boAt (Imagine Marketing Limited) | Boat Share Price | Live Updates

Company Overview

Established in 2014, Imagine Marketing Ltd has successfully developed boAt as India’s leading consumer electronics brand in the e-commerce space. With a focus on trading consumer technology products, boAt offers an extensive range of headphones, earphones, car accessories, party speakers, wireless earphones, and related accessories. As of 30th September 2021, boAt holds the top position in India with a remarkable 48% market share in wireless hearables by volume. Additionally, boAt ranks #3 among smartwatch brands in India, commanding a substantial 23% market share by volume.

The company reported the following subsidiaries and associate companies:

- Dive Marketing Private Limited

- Imagine Marketing Singapore Pte Limited

- HOB Ventures Private Limited

- KaHa Technologies Private Limited

- KaHa Singapore Pte Limited

- Sirena Labs Private Limited (Associate Company)

- Kimirica Lifestyle Private Limited (Associate Company)

Business Model

Imagine Marketing Ltd. operates in the online and offline retailing of the following consumer electronic product categories:

- Headphones, Earphones, Speakers (Wired & Wireless), comprise 83% of the total sales as on 30-Sept-2021

- Smart watches (14% of the total sales)

- Others (cables, chargers, men’s grooming kits, and gaming equipment)

As of September 30, 2021, the company generated 83% of its total sales from online platforms, including Amazon and Flipkart, while the remaining sales came from offline distributors, modern retailers, and its own website. The company’s manufacturing vendors are based across China, Vietnam, and India.

Registered Office

Unit No. 204 & 205, 2nd floor, D Wing and E Wing, Corporate Avenue, Andheri Ghatkopar Link Road, Andheri(East), Mumbai-4400093, Maharashtra, India.

| Symbol | Imagine Marketing Ltd (boAT) |

|---|---|

| Face Value | ₹ 1 each |

| ISIN | INE03AV01027 |

| DEMAT Status | NSDL/CDSL |

| Lot Size | 10 |

Key Business Highlights Helping to Determine Boat Share Price

- BoAt is one of the largest Indian e-commerce brands, with leading market positions across multiple fast-growing product categories. “boAt” is the #1 wireless wearables brand and the #2 smartwatch brand in India by volume, with market shares of 48% and 23%, respectively

- Diversified business model with increasing sales from offline channels. Its products are now available for sale

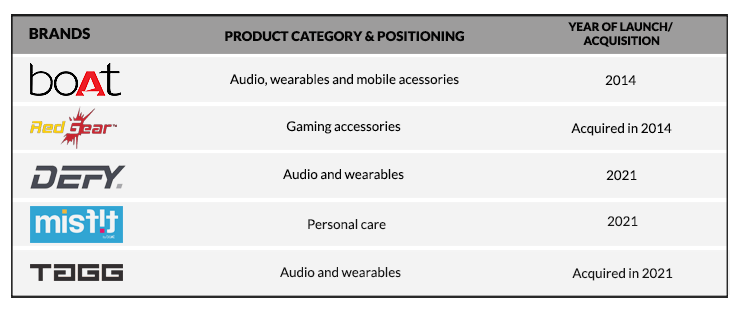

in over 23,000 retail stores across India, facilitated by a retail network of over 51 distributors and more than 180 sub-distributors. - The company is expanding into adjacent product categories through brand extensions, new brands, and

acquisitions. - The company is also entering international markets in the UAE, Nepal, and & South East Asia, primarily within the core audio and wearables categories.

Ratio

| Ratio | FY22 | FY21 |

|---|---|---|

| Operating Margin | 5% | 10% |

| Net Profit Margin | 2% | 7% |

| Return on Equity | 11% | 19% |

| Debt-Equity | 1.53 | 0.09 |

| Current Ratio | 1.23 | 3.18 |

| Dividend Payout | 0% | 0% |

Financial Highlights

| Particulars | 2021-22 | 2020-21 | 2019-20 | 2018-19 |

|---|---|---|---|---|

| Total Revenues (₹ crores) | 2,886.44 | 1,320.37 | 609.95 | 226.11 |

| PAT/(Loss) (₹ crores) | 68.70 | 86.53 | 47.79 | 8.03 |

| Diluted EPS (₹) | 5.09 | 7.97 | 4.42 | 0.79 |

| Book Value per Share (₹) | 62.34 | 70,668 | 14,306 | 4,619 |

| Equity (₹ crores) | 601.94 | 464.16 | 71.53 | 23.10 |

Note:- During the year 2021-22, the face value of the equity shares was sub-divided from ₹10 per Equity share to ₹1 per Equity share.

Financial Charts

Historical Chart

Shareholding Pattern

Peer Comparison

| Company | Market Cap (₹ Crores) | Profitability Margin (%) | ROCE (%) | ROE (%) | D/E Ratio | P/E Ratio | P/B Ratio | Book Value per Share (₹) |

|---|---|---|---|---|---|---|---|---|

| Boat (Imagine Marketing Ltd) | 8352 | 2% | 20% | 11% | 1.53 | 169.61 | 13.88 | 62.34 |

| Pulz Electronics Ltd | 40 | 7% | 12% | 9% | 0.00 | 15.35 | 1.42 | 26.14 |

Note:- Other peers for Boat which are not in listed segment are- MIVI, Boult Audio & Piron.

Media Updates

The ₹2,000 crore IPO consists of a fresh issue of shares worth up to ₹900 crore and an offer for sale of shares worth up to ₹1,100 crore, according to the company’s draft prospectus. boAt co-founders Aman Gupta and Sameer Mehta will pare their stake worth ₹150 crore each in the company, the filing shows. Its investor South Lake Investment will also sell shares worth ₹800 crore. The headphone maker plans to utilise the proceeds of the IPO to repay or prepay its borrowings.

Read more here: https://www.fortuneindia.com/investing/boat-parent-imagine-marketing-files-for-2000-crore-ipo/106868

Frequently Asked Questions

The buying and selling of unlisted shares and pre-IPO shares is fully legal and valid.

The procedure to buy the boAT unlisted shares is fairly simple. Once you have settled on the price and quantity of the transaction, you would have to transfer the funds into the bank account of the seller.

When the funds are transferred and transaction details are shared with the seller, your demat account will be credited with the shares either on the same day of the fund transfer or before the end of the next working day.

In the secondary market, the transactions related to unlisted shares take place with the existing owners of the shares who are generally the employees or existing investors in the company. The company itself is not directly involved.

The boAT shares will get credited either the same day or before the end of the next working day when you transfer the funds into our bank account.

The minimum lot size varies on the basis of market conditions and demand and supply factors. To know the current lot size for boAT unlisted shares, please visit the stock page on our website: www.delistedstocks.in

There are many factors which influence the pricing of unlisted shares. Apart from the supply and demand factors, the latest transactions happened on the same stock, last funding round of the company, and valuation level of companies of the similar size affect the pricing of the unlisted shares.

Before IPO, there is no restriction on sale and transfer of your boAT unlisted shares.

But once the shares are listed on the stock exchange, for retail investors, there is a minimum lock-in period 6 months after listing on the stock exchange.

Once the selling price and quantity of shares is agreed with us, we will provide you with an UTR number to transfer the shares. Once you have transferred the shares into our company’s demat account, funds are released into your bank account within 24 hours or before the end of the next working day of the transfer of the shares

If your holding period is less than 2 years, then such income is treated as business income and liable to get taxed as per tax slab of the investor.

If your holding period is more than 2 years, then your profits would be subject to long-term capital gains tax. The current short-term capital gain tax rate is 20% after indexation.

The trading in unlisted shares is governed by Securities & Contract (Regulation) Act, which comes under the preview of SEBI. The SEBI regulations become applicable when the stocks of the company get listed on the stock exchange. There is a minimum lock-in period of 6 months for pre-IPO investors.

The major risk associated with investing in unlisted stocks is the liquidity risk. The possible exit route for investors is either to sell to another investor or wait till the company gets listed on the stock exchange.

Yes, NRI’s can also buy and sell boAT unlisted shares just like domestic investors. But their investment is on a non-repatriable basis.