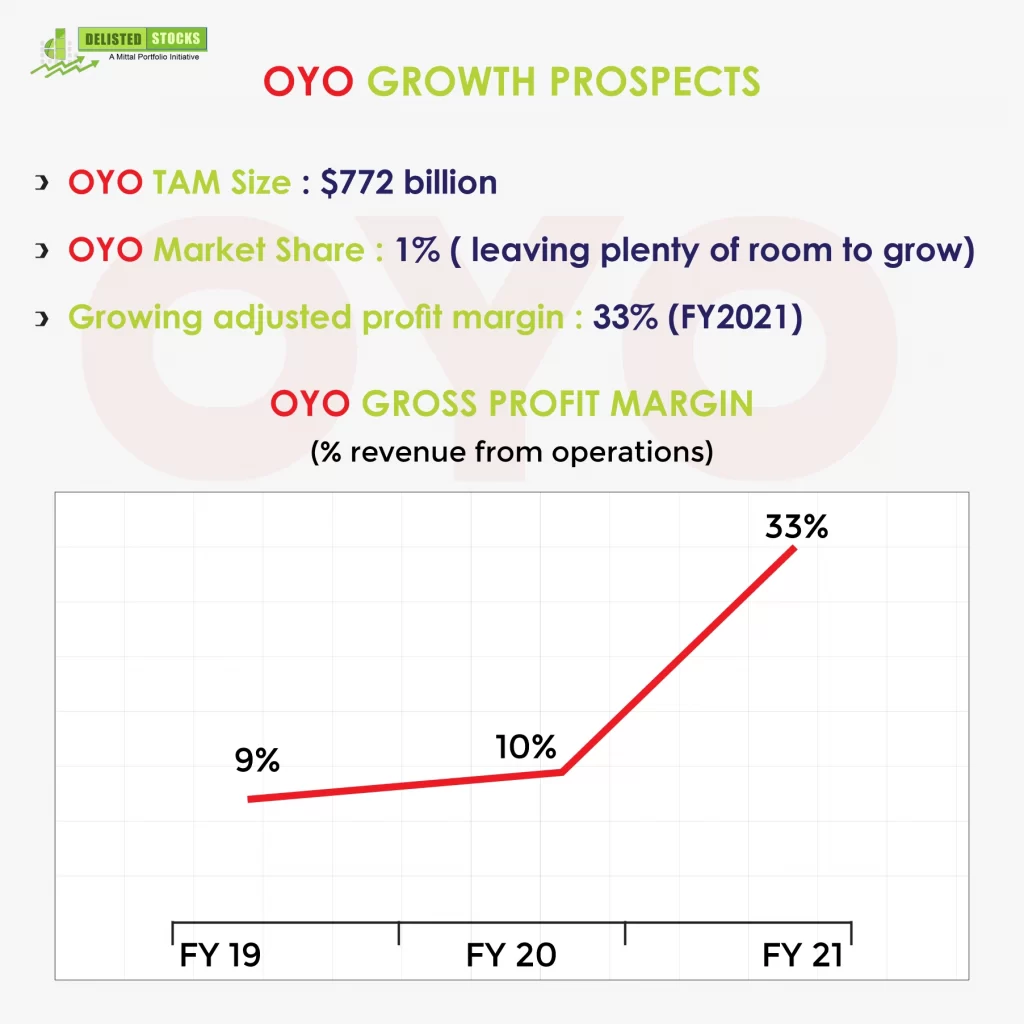

However, despite facing a tough year, its adjusted gross profit margin percentage improved to 33% in fiscal year 2020 from 9% during fiscal year 2019 on the back of better cost control and operational improvements.

What gives hope is that it is still in expansion mode and building up its business in key growth markets of India, South-East Asia and Europe. It’s low market share (1%) leaves ample scope to grow in its existing markets and it is targeting USA and China as next markets to expand.

Oyo’s low market share leaves plenty of scope for the company to build upon its brand and platform to capture bigger market share in its existing markets. Beside, Oyo plans to scale its business in big-ticket markets- USA and China, which can prove to be a game-changer for Oyo in terms of substantially increasing its GBV per storefront and overall profitability figures.

Oyo business model has strong network effects. The more it attracts travelers to its platform, the more room bookings will take place. The more bookings take place, the more hotels will take interest to be part of the Oyo brand franchisee.

Here lies the opportunity for investors to multiply their wealth when Oyo scales these markets and multiply its business manifold.

In October, 2021, Oyo filed DRHP with SEBI, local market regulator for an IPO to raise ₹ 7,000 crore worth of fresh equity issue and remaining amount for ‘offer for sale’ under which the existing investors will sell their stake either partially or fully.

Further, out of the total fresh issue of equity, Oyo will use the ₹ 2,400 crore towards repayment of loans and another ₹ 2,900 crore towards business expansion opportunities. Oyo wants to drastically improve its business by onboarding new hotel franchisees and expanding its technology platform.

Though the final date for IPO is not public yet, industry experts believe that Oyo may look at the impact of Covid variant Omicron in its key business markets before taking the final call on the dates of the public issue. In an optimistic scenario, Oyo may bring its public issue by February, 2021.

Yes, you can. The procedure to buy the Oyo unlisted shares is fairly simple. Once you have settled on the price and quantity of the shares to buy with the broker, you would have to transfer the funds into the bank account of the seller. Once the funds are transferred and transaction details are shared with the seller, your demat account will be credited with Oyo unlisted shares either on the same day of the fund transfer or before the end of the next working day. To know the latest price of unlisted shares of Oyo Rooms, click here.

Before IPO, there is no restriction on sale and transfer of your Oyo unlisted shares. But once Oyo shares are listed on the stock exchange, for retail investors, there is a minimum lock-in period of 6 months.

In the short-term, the biggest risk factor for Oyo is the spread of Covid variant: Omicron, which may lead to a halt in international travel and domestic travel in the key markets of Oyo. The spread of Covid variant may even impact Oyo's listing on the stock exchange as the company may postpone its public issue due to adverse investor sentiment.

Oyo is engaged in a highly-competitive industry where it competes with a variety of strong brands like hotel aggregators like Fabhotels, OTAs like booking.com, homestay booking platforms like Airbnb, and traditional hotel companies. The tough competition not only presents the growth opportunities but also puts pricing pressures and ability to attract hotel partners to its online platform.

Oyo is yet to show profitability and generate positive cash from operations since its incorporation. This presents an execution risk for investors as any slowdown in the economies of countries where Oyo operates, may delay the profitability of the business.

Oyo always attracted higher valuations in each valuation round. In its latest valuation round completed in August, 2021, Oyo was valued around $10 billion. Oyo is backed by strong investors like Softbank, Microsoft, Airbnb who still believe in its vision and investing capital in its growth story. Click here to know more about Oyo past funding rounds.

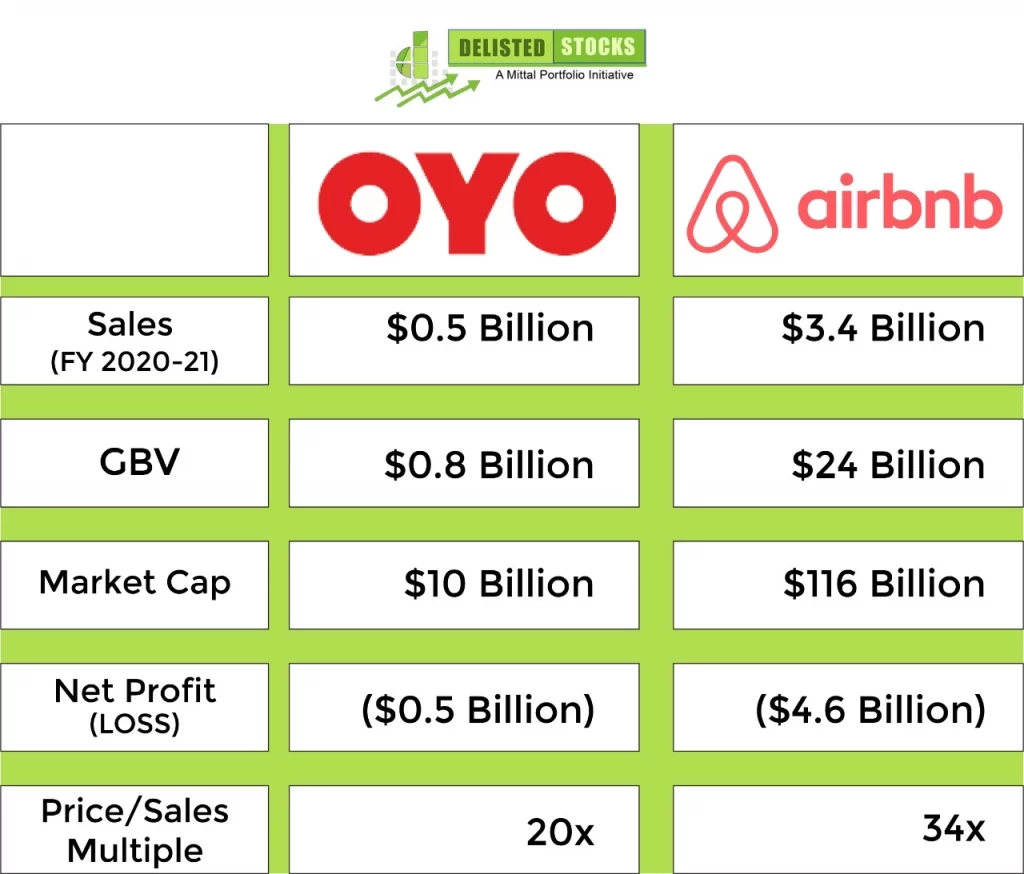

Since, there are no listed players in India having comparable business models, we can compare Oyo with the global leader in the homestay market, Airbnb.

During FY 2020, Oyo generated annual revenues of around $500 million against $3.4 billion for Airbnb. During this period, the gross booking value (GBV) for Oyo rooms was $874 million against $24 billion for Airbnb.

One of the major reasons behind this wide gap in GBV figures is that Oyo charges commission rates of 20-35% of each reservation from its franchisee partners while Airbnb charges 3-15% from each reservation.

The price/sales multiple of 20 for Oyo Rooms and 34 for Airbnb shows us Oyo Rooms is still undervalued as compared to Airbnb and gives its investors potential for future returns.

Low market share in its existing markets and entry into big markets of USA and China present an attractive opportunity for long-term investors to grow their wealth with Oyo as it scratches more market share and business growth. All this and consistent efforts by Oyo to de-risk the business by enrolling more members into its Oyo Wizards loyalty program, going upscale in accommodation business, venturing into the related businesses like wedding marketplace, office workplace will yield results in coming few years.

Another sign of Oyo stock becoming multi-bagger in near future is that its founder, Ritesh Agarwal, is retaining his 30% stake in the company and not offloading it during its proposed IPO. This faith shown by the founders in their company is another confidence measure for new investors to invest in their growth story.

For any questions related to investment in Oyo Rooms unlisted shares, let us know in the comments below: