01 Feb, 2023, News

Author: Delisted Stocks Team

01 Feb, 2023, News

Author: Delisted Stocks Team

PharmEasy’s founders told the Board that they will not sell its diagnostic business Thyrocare. This move comes amid the e-pharmacy’s struggles to raise fresh funds because of a broader tech downturn.

PharmEasy’s parent API Holdings also delayed internal plans for a potential initial public offering (IPO) to 2025, the people privy to the goings-on at the company said on condition of anonymity. Investors and the company have prioritised hitting operating profit by September this year.

PharmEasy’s cash runway has shrunk to about a year, based on its December burn rate, people aware of its financials said. Cash burn is typically used for privately held unprofitable start-ups and indicates the rate at which it uses capital to run day-to-day operations.

It is on a Rs 5,200 crore revenue as of December 2022, with a cash burn of Rs 30 crore per month. In January, its cash burn narrowed to Rs 15 crore, indicating its intent to cut that metric.

Siddharth Shah, chief executive of PharmEasy, made it clear at the board meeting that they are not looking to sell Thyrocare even as there has been speculation about it since last year. The online pharmacy platform, which has picked up a loan from Goldman Sachs, has a debt repayment obligation of Rs 30 crore per quarter.

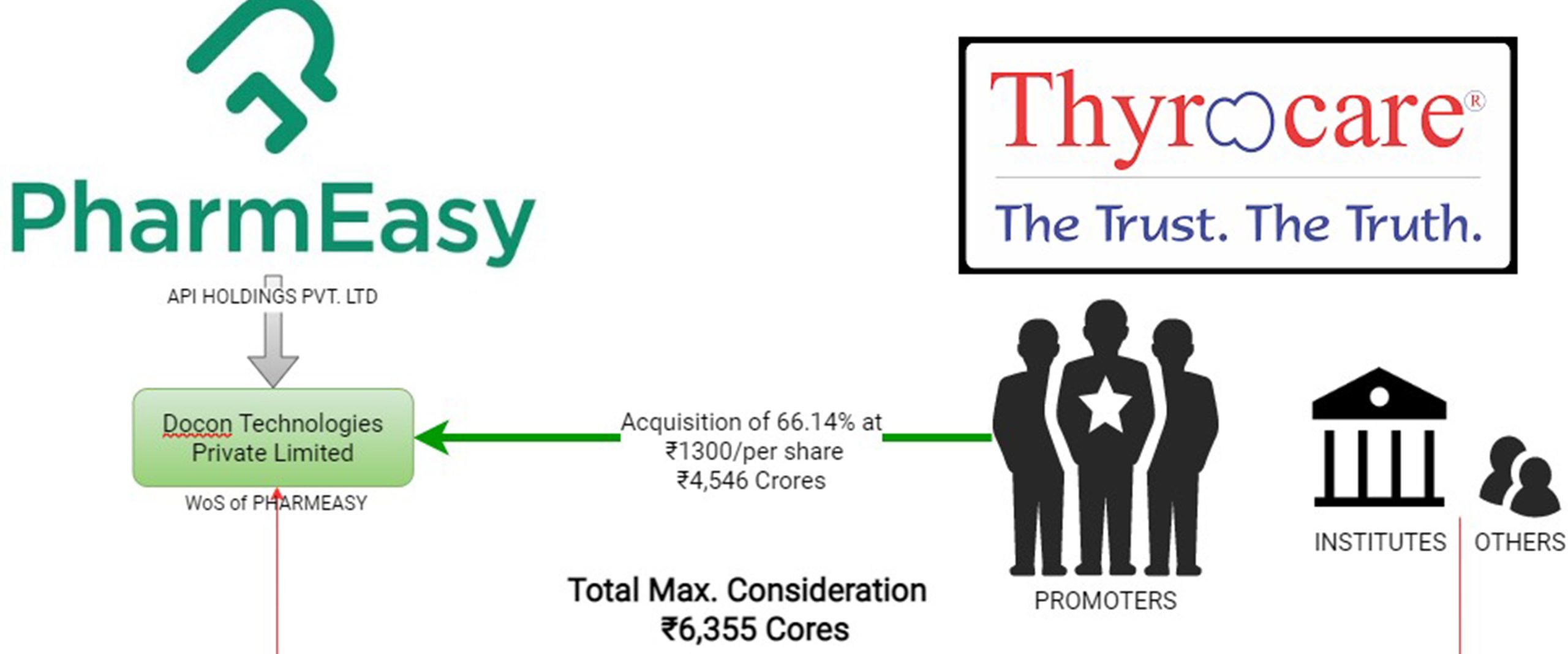

PharmEasy’s $300 million debt from Goldman was picked up to refinance an earlier loan from Kotak Mahindra Bank for financing the Thyrocare acquisition in 2021.

“PharmEasy founders don’t want to go out and raise money right now as valuations will take a severe hit amid softening valuations. Investors are very keen on seeing EBIDTA level profits before writing a cheque in highly valued start-ups. Internally, they are even aiming to hit this by June quarter of the new financial year, but it remains to be seen if that plays out as per the plan.

PharmEasy explored a capital raising plan last year, but those came with a 40-50% cut in its current $5.6 billion valuation. As reported by ET first in October about its internal funding, the company has now closed its Rs 650-crore rights issue from existing investors Prosus Ventures, Temasek and others.