6th September, 2022

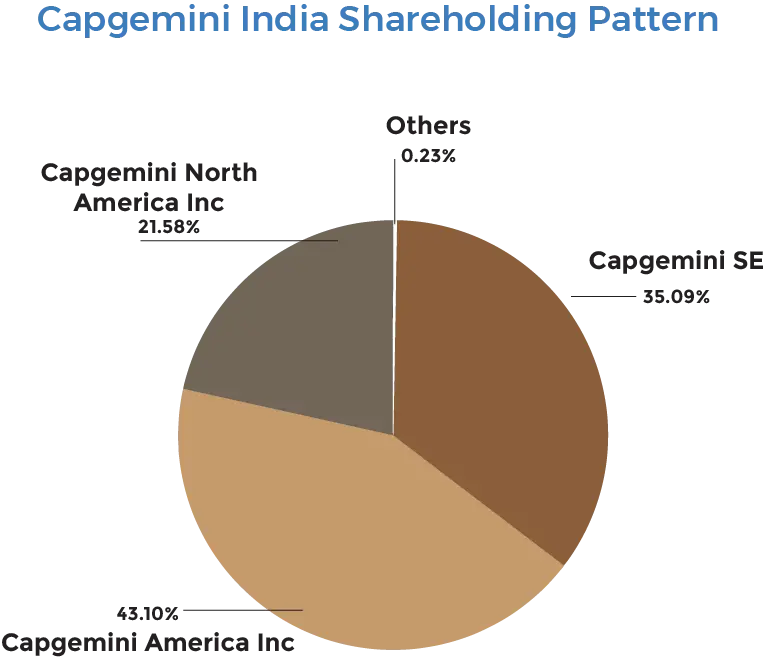

Capgemini Technology Services India (Capgemini India), formerly known as iGate Global Solutions, is a subsidiary of Capgemini SE, a Paris based multinational information technology company with annual revenues of €18 billion.

The company has a global presence with employees working in over 50 countries in the world. The company serves the needs of its clients specialising in cloud, data, artificial intelligence (AI), connectivity, software, digital engineering and platforms.

Capgemini India, though not listed in the country yet, has seen heavy demand for its unlisted shares in recent years in line with the listed peers. However, what is different is even as demand for the likes of TCS and Infosys has ebbed due to increasing headwinds, Capgemini unlisted shares maintained have not had any major selling. This is also in contrast to selling in parent Capgemini SE shares listed in France.

So, what Capgemini is doing differently in India? And, should you buy unlisted shares of the company given its performance? We will explore the answers to these questions below.

About the company

Capgemini India provides IT services to mostly medium and small companies across the world. In India, the company’s offshore centres are located at Bangalore, Bhubneshwar, Hyderabad, Chennai, Noida, Mumbai, Pune, Gurugram, Kolkata, Trichy, Salem and Gandhinagar.

The company has two key subsidiaries Annik Inc. USA and Aricent Technologies. Annik provides services in the field of market research, data collection, data integration, and analytics; while Aricent deals with communication software services, consumer and enterprise applications, network management for the clients in the communication industry.

The company’s total manpower as on 31 December 2021 was 1,69,000, which is a large chunk of total manpower employed by Capgemini SE – 3,25,000. At the global level, Capgemeni added 1,40,000 employees with about 50,000 hired in India in just the nine month period of April-December 2021.

Business & Financials

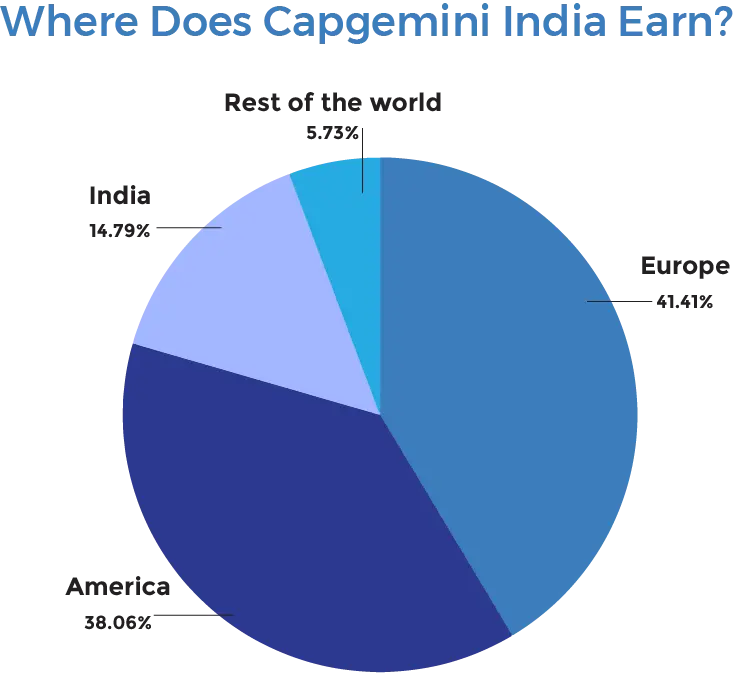

Capgemini India’s major markets are: Americas (FY21 revenue of Rs 6433.9 crore), Europe (Rs 5807.1 crore), India (Rs 1,926.7 crore) and Rest of the World (Rs 803 crore).

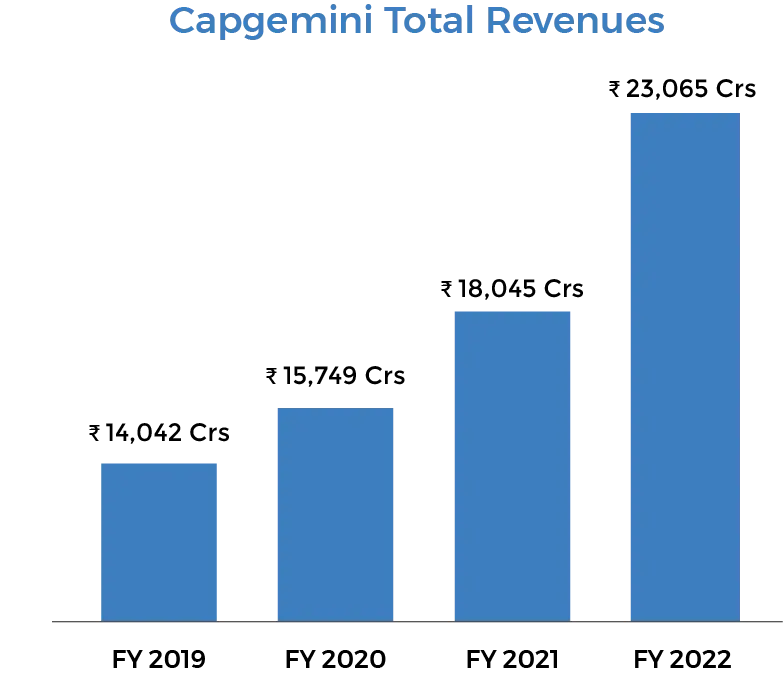

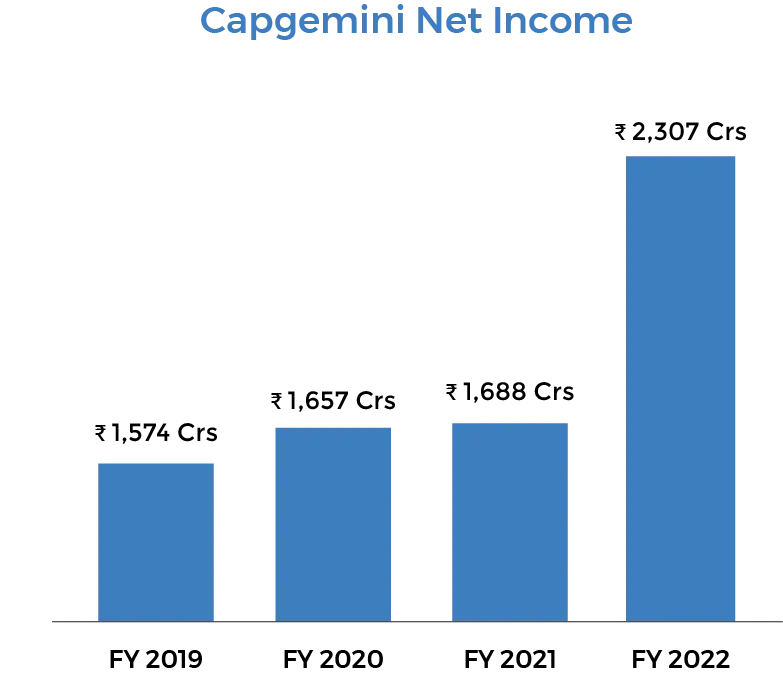

The company has shown a decent pace of growth in recent years. In the last four years, revenue has grown at a compound annual growth rate (CAGR) of 8.05 per cent. Meanwhile, its profits have grown at a CAGR of 4.36 per cent in the period from Rs 1425 in FY18 to Rs 1690 crore in FY21.

The company’s growth in revenue is comparable to that of Wipro and Tech Mahindra that have grown at 8-9 per cent a year and is inferior to TCS, Infosys and HCL Tech that have growth in low double digits in the last five years. In terms of profit growth, its performance is disappointing compared to 7-15 per cent for above-mentioned names.

The Indian arm of Capgemini has also lagged its parent in terms of revenue growth. Capgemini SE said it grew at 14.6 per cent in 2021.

The company is almost debt free with debt to equity ratio of 0.1.

Recent mergers

The company has recently merged India based subsidiary iGATE Infrastructure Management Services Limited with itself which will be effective from 08 July 2021. Similarly, it has merged Liquidhub India Private Limited and Liquidhub Analytics Private Limited with itself as well effective from 17 August 2021.

Parent’s recent performance

Since Capgemini India is not listed in India, it is not obliged to give a quarter on quarter earnings report. However, some of its growth contribution can be inferred from consolidated performance of Capgemini SE, its parent company.

In its latest disclosure, Capgemini SE, which follows January to December financial year, said its revenue grew 22.7 per cent year on year in the first half of 2022 (H1CY22). The growth was also better than full year growth of 2021, indicating strong momentum in recent months.

The company also managed to grow its operating margin by 20 basis points to 12.2 per cent in the period when other IT companies have seen erosion of margins due to rising employee costs and slowing growth momentum. The company said its profits grew 50 per cent.

Its bookings totalled €11.6 billion in the first half of 2022, up 22 per cent year on year at constant exchange rates. In rupee terms, this translates into Rs 92,160.15 crore. This also in contrast to domestic companies that have seen lesser deals in most recent quarters.

Growth outlook

Again, the Indian arm is not obliged to provide any outlook of business but the parent’s growth outlook takes account of the domestic business. Capgemini SE in July said given the strong demand momentum, the Group is raising its growth objective for 2022 and is now aiming for revenue growth of 14 per cent to 15 per cent at constant currency, instead of 8 per cent to 10 per cent previously. None of the Indian companies have increased their growth outlook by such a big margin.

The Group’s other objectives for 2022 are unchanged with an operating margin of 12.9 percent to 13.1 percent and organic free cash flow above €1.7 billion (Rs 13,506.23 crore).

Price & valuations

Capgemini India unlisted shares have seen a massive run in the recent years. From Rs 2,500 per share towards the end of 2020, the stock is now quoting between Rs 11,500 to 14,000 per share. This is a jump of over five times in less than two years.

This is in contrast to many of the listed IT stocks that have seen some selling recently. For instance, TCS is down 9 per cent in the last one year, Infosys 10 per cent, HCL Tech 18 per cent, Tech Mahindra 27 per cent and Wipro down 34 per cent.

Relatively smaller IT names like Mindtree, L&T Tech and Happiest Minds – which are more comparable to the size of Capgemini India – are also down up to 30 percent.

As of FY21, total number of outstanding shares of the company stood at 59,139,500, which translates into a market cap of Rs 68,010 crore to Rs 82,795 crore on the prevailing prices. Given the earnings per share for FY21, the stock is valued at upwards of 40 times. This makes it expensive compared to listed IT names that trade between 20 to 30 times their earnings.

Given the superior growth outlook, investors can buy Capgemini India unlisted shares on correction.

Tell us in the comments section below whether you would like to invest in Capgemini Technology Services India Ltd unlisted shares.

Read our other blogs:

Your blog is very nice all information about shares

buy shares of unlisted companies

buy unlisted share

buy sell unlisted shares