13th September, 2022

Mobikwik is the largest Buy Now Pay Later (BNPL) fintech and one of the largest mobile wallets in India. The company was founded in 2009 by Bipin Preet Singh and Upasana Taku, and has its registered office in Haryana. Company's user services expanded to include bill payments, ecommerce shopping, food delivery, petrol pumps, large retail chains, pharmacies, kirana stores, etc.

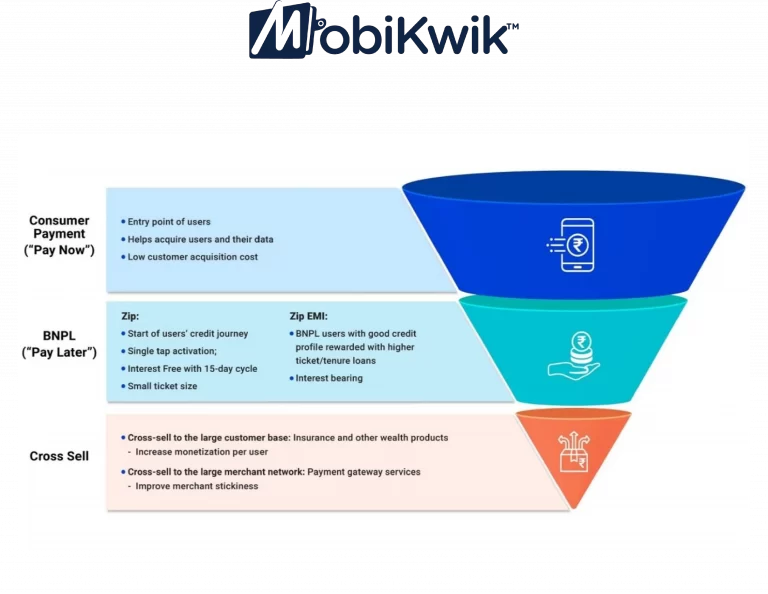

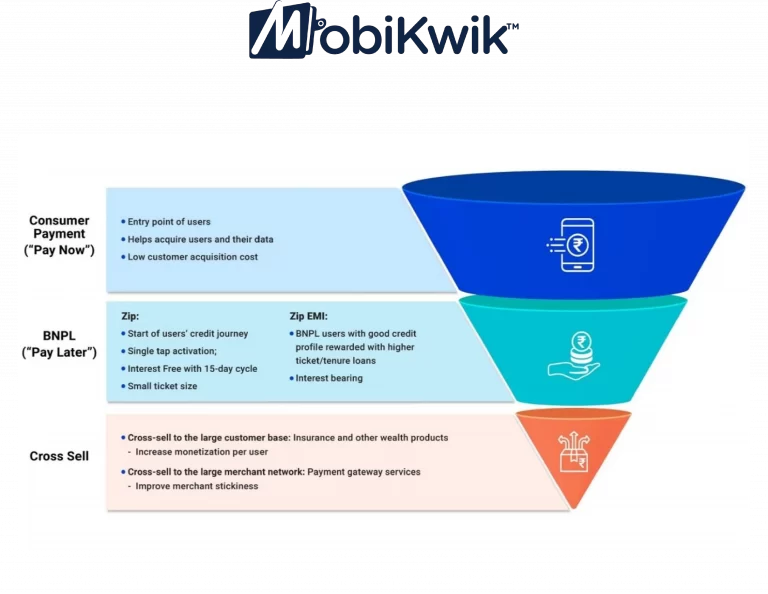

MobiKwik wallet is a semi closed wallet authorized in 2013 by the Reserve Bank of India (RBI). The RBI license allows the company to create marketplaces where customers can purchase goods and services from third-party vendors, avoiding the reportedly high failure rates of payment gateway transactions in India. Mobikwik platform also enables peer-to-peer payments via unified payment interface (“UPI”), MobiKwik Wallet as well as through MobiKwik Wallet to bank payments. They are focused on addressing the unmet credit needs of the fast-growing digitally paying users by combining the convenience of everyday mobile payments with the benefits of BNPL.

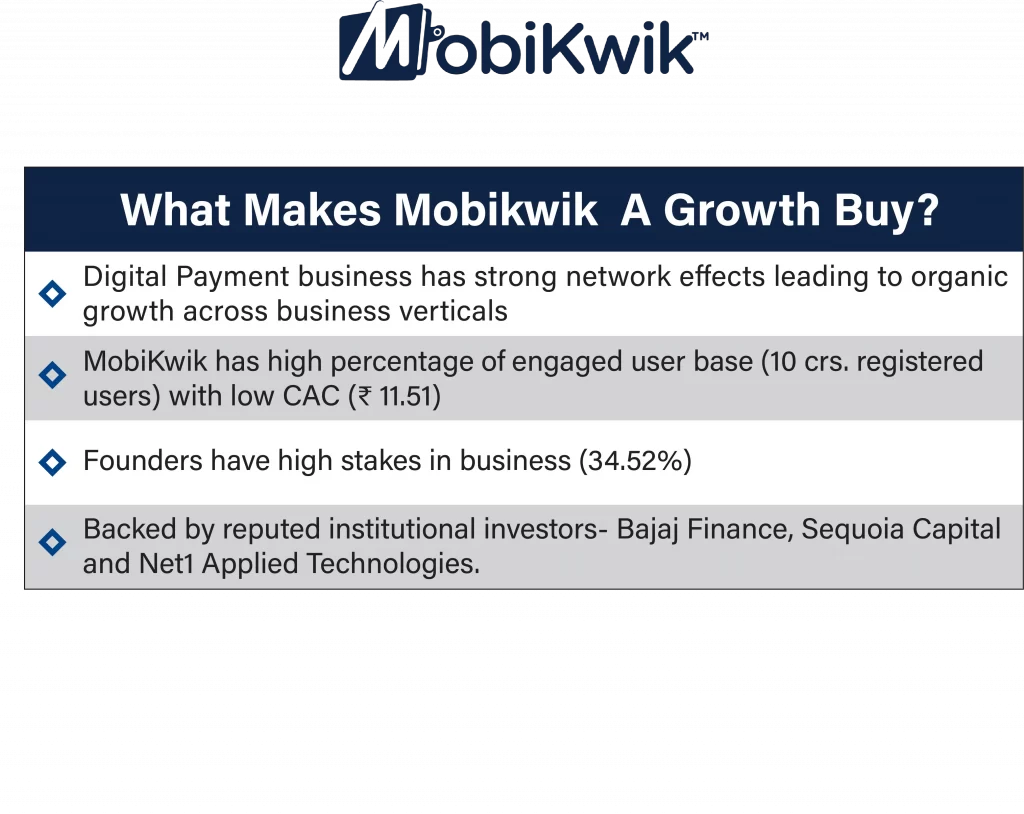

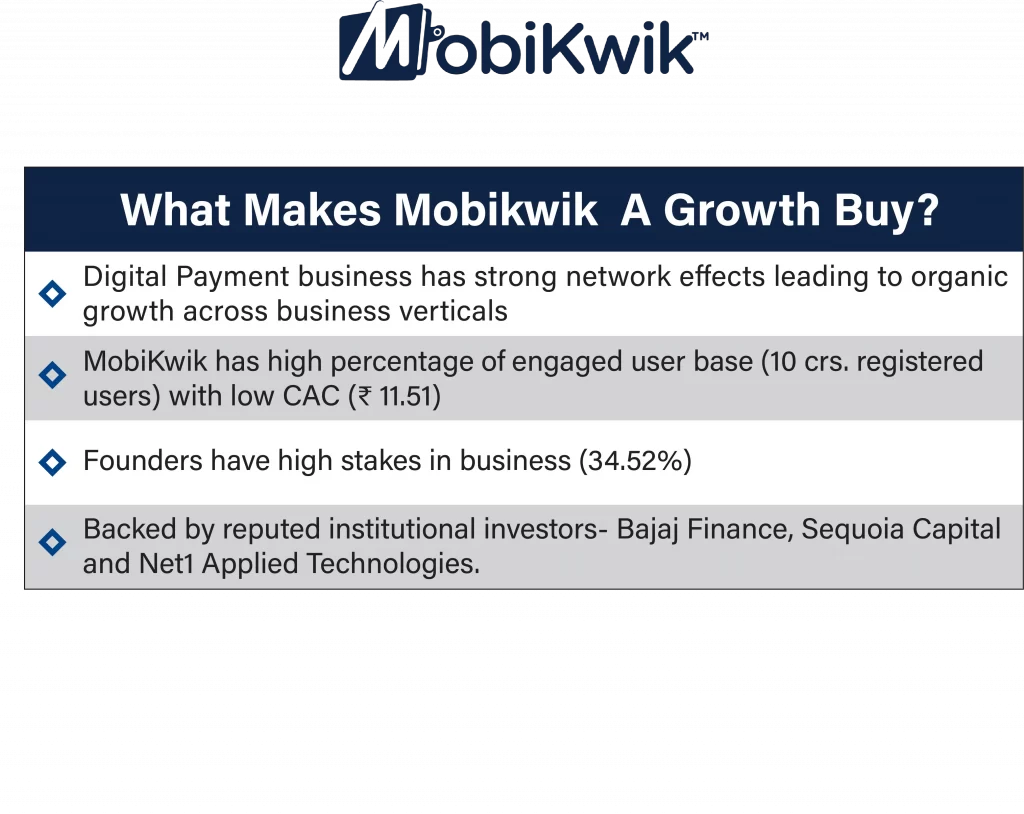

Mobikwik has over 101 million registered users and more than 3 million ecommerce, physical retail and biller partners. It has a strong presence in India with 30 Lakh plus active customer base. As per National Payments Corporation of India, in this short span of time MobiKwik has acquired 26% share of the entire IMPS transfer market in India.

The recent meltdown in the newly-listed start-up IPOs deferred the primary issue plans of the company, which is further hurting its stock prices. Shares of Mobikwik are currently trading at Rs 600-650. However, the script has lost about half its value from its peak, when it was trading at Rs 1,200-1,250.

According to the Redseer report, India’s online transacting users has rapidly grown at a CAGR of approximately 15% from 180 million in Fiscal 2018 to over 250 million in Fiscal 2021. It focuses on addressing the unmet credit needs of these fast growing online transactors by combining the convenience of everyday mobile payments with the benefits of Buy Now pay Later (BNPL).

Subsidiaries of Mobikwik Systems Limited:

- Zaak EPayments Services Private limited

- Mobikwik Finance Private limited

- Mobikwik Credit Private limited

- Harvest fintech Private limited

Mobikwik is a fintech company - one of the largest mobile wallets (MobiKwik Wallet) and Buy Now Pay Later (“BNPL”) players in India, based on mobile wallet gross merchandise value (“GMV”) and BNPL GMV, respectively, in Fiscal 2021. It is a technology-first company operating in payments and financial services. It leverages big data analytics and deep data science (including machine learning) to continuously delight users and merchants on our platform.

Mobikwik Product & Services:

- Phone Recharge & DTH

- Bill Payments

- Shopping in Local Stores

- Boost your finances with MobiKwik

- Transfer money to Bank

Mobikwik Industry Overview:

- Financial technology (Fintech) is used to describe new tech that seeks to improve and automate the delivery and use of financial services. At its core, fintech is utilized to help companies, business owners and consumers better manage their financial operations, processes, and lives by utilizing specialized software and algorithms.

- The Indian Fintech ecosystem sees a wide range of sub segments including Payments, Lending, Wealth Technology (Wealth Tech), Personal Finance Management, Insurance Technology (Insures), Regulation Technology (Reg Tech) etc.

- It is expected that the Indian Fintech market, currently valued at $31 Bn, may grow to $84 Bn by 2025, at a CAGR of 22%. The Fintech transaction value size is set to grow from US$ 66 Bn in 2019 to US$ 138 Bn in 2023, at a CAGR of 20%.

- The India mobile payments market was valued at $125.6 billion in 2019, and is projected to reach $1,384.0 billion by 2027, registering a CAGR of 35.0%. The mobile web payments segment was the highest revenue contributor with $65.3 billion in 2019, and is estimated to reach $638.6 billion by 2027, registering a CAGR of 33.0%, encouraging accelerated growth of the Indian consumer internet market.

- The online-transactor user base in India has been rapidly expanding, as a larger share of the population gets access to high speed 4G internet and gets comfortable with basic services such as recharges, bill payments. This has been facilitated further by the rapid growth in the mobile payment user base of India, which has been further enabled by the growth of payment instruments such as mobile wallets and unified payments interface. It is estimated that India may see the fastest growth in digital payment transaction value between 2019 to 2023 with a CAGR of 20.2%.

- India’s mobile payment user base has grown to be the second largest in the world behind China. Rigorous investment in mobile payment technology, large merchant ecosystem penetration created by mobile payment platforms and government initiatives on growth are all factors that are fuelling the growth of the mobile payment market in India and will continue to do so in the future.

- This industry is growing at a fast pace and there are many prominent players in the market, which include Paytm, Phone Pe etc., but still there is huge growth opportunity.

Mobikwik Future Prospects:

- India’s fintech industry has shown a remarkable growth trajectory in recent times, having undergone a radical transformation. According to a recent report by Research and Markets, as of March 2020, India accounted for the highest fintech adoption rate, a whopping 87 per cent, out of all the emerging markets in the world, falling second only to China.

- Future of the Fintech industry looks shining and growing rapidly on the back of rise of start-ups in Fintech industry, penetration of smartphone users, continuous build-up of the digital infrastructure and overall streamlining of financial processes in many industries. In a recent report, by Research and Markets, as of March 2020, India alongside China, accounted for the highest FinTech adoption rate 87%, out of all the emerging markets in the world. On the other hand, the global average adoption rate stood at 64%.

- The report also states that “The FinTech market in India was valued at Rs 1,920.16 billion in 2019 and is expected to reach Rs 6,207.41 billion by 2025, expanding at a compound annual growth rate (CAGR) of approximately 22.7 percent during the 2020-2025 period.

Tell us in the comments section below whether you would like to invest in Mobikwik unlisted shares.

Read our other blogs:

.