9th Aug, 2022

Arohan Financial Services Limited is the largest NBFC MFI in eastern India. Arohan Financial Services Limited is a Public incorporated on 27 September 1991. It is classified as Non-govt company and is registered at Registrar of Companies, Kolkata. Its authorized share capital is Rs. 1,600,000,000 and its paid up capital is Rs. 1,201,773,060.

Arohan Financial Services Private Limited is an Indian Non-Government Company. It is a private company and is classified as ‘company limited by shares’. The main motive of the company is to offer microfinance loans to customers from the economically weaker sections of the society. It is involved in Legal, accounting, book-keeping and auditing activities; tax consultancy; market research and public opinion polling; business and management consultancy. The company is engaged in the business of micro lending mainly to women borrowers and operates on a Joint Liability Group (JLG) model. It was set up through the acquisition of an existing NBFC, ANG Resources Ltd, with the support of Bellwether Microfinance Fund.

Arohan provides income generating loans and other financial inclusion related products to customers who have limited or no access to financial services. The company is a microfinance institution (MFI). It offers credit mainly to economically backward women and men. Arohan Financial Services Private Limited provides consumer financial solutions. The Company offers short term small size products and consumption loans to economically active women. It serves customers mainly in India.

Arohan Financial Services IPO Objectives are as follows:

- Fulfilment of general corporate purposes

- Augmenting the capital base

- Prepayment or repayment of the entire or a small part of its outstanding borrowings

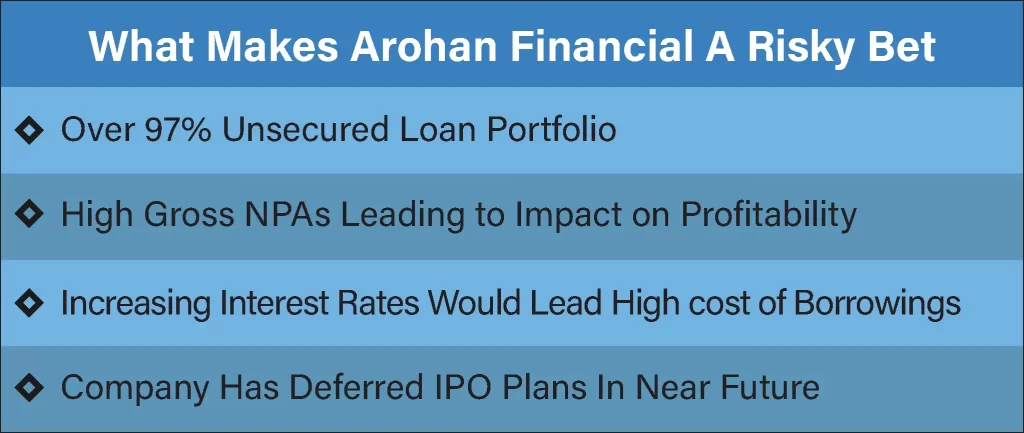

It was concluded that Arohan Financial Services, the microfinance arm of the Aavishkaar Group in a way may raise ₹150 crores from its existing investors after giving up plans to garner ₹850 crores in an initial public offering (IPO) where the lender may seek fresh approval for the IPO after bolstering its capital position. It was said by the managing director of Arohan Financial Services that their current IPO ticket validity may come to an end probably by the last week of April. And even if they plan to seek fresh approval, the process cannot happen before mid of June. In the interim period, Arohan Financial Services may raise about ₹150 crores.

Arohan Financial Services Limited offers a broad range of products to financially underserved customers. The financial products of the company are classified into the following categories:

- Credit- Their credit products include income generating loans and other loan products for various household purposes.

- Insurance products- Their insurance products include life and health insurance covers issued and underwritten by certain Indian insurance companies with whom they have entered into tie-ups. They also offer term loans to microfinance institutions.

As of September 30, 2020, Arohan Financial Services Limited served approximately 2.21 million borrowers in 17 states. These included 12 of the 14 Low Income States in India (as defined in the CRISIL Report). Their microfinance business branch network consisted of 710 branches in 11 states and their MSME lending business branch network consisted of 10 branches in eight states.

Arohan Financial Services Limited is a part of the Aavishkaar Group, which provides business solutions to assist sustainable enterprises dedicated to social and environmental change, has advised a large number of organisations on inclusive business strategies and has provided significant amounts of venture capital funding to social impact businesses. As of September 30, 2020, the Aavishkaar Group had an AUM of approximately US$ 1.00 billion across Asia.

Arohan Financial Services Limited have a bank loan rating of A- (stable outlook), MFI grading of MF1 from CARE Ratings, a Social Performance rating of SP1, COCA Dimensions of C1, all of which are top-notch grading. They were certified as a “Great Place to Work” and were ranked 86th among the best companies to work for in India by the Great Place to Work Institute India, in 2020. In the same year, they were in the top 25 companies among the banking, financial services and insurance industry, and among the top three NBFC-MFIs to be certified as a Great Place to Work.

Key Accomplishments of Arohan Financial Services Limited:

- Arohan Financial Services Limited was awarded the “Microfinance Organization of the Year” award by Access Assist at the Inclusive Finance India Awards 2018.

- Arohan Financial Services Limited was also awarded the “Microfinance Institution of the Year” award in 2010 in the “Small and Medium Category” by Access Assist.

It was presumed that between FY17 – FY20, Arohan Financial Services as per CRISIL report was supposed to have the second highest gross loan portfolio growth at 68% CAGR and stood amongst the top five NBFC-MFIs in India. It has also filed preliminary papers with SEBI to raise Rs. 1750 crores to Rs. 1800 crores. Along with this, the company’s IPO will certainly include a fresh issue of Rs. 850 crores and an offer for sale (OFS) of 27,055,893 shares by the existing shareholders. The qualified institutional buyers (QIB) can further subscribe to up to 50% of the IPO whereas the retail individual investors will have up to 35% of the reserved portion. 15% of the issue size will be set aside for non-institutional investors.

As on 31-March-2021, the company had 737 branches in 231 districts across 17 states with Assets under management (AUM) of Rs 4,648 crores with net NPA ratio of 3.96%. Arohan Financial is the largest player in the Eastern India and fifth-largest NBFC-MFI in India. The company has a diversified portfolio across India’s top-5 states (West Bengal, Assam, Bihar, Odisha, and Uttar Pradesh).

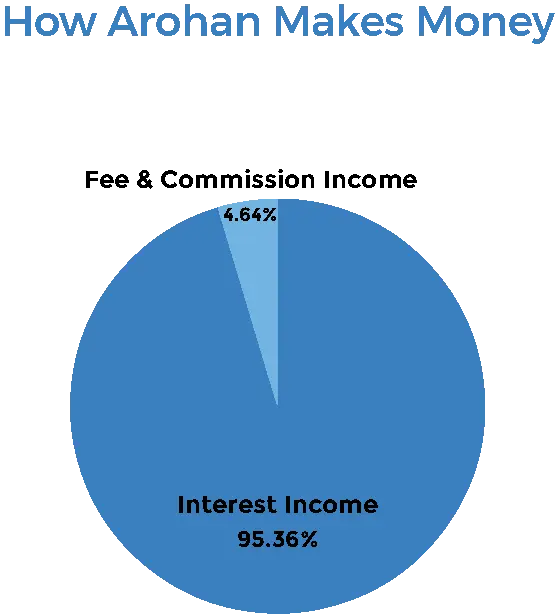

The company’s cost of borrowing was 10.64% during FY 2021 with 70% of the funding coming from banks. The company’s yield during FY 2021 was 20.68%, earning a spread of 9.92% to the company. The company reported CRAR of 24.27% and leverage ratio of 4.61 during FY 2021.

Should We Invest in the Arohan Financial Services IPO?

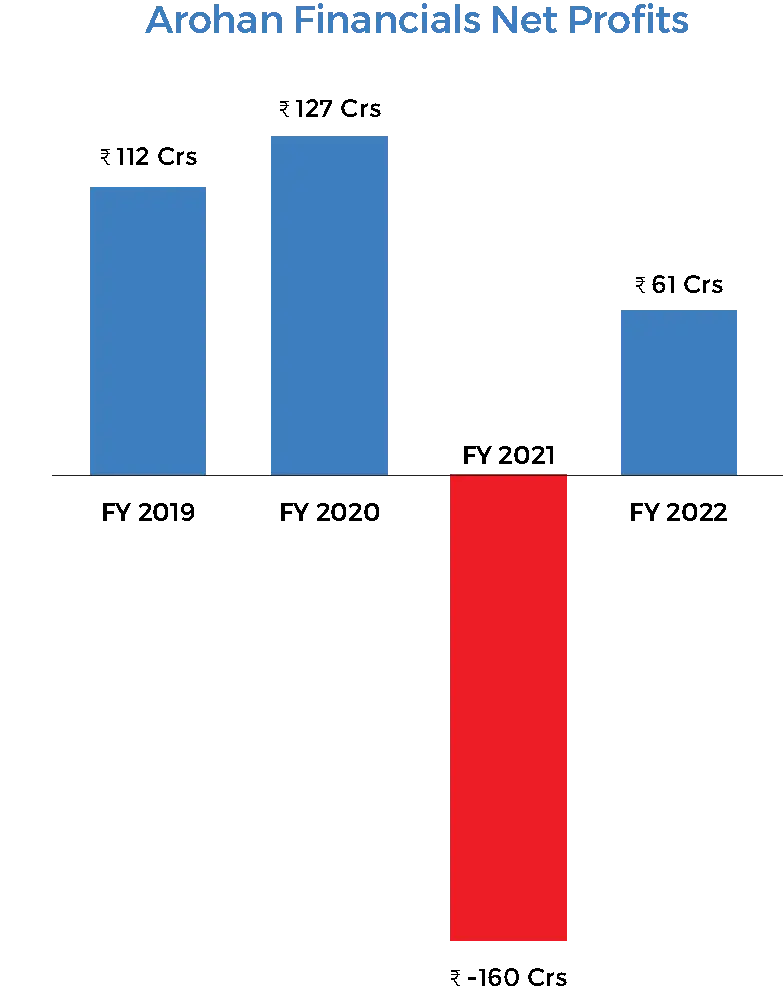

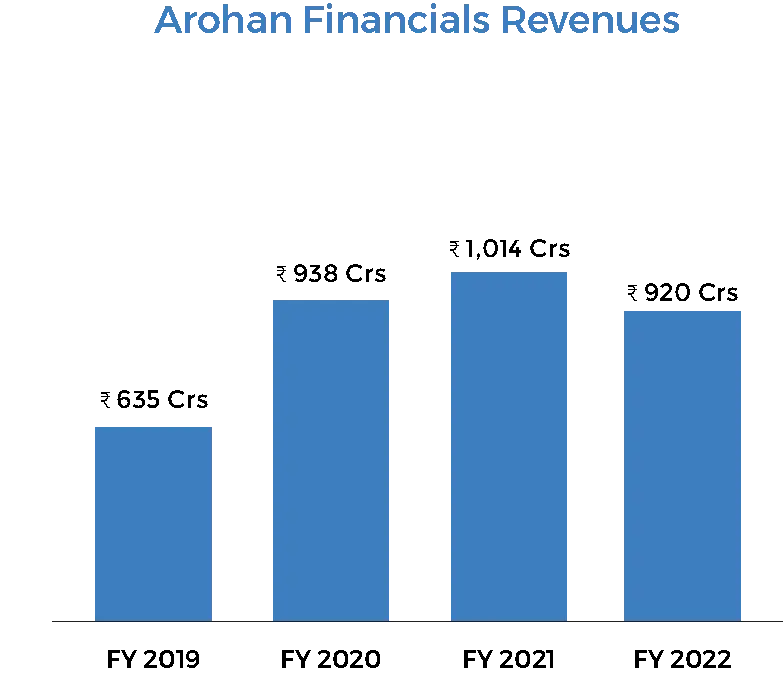

Besides an impressive scale of operations, Arohan Financial Services Limited has healthy profitability indicators and a highly experienced management team with a proven track record. Furthermore, Arohan has a well-diversified borrowing profile owing to a high share of funding received from banks. With the Indian financial services industry set to expand in the upcoming years, the outlook for this company seems to be quite positive.

Hence, investors might consider subscribing to its initial offer. So, it is rightly said, investors should take into account various aspects like the company’s weaknesses, financials, etc., before applying.

Tell us in the comments section below whether you would like to invest in Arohan Financial Services Ltd unlisted shares.

Read our other blogs: