11 Jul, 2022, Blog

Author: Delisted Stocks Team

11 Jul, 2022, Blog

Author: Delisted Stocks Team

BVG India is one of India’s largest integrated services companies with more than 54,000 employees as of June 30, 2021. The company holds a leading market share of 6.4% in the integrated facilities management services market in India in Fiscal 2021 and offers a wide range of integrated services including soft services such as mechanized housekeeping, industrial housekeeping, manpower supply, security services, and janitorial services, hard services such as electro-mechanical works and highway maintenance, and specialized services such as paint-shop cleaning and logistics management.

It also provides beach development and cleaning services and also manages the operation and maintenance of buses including electric buses. It offers these services to a diverse base of clients operating across sectors including the industrial and consumer sector, transport and transit infrastructure sector, hospitals, healthcare sector, and government establishments. Surprisingly, they are among the few companies to also service religious institutions in India.

The Promoters, Hanmantrao Ramdas Gaikwad and Umesh Mane, have nearly two decades of experience in operating this business. They are supported by a qualified and experienced senior management team, which has demonstrated its ability to manage and grow the operations organically. In addition, some of the key managerial personnel and senior managerial personnel have been with the company for more than 10 years. The company has also been supported by private equity investors such as 3i Group Plc.

The company has four subsidiary companies:

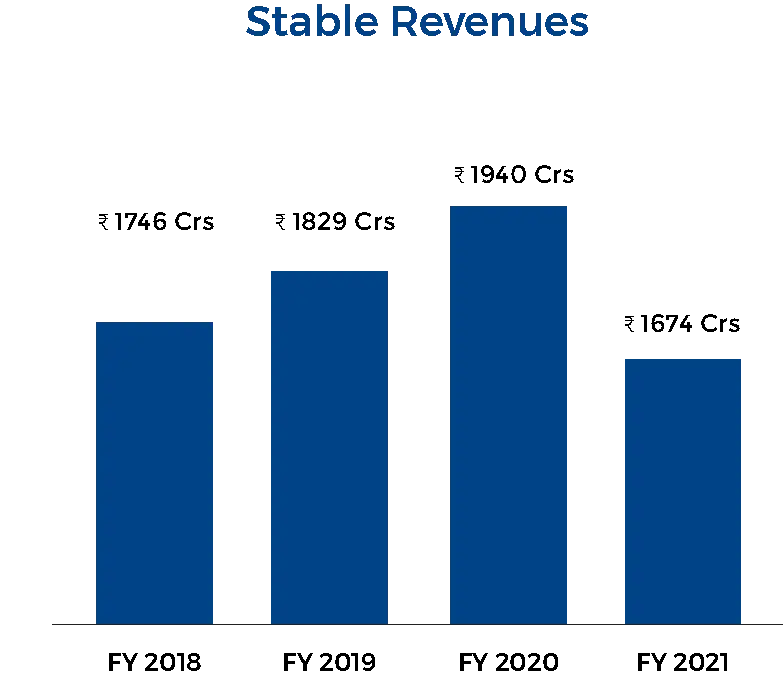

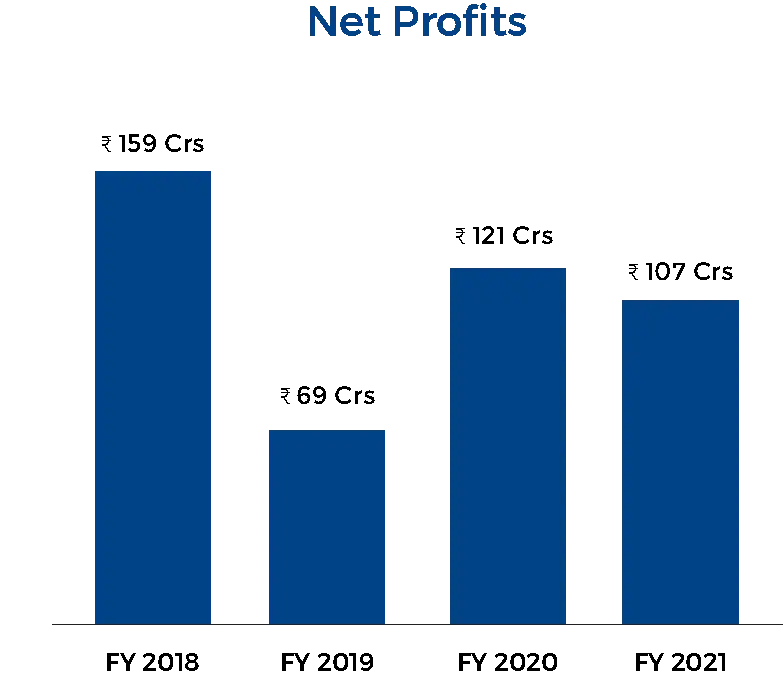

A LOOK AT KEY FINANCIALS:

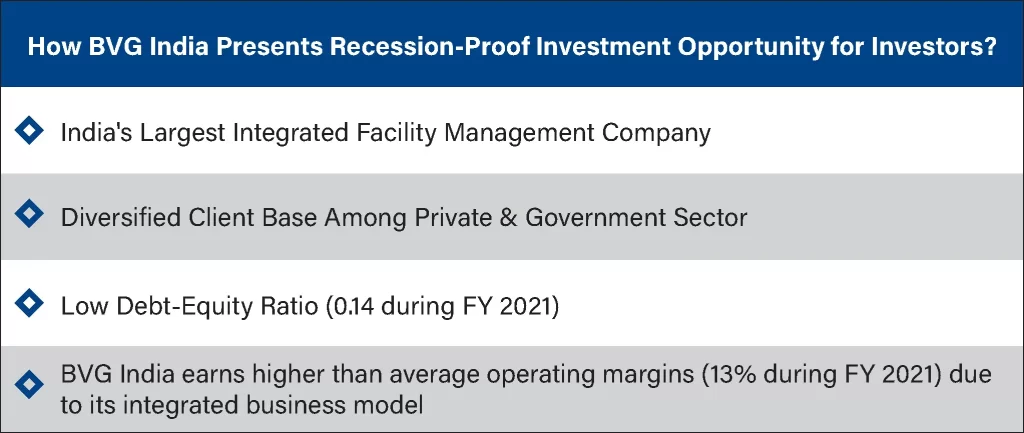

The company’s business is based on a ‘solution pricing’ model and it seeks to largely operate through output-based and/ or fixed billing contracts instead of on a cost-plus basis, which enables them to optimize resource allocation. Its profit from continuing operations was ₹ 69.2 crores, ₹ 121.8 crores, and ₹ 107.3 crores in Fiscal 2019, 2020, and 2021, respectively. The total income was ₹ 1829.8 crores, ₹ 1940.4 crores, and ₹ 1674.5 crores in Fiscal 2019, 2020, and 2021, respectively. The EBITDA from continuing operations was ₹ 181 crores, ₹ 252.6 crores, and ₹ 231.7 crores in Fiscal 2019, 2020, and 2021, respectively, and EBITDA Margins (as a percentage of total income) were 9.90%, 13.02%, and 13.84%%, respectively. The ROE in Fiscal 2019, 2020, and 2021 was 11.92%, 17.42%, and 13.75%, respectively, and ROCE in the same periods was 13.95%, 17.47%, and 15.62%, respectively. In Fiscal 2019, 2020, and 2021, the Net Worth was ₹ 580.4 crores, ₹ 699.4 crores, and ₹ 781.1 crores, respectively.

It caters to the diversified client base in both the private and government sector like Indian Railways, HAL, M&M, Hyundai, Fiat, and Bajaj Auto. BVG earns higher than industry average operating margins (earned 13.84% in 2021) due to its integrated business model.

INDUSTRY AND ITS DYNAMICS:

The Indian FM (facility management) market has grown at the rate of 19.6% between Fiscal 12 and Fiscal 2021. The FM market is estimated at ₹26,000 crores in Fiscal 2021. The concept of FM is well accepted in the commercial sector and the rate of outsourcing is high compared to the residential sector. FM in the residential sector is slowly gaining popularity, particularly among the high-rise residential communities in urban areas.

The FM market in India is highly unorganized with an ongoing shift in business towards organized players who ensure high standards in compliance and service delivery. Local and unorganized players do not comply with statutory compliances and insurances, giving them the advantage of providing services at a lower cost compared to organized players.

Customers have started preferring integrated players who provide a one-stop-shop for FM needs, rather than unorganized companies that are incapable of providing integrated services and do not have a good track record of compliance.

The outlook of FM services in India is shaping up to be highly optimistic mainly due to the rising awareness of the associated benefits of using FM services among the end-users and the need for improved safety, comfort, and professional maintenance of assets. The presence of Global and Indian MNCs across various end-user sectors is mainly driving the market for FM services in India as they are the potential customers due to their increased awareness levels, exposure to facilities, and willingness to invest. India, having wide geography and high population, there is a tremendous need for various services like emergency medical services, waste management, etc.

THE GOLDEN STRENGTH AND STRONG ROOTS:

BVG India has the ability to provide a wide range of services to clients under a single contract and cater to clients across a wide range of sectors and locations, which enables it to leverage economies of scale and provide cost-effective services to its client base. This experience, track record, and related brand equity also enable them to qualify for additional opportunities in the form of collaborations and evolving outsourcing requirements, allowing them to benefit from early-mover advantages in various other segments. For instance, BVG India stood as the single qualified bidder in offering Emergency Medical Services. It is among the first few companies in India to provide railway station management services including cleaning, ticketing, and management of food supply kiosks. It is the first company in India to be awarded contracts for providing emergency police response services, which are being outsourced in the state of Madhya Pradesh.

Other value-added services include providing basic periodic health screening facilities to the tribal communities in certain parts of Maharashtra.

NOTE TO INVESTORS:

As per the latest price of BVG India’s unlisted shares, it is trading at Rs. 1060/share which is fairly undervalued if compared with peers at this valuation. BVG India commands almost 3x profit margin and twice ROCE as compared to its peer Team Lease Services Ltd. and is trading at less than 1/3rd the PE multiple and ½ PB multiple as compared to the latter. Thus BVG India provides a great opportunity at an attractive valuation to those investors who want to participate and benefit from the growth story of the facility management sector of India. [Click here to know more about BVG India Ltd share price]

Tell us in the comments section below whether you would like to invest in BVG India Ltd unlisted shares.

Read our other blogs: