4th Aug, 2022

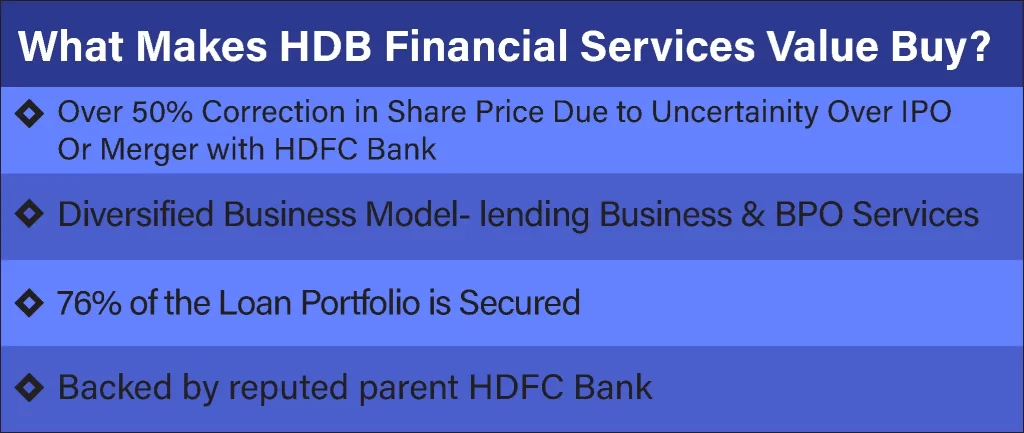

HDB Financial Services (HDBFS) is a subsidiary of HDFC Bank with 95% stake. It was incorporated in Ahmedabad in 2008 and provisions to the growing needs of an Aspirational India. HDB Financial Services (HDBFS) registered office is situated at Ahmedabad, India, while its corporate office is located in Mumbai, India.

HDB Financial Services (HDBFS) is a leading Non-banking Financial company (NBFC) as defined under Section 45-IA of the Reserve Bank of India (‘RBI’) Act, 1934 that caters to the growing need of both retail and commercial clients. The Company also provides services related to the marketing and promotion of various financial products and is a one stop shop for all the requirements, be it loans, investments or protections.

HDB Financial Services (HDBFS) provides lending services, fee based products and business process outsourcing services. The company operates through lending business and BPO services segments. It offers personal loan, salaried personal loan, new to a credit loan, doctor’s loan, business loan, auto loan, two-wheeler loan, fintech co-lending programs, gold loan, loan against property, Emergency Credit Line Guarantee Scheme (ECLGS), HDB EMI Card, enterprise business loan, loan against securities, credit card balance transfer, consumer durables loan, digital product loan, lifestyle product loan, commercial vehicle loan, construction equipment loan, tractor loan, life insurance, general insurance.

HDB Financial Services (HDBFS) is a well-established business with strong capitalization. The company has furthermore set up approximately 15 call centers across the country. HDB Financial Services Limited Unlisted Shares provides collections and various other back office services to HDFC Bank at approximately 750 locations through its calling and field support system. HDBFS is recognized with CARE AAA & CRISIL AAA ranking for its long-term debt and Bank facilities with A1+ rating for its short-term debt & commercial papers, making it a strong and reliable financial institution.

Overview of HDB Financial Services (HDBFS): Economic

The Indian economy had already been undergoing a protracted slowdown as stress in finance. The Novel Coronavirus (Covid-19) has cast a long shadow over a much-anticipated mild recovery in the Indian economy in fiscal 2021declaring it a pandemic. Both global and domestic, are unanimous that the Covid-19 pandemic will be an economic tsunami for the world economy. Even though India may not slip into a recession, it is expected that the impact on India’s GDP growth would be significant.

Business Model

The business model of HDB financial Services is based on offering loan products with custom features and focused towards first-time borrowers and underserved segment class. The company offers consumer loans, business loans, loans against property, asset-backed finance and micro lending.

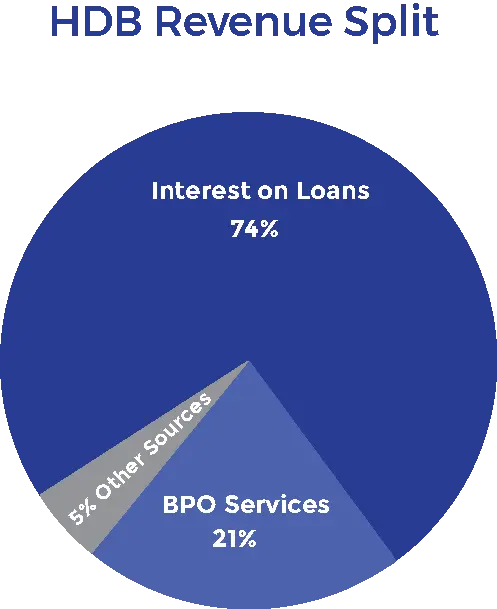

Under BPO Services, the company manages call centers at over 700 locations in India. These call centers manage the collection of overdue retail loans of HDFC Bank and also provide sales support and back-office services including form processing, document verification, accounting operations to HDFC Bank. The BPO segment accounts for around 18% of the total income of the company.

HDB is also a corporate agent of HDFC Life Insurance, Aditya Birla Sun Life Insurance, HDFC Ergo General Insurance and Tata AIG General Insurance to sell their life and non-life insurance products to its customers.

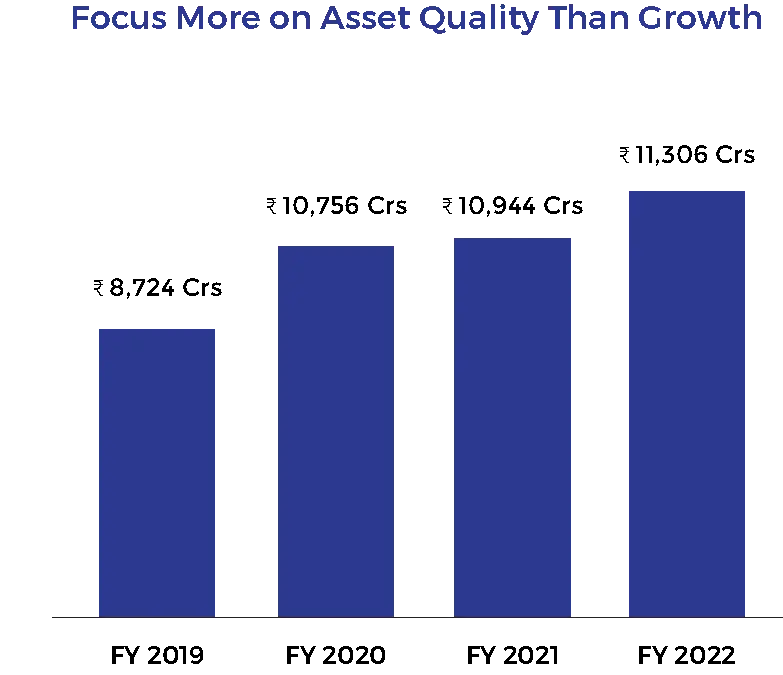

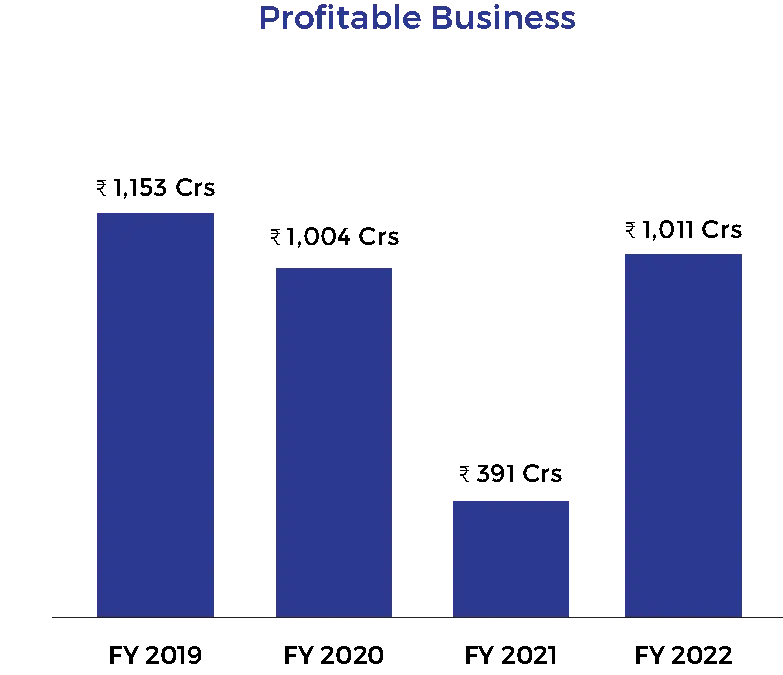

As on 31-March-2021, the company had assets under management (AUM) of ₹ 61,560 crores. It was perceived that HDB Financial Services Limited (HDBFSL) posted a net profit of Rs 304.1 crore in the third quarter ended December 2021 (Q3FY22). It had posted a loss of Rs 146.2 crore in the same quarter last year (Q3FY21). Sequentially, net profit rose over 50% when compared to Rs 191.7 crore reported in the second quarter ended September 30, 2021 (Q2FY22).

HDB Financial Services revenues in the reporting quarter rose 15 per cent to Rs 1,981.6 crore from Rs 1,723.7 crore in Q3FY21. Sequentially, they grew marginally from Rs 1,916.7 crore in Q2FY22. Its credit growth, on an annual basis, was flat as its total loan book stood at Rs 60,478 crore at end of December 2021 as against Rs 60,068 crore a year ago and Rs 60,008 crore in September 2021.

Whereas, the liquidity coverage ratio was healthy at 222 per cent in December 2021. Its gross non-performing assets stood at 6.05 per cent at end of December 2021 as against 5.9 per cent (pro forma basis) a year ago and 6.1 per cent in September 2021. Its Capital Adequacy Ratio (CAR) was at 20.3 per cent with Tier-I at 14.9 per cent in December 2021. As on December 31, 2021, HDBFSL had 1,328 branches across 965 cities / towns.

If we talk about the procedure to buy the HDB Financial Services shares, we can see that it is fairly simple and easy. Once you have settled on the price and quantity of the transaction, you would have to transfer the funds into the bank account of the seller. When the funds are transferred and transaction details are shared with the seller, your demat account will be credited with the shares either on the same day of the fund transfer or before the end of the next working day. And it gives an advantage to an NRI also to buy and sell HDB Financial services unlisted shares just like the domestic investors where the investment is on a non-repatriable basis. (Click here to know the latest share price of HDB Financial Services Ltd unlisted shares)

Industry Structure and Developments:

The NBFCs witnessed stress in their asset quality during the first half year of 2019-20. The gross NPA ratio of the NBFC sector increased from 6.1 per cent as at End-March 2019 to 6.3 per cent as at end-September 2019. The net NPA ratio, however, remained steady at 3.4 percent between end-March 2019 and end-September 2019. As at End-September 2019, the CRAR of the NBFC sector stood at 19.5 per cent, lower than 20 per cent as at End-March 2019.

RBI has been announcing various measures which will aid in liquidity flow into the system and should give relief to NBFCs. The importance of NBFCs in credit intermediation is growing, the default by a large NBFC brought the focus on the asset liability mismatches of NBFCs, which poses risks to the NBFC sector as well as the financial system as a whole.

For any questions related to investment in HDB Financial Services unlisted shares, let us know in the comments below.

Read our Other Blogs:

Investing In This Beer Company Won’t Give You A Hangover

Why are Unlisted shares more safe to invest