16th Aug, 2022

Tamilnad Mercantile Bank Limited (TMB) is a private sector bank. Earlier the name of this bank was kept as “Nadar Bank Ltd and the bank was registered on May 11, 1921 as The Nadar Bank Ltd.” It is a scheduled commercial bank and authorized dealers in foreign exchange. It is one of the oldest private sector banks of the country. The bank has regional concentration in Tamil Nadu as 76% of its total business comes from the single state of Tamil Nadu. TMB was the first private Sector bank to introduce computerization operation at branch level in India and today all branches are networked using FINACLE software of Infosys to achieve 100% connectivity.

Tamilnad Mercantile Bank Limited (TMB) offers personal banking, NRI and international banking, and business and corporate banking services. TMB offers personal loans, education loans and home loans, while in the business loan segment it offers tractor loans, SME credit, truck finance, mortgage loans and traders loans.

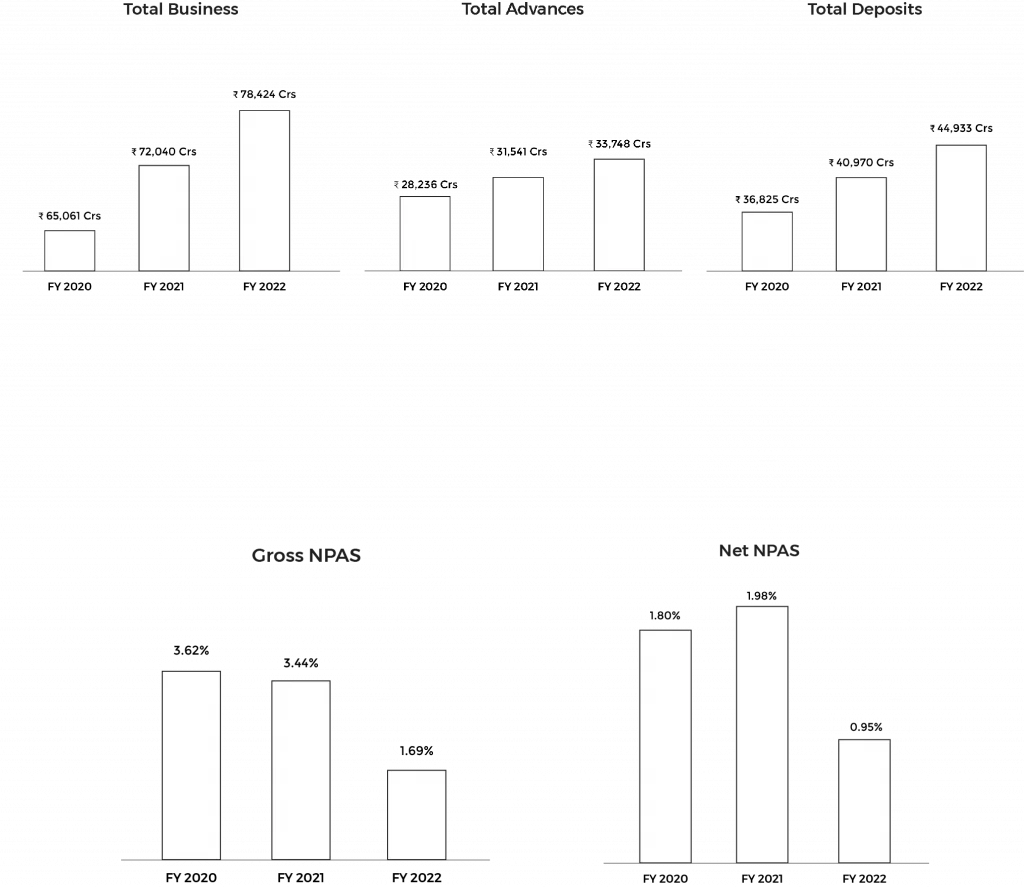

Taking into consideration the annual reports of Tamilnad Mercantile Bank Limited (TMB), it could be assessed that as on 31-March-2021, the bank has the largest lending exposure towards the MSME sector (39%), followed by Agri (28%), retail (20%) and wholesale (13%). The bank reported 3.77% net-interest margin (NIM), 18.94% CRAR, 28.52% CASA ratio, Gross NPA of 3.44% and Net NPA of 1.98%. The bank had more than 509 branches and 70% of its branches were in rural and semi-urban areas while the remaining 30% were in metro and urban cities. Whereas on 31-March-2021, the bank reported total outstanding equity shares of 14,25,11,454 of face value of Rs 10 each and the bank had no subsidiary and joint-venture.

OVERVIEW

Under the guidance of the Nadar Business Community, the Nadar Bank was established in 1921. The name of the bank was changed to Tamilnad Mercantile Bank in 1962, with an aim to widen its appeal beyond the Nadar community. For five years, from 2010 to 2015, TMB was the fastest-growing private sector bank. The first private sector bank in India to introduce computerization for branch-level operations, the TMB adopted modernizations in 1983. Today, all the 509 branches of the bank are networked through the Infosys FINACLE Software and have 100% connectivity. The bank has tie-up with ICICI Prudential Mutual Fund, UTI Mutual Fund, Reliance Mutual Fund, Franklin Templeton Mutual Fund, Birla Sun Life Mutual Fund, Sundaram Mutual Fund and HDFC Mutual Fund for selling their Mutual Fund Products. The bank became a Depository participant through NSDL to make available Demat facilities.

Initiatives taken by the company during the year 2018-19 include Inauguration of two link offices at Delhi and Vijayawada, Dedicated MSME processing centre at Surat, Specialized NRI desk at Mumbai, 11 Jewel Loan shops in rural areas, the launch of TMB Multi-currency travel card, International Rupay debit card and Contactless debit cards.

The bank has been continuously increasing its branch network and is also able to generate high quantum of deposits. It has been a leader in various technological advancement in the industry which is providing an edge to them over competitors and has benefitted the Tamilnad mercantile bank share value. The bank has been improving its Current and Savings Account (CASA) deposit ratio resulting in improved Net Interest Margin. It is expected to deliver decent CAGR returns to the esteemed Tamilnad Mercantile bank shareholders.

TAMILNAD MERCANTILE BANK REVENUE SEGMENTATION

| Key | Value(In %age) |

|---|---|

| Interest/Discount on advance/bills | 63.41 |

| Income on investments | 17.66 |

| Interest on balance with RBI and other inter bank funds | 1.07 |

| Other income | 13.86 |

| Commission | 3.99 |

PRODUCT AND SERVICES

The key clientele of the bank are retail customers, business enterprises and individual customers from rural, semi urban and urban (non metro) centres mainly from southern India.

Asset products

RAM customers

1. Retail asset products – Home loans, Personal loans, Security-backed loans etc.

2. Agricultural customers – Manufacturing, trading and service sector loan products.

3. MSME’s – Loans to individual farmers, groups of farmers, agriculture businesses.

Corporate customers

1. Working capital funding

2. Term financial funding

3. Foreign exchange business funding in domestic and foreign currencies.

Deposit Products

1. Saving bank account

2. Current account

3. Deposits

KEY HIGHLIGHTS

- Total Business witnessed growth of 4.68% to Rs. 65,061.21 Crs.

- Total Deposit increased by 4.81% to Rs. 36,825.03 Crs and Total Advances increased by 4.51% to Rs. 28,236.18 Crs.

- Gross NPA dropped to 3.62% and NPA dropped to 1.8%. Provision coverage ratio increased 80.75%.

FUTURE PROSPECTS OF TAMILNAD MERCANTILE BANK LTD.

- India Banking Market is projected to grow at a double digit CAGR during 2019-2024 owing to rising disposable income, growing digital payment system in the country, growing bank branch networks and entrance of the foreign banks in the Indian market.

- According to a recent Survey India will become the third largest domestic banking sector by 2050 after China and the U. S.

- According to RBI, India’s foreign exchange reserves reached INR 43 lakh Cr., as of February 5, 2021. According to RBI, bank credit and deposits stood at Rs. 106 lakh Cr. and Rs. 146 lakh Cr. respectively, as of January 15, 2021.

- Deposit growth is expected to slow to 6-8% in Fiscal 2022 due to households moving away from bank deposits and increasing consumption. Also, expenses due to the second wave are likely to result in deposit growth slowdown in Fiscal 2022.

- Earlier, credit growth in FY22 was expected to be much higher due to faster economic revival. However, the second wave led to realignment in growth expectations. Overall, bank credit outstanding is expected to grow 8-10% in Fiscal 2022. Much of this growth would be mainly driven by retail and agri loans.

- CRISIL research expects the entire stress would be recognised till Fiscal 2022-end; Fiscal 2023 would witness typical slippages and recoveries.

- As merged banks focus on integration and banks placed under corrective action come out of the PCA framework, credit growth of public banks is expected to lag that of private banks in the medium term. Public banks are expected to grow by 6-8% in Fiscal 2022, whereas private banks are expected to grow 9-11%.

- In Fiscal 2022, public banks are expected to witness a GNPA increase of ~100 bps due to stress on account of the second wave in Q1 of this Fiscal. Segments such as MSME, microfinance institutions (MFIs) and personal loans are expected to see higher stress.

CONCLUSION

- The bank has been continuously increasing its branch network and is also able to generate high quantum of deposits.

- The bank has been a leader in various technological advancement in the industry which is providing an edge to them over competitors and has benefitted the Tamilnad mercantile bank share value

- The bank has been improving its Current and Savings Account (CASA) deposit ratio resulting in improved Net Interest Margin.

- The bank is expected to deliver decent CAGR returns to the esteemed Tamilnad Mercantile bank shareholders.

Tell us in the comments section below whether you would like to invest in TMB Bank unlisted shares.

Read our other blogs: