05 Mar, 2022, Blog

Author: Delisted Stocks Team

05 Mar, 2022, Blog

Author: Delisted Stocks Team

In India, there are over 12 lakh registered companies but just around 5,000 of them are listed. This means the chance to find hidden gems — companies that may deliver multibagger returns — is much larger in the unlisted market.

Obviously, it is not an easy task, given most of them are not easily discoverable. Even for those that are relatively known, finding financial data and management quality about them is a tough task.

But what if we say there is one unlisted company that is not just a leader in the space it operates, but it has shown unrelenting growth and boasts of some of the most efficient management in the country?

Unbelievable, right!

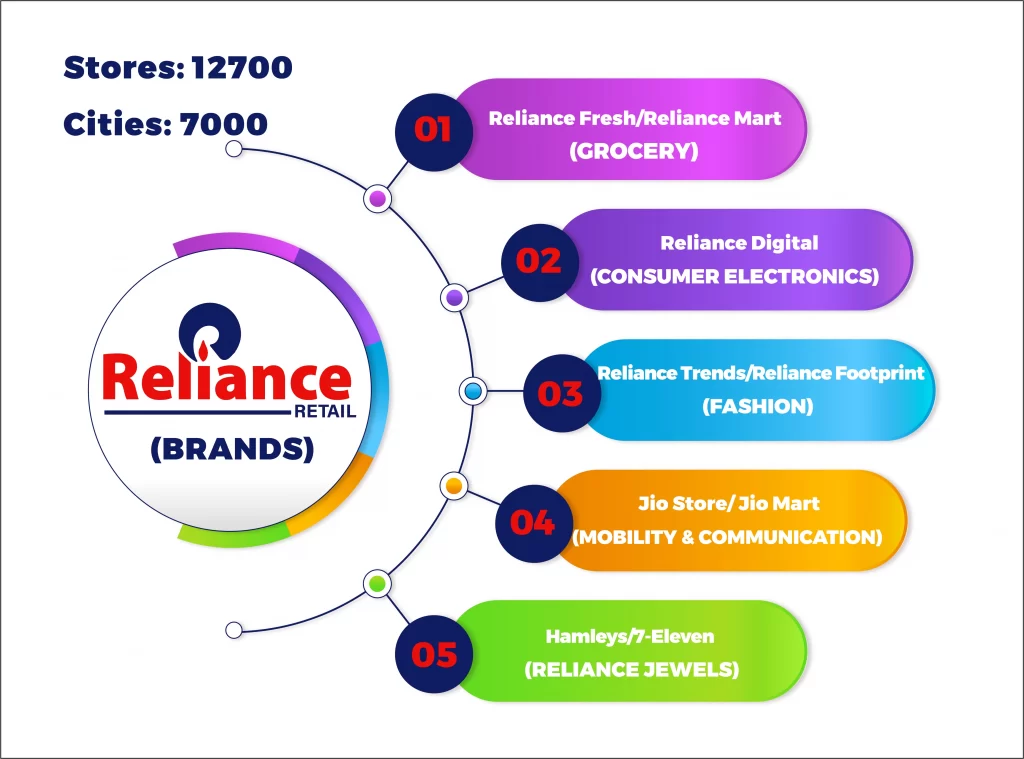

We are talking about Reliance Retail, which is the largest retailer in terms of revenue in the country. It boasts brands like Jio Mart, Reliance Digital, Reliance Trends, AJIO, Hamleys under its banner. And, perhaps it has just scratched the surface, as it continues to build and acquire more businesses to keep growing at a rapid pace.

Any financial advisor worth his salt would say you should always own a leader in the business who continues to grow, and today there is perhaps no other company as attractive as Reliance Retail. It is a true differentiator in the retail industry and therefore remains an attractive, safe and sure bet for investors. Checkout Reliance retail share price and other details before you make in decisions on investing in this unlisted stock.

Below are five reasons that prove this argument

Most recognisable constellation of brands

One of the simplest investing advice any advisor can give is to invest in those brands that you are most familiar with. That is, look around you, find the products you use everyday, services you employ regularly and stores you frequent — invest in them.

You are less likely to err in that way.

Now look at the following bouquet of brands: Reliance Trends, Reliance Jewels, Reliance Digital, Reliance fresh, Jio Mart, Just Dial, Net Meds, Zivame, Ajio.com, Project Eve, 7-Eleven, Hamleys, Urban Ladder, Dunzo — what is common in them?

They are all owned and operated by Reliance Retail, and there is a very good probability that you have come across, or already using a couple of them regularly. The company is moving ahead with a sole intention to dominate both the supply channel and direct to consumer retail. It has been investing and strengthening its business on both fronts, using other partner services like Jio and WhatsApp.

At one side it is adding stores for the brands it owns at a rapid pace — 9,000 and counting — making sure there is one at everyone’s reach.

Where it cannot reach, it is collaborating with your local grocery and departmental stores to ensure quick delivery and access to its homegrown brands. On the other hand, it is acquiring startups to venture deeper into the e-commerce field.

Reliance Retail claims it has been ranked as the fastest growing retailer in the world. It is ranked 53rd in the list of top global retailers and is the only Indian retailer to feature in the Top 100. It is the largest and the most profitable retailer in India with the widest reach.

The company said it has more than 150 million loyal customers buying across all its formats. It recorded more than 640 million footfalls across all its stores in FY20, a scale unmatched by any other retailer in India.

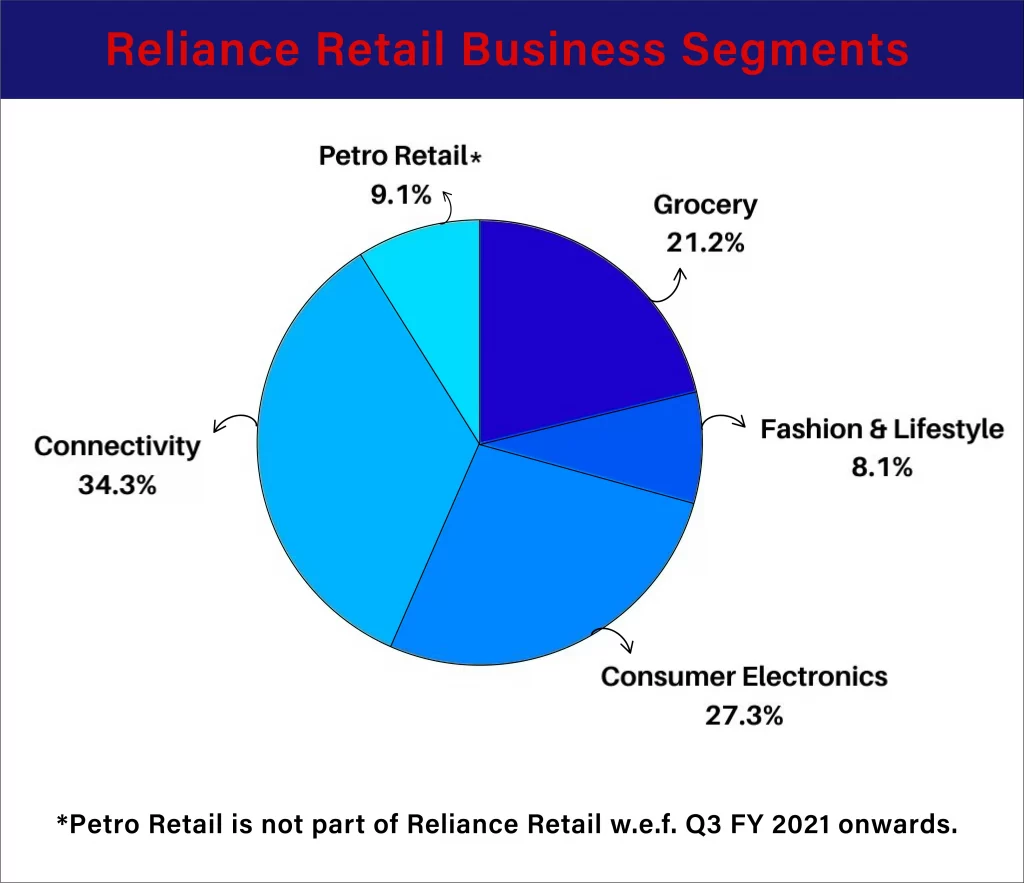

If we look at its FY21 financial report, when almost every other business showed a drop in revenue due to extended lockdown across the country, Reliance Retail reported sales at Rs 1.50 lakh crore, up about 2 per cent YoY. Profits though came in a little lower compared to previous fiscal, which is understandable.

Jefferies believes the company’s offline business, which largely contributes to its revenue, will grow at 16% CAGR over next four years, indicating a bright future.

High growth potential

A number of brands and companies have tried to penetrate the retail space, but India's retail market is still dominated by mom-and-pop stores or traditional kirana stores. Organised retail, which is the segment Reliance Retail operates in, has barely one-fifth of the retail market share in the country.

In that scenario, the market opportunity is huge.

The organised retail segment is expected to grow at 15-18% compound annual growth rate (CAGR) till 2025. And, with a number of brands and outlets, Reliance Retail, being the largest retailer, has positioned itself perfectly to ride the rise of organised retail.

In another development, which clears legal hurdles, it will also get hold of Future Group’s retail business including the popular Big Bazaar stores. This consolidates its pace as the undisputed king of retail, and puts it in a comfortable position despite threats posed by online retailers Amazon and Flipkart and brick and mortar stores of D-Mart and V-Mart.

Bigger than parent

Bigger than parent

There will hardly be any parent in India who won’t wish that their children surpass them in all manner of successes. Reliance Retail in that sense has not disappointed its parent Reliance Industries, which happens to be the most valued listed company in India. Big shoes to fill, eh!

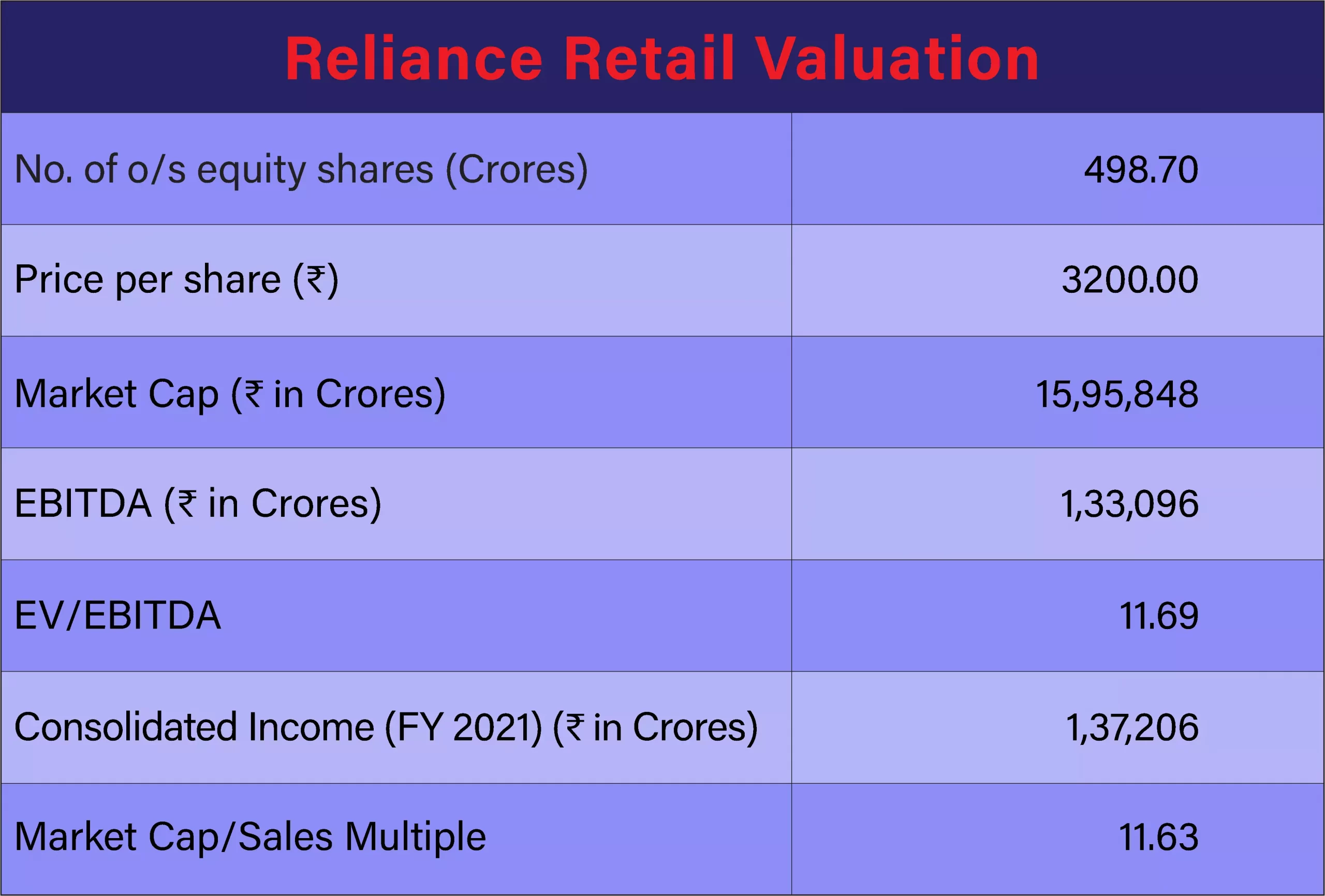

Today, Reliance Retail shares trade at around Rs 3,225 in the unlisted market. With the number of outstanding shares at 499.04 crore, the market cap of the company stands at a whopping Rs 16.10 lakh crore. [Click here to know more about Reliance Retail share price]

In comparison, Reliance Industries, which owns it along with other highly successful telecom and petrochemical businesses, gets valued at a tad less than Rs 16 lakh crore.

Gearing up for IPO

The company has not announced exactly when it will be bringing the IPO, but it will be sooner than later. Going by the management commentary and analyst expectations, in the next 2-3 years, both Reliance Retail and Jio Platforms, or at least one of them is likely to be listed.

We have already seen venture capital and institutional investors like Silver Lake Partners, KKR, GIC, TPG and General Atlantic, as well as sovereign wealth funds Mubadala, ADIA and PIF positioning themselves to benefit from the listing by buying a little over 10% stake for Rs 47,250 crore.

So, it is high time you position yourself too.