Every investor wants the biggest bang for the buck. Value investors try their best to find great businesses at cheap prices. To determine if a stock is trading cheap or expensive, there are several valuation models that can be employed to estimate their intrinsic value.

Valuing a listed company, with abundance of publicly available information, is much easier.

In comparison, valuing a private company, which only trades in an unlisted market, can be a difficult and often frustrating task, but not impossible.

In theory, the process of valuing private companies is not different from the process of valuing public companies. You estimate cash flows, attach a discount rate based upon the riskiness of the cash flows and compute a present value.

The challenge is lack of efficient price discovery, and financial statements are likely to go back fewer years, and have less details.

In cases of some large private companies, the information may be relatively easily available and in more detail.

But in cases of smaller firms, you might not find credible sources with the required data and information. Nonetheless, you will have to work with what is available.

Illiquidity discount

Before we discuss the various methods of valuing an unlisted company, you need to understand illiquidity discount.

One big advantage of investing in listed stock is you can easily sell your investments, as there are many buyers available for most scrips on any trading day.

But, in an unlisted market, you may not be able to sell your investment so easily. Two companies with the same fundamentals, similar revenue and profits and doing the same business—but one listed and another unlisted–will be priced differently.

Aswath Damodaran, Professor of Finance at New York University, says the illiquidity discount for a private firm is between 20-30%. Healthier and larger companies, with more liquid assets, should have smaller discounts than money-losing smaller businesses with more illiquid assets.

This illiquidity discount may widen when the economy is doing badly and liquidity is tough to come by.

Valuing unlisted shares

There are various methods of valuing a firm. Here are a few of them:

Net Asset Value method

Net asset value method is a relatively less popular way to value a company. The net asset value is arrived after subtracting the market value of total liabilities from the fair value of the total assets. This method does not require forecasting future cash flows.

This method is more frequently used to value that company which has strong assets on its balance sheet which command ready market value like lucrative real estate, financial assets like equities, bonds, technology patents, exclusive marketing rights of certain brand.

However, interpreting what assets should be valued at what price needs a deeper understanding of the business.

Another variant of NAV method is the ‘Replacement cost’ method which assigns the value of assets which any person would be willing to pay to acquire them right now.

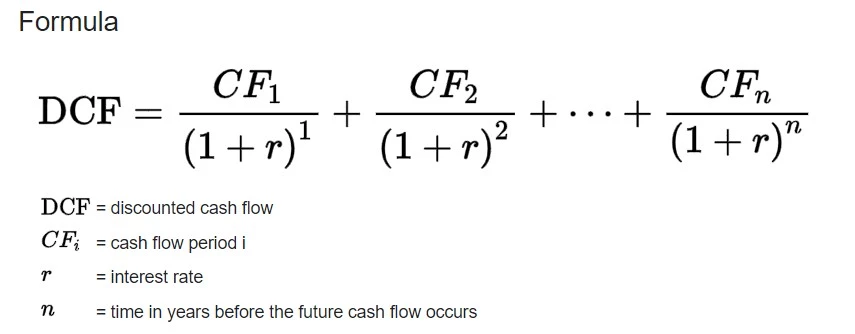

Discounted cash flow (DCF) method

DCF method is another popular method of valuation employed by many analysts. This method is used for mature stage companies which have had stable business operations and generating reliable cash flows.

This method is also used by investors when they have to acquire majority control of the company or an asset.

This method is also preferred when a company’s capital structure will undergo significant change i.e. take on a higher percentage of debt.

It is especially suitable for loss-making tech companies whose business model starts generating profits many years from now. The model tries to establish the value of return that investment generates after adjusting for the time value of money (the idea that Rs 100 today is more valuable than Rs 100 in 2030).

Let’s understand with an example.

Suppose a business invests Rs 11 crore today in a project. It is likely to generate cash flow of Rs 1 crore in 2023 and 2024 each, Rs 4 crore in 2025 and 2026 each and Rs 6 crore in 2027.

Now, you need to determine a discount rate, which is usually weighted average cost of capital (WACC) for the firm, let’s say 5%.

Using the DCF formula (below), calculate DCF for each year.

Add all DCF, and subtract the initial investment to calculate net present value.

If the value is positive, the cost of the investment today is worth it, and vice versa. In our example, value will be positive.

Last transaction method

Under this method, you try to estimate the value of your unlisted shares based on at what valuation the company raised funding in its last funding round.

Institutional investors, who are usually among the first investors in these firms and usually have insider information, are considered ‘smart’ and hence provide a cue to the market on how to value such companies.

But they can go wrong as well.

For example, before listing on Paytm raised funds at a valuation of $16 billion. But, after listing, the valuation has plunged about half of that value. So, going by market wisdom, it was overvalued before the IPO.

Relative valuation method

Relative valuation method, as the name suggests, values a business against its competitors or industry peers, preferably of the same size, to assess the firm’s financial worth.

This method is only relevant to use when you can find a comparable company having a similar business profile as the company to be valued.

Then, you select the suitable valuation multiples like Price/Earnings (P/E), Price/Sales (P/S), Price/Book Value (P/B), EV/EBITDA, based on data available and suitability.

Using these multiples, you try to judge whether the specific company is trading expensive or cheap as compared to its peers or overall market.

Valuing loss-making firms

Valuing loss-making companies becomes a little difficult as they are relatively young and have no profit or positive free cash flow history.

So, not all methods will work on it.

The best way to value them is by using the DCF method or relative valuation method.

You can calculate price to sales, price to book or enterprise value to Ebitda and compare them to the same for a listed company in the same business.

In that way, you can determine if you are paying more for a business or it is a cheap deal.

Which method should you use?

There is no one-size-fits-all method.

For example for a loss making company, using price to earnings (P/E) method may not make much sense. At the same time, the net asset value (NAV) method may not be appropriate for an asset light business.

All methods have their own relevance and pitfalls.

Moreover, lack of data may also render some methods not possible to use.

You should decide what kind of company you are analysing and how much data is available and then decide which method would be more prudent to use.

Read our other blogs: