27th Aug, 2022

Orbis Financial Corporation Limited is an unlisted public company incorporated on 28 November, 2005. Orbis Financial Corporation Limited (OFCL) company basically operates as a market intermediary and indulged in providing custodial, fund accounting, professional clearing, depository services, share transfer, FPI registration, and trustee services to a wide array of client segments, namely- FPI, PMS, FDI, DII, AIFs, and aTMs. Orbis is a leading player in India providing securities services since 2009.

OFCL commenced its operations in FY 2009 as a custodian of securities and a clearing member in all market segments that were registered with SEBI. In FY 2019, the company received a license for offering registrar and transfer agent services and trustee services from SEBI. The trustee services are offered through a wholly-owned subsidiary Orbis Trusteeship Services Private Limited. In other words, OFCL worked majorly in providing RTA services in 2019 as a SEBI accredited registrar and share transfer agent (R&T Agent) followed by trustee services as a SEBI accredited trustee services provider.

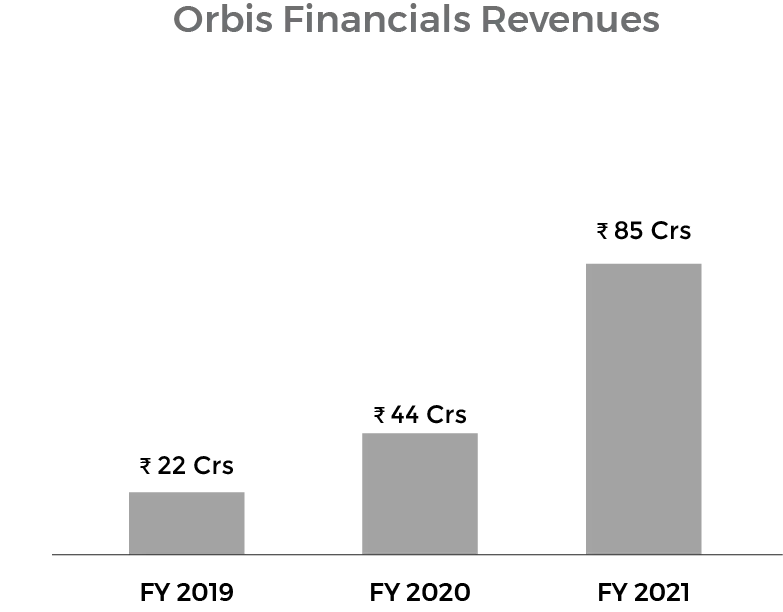

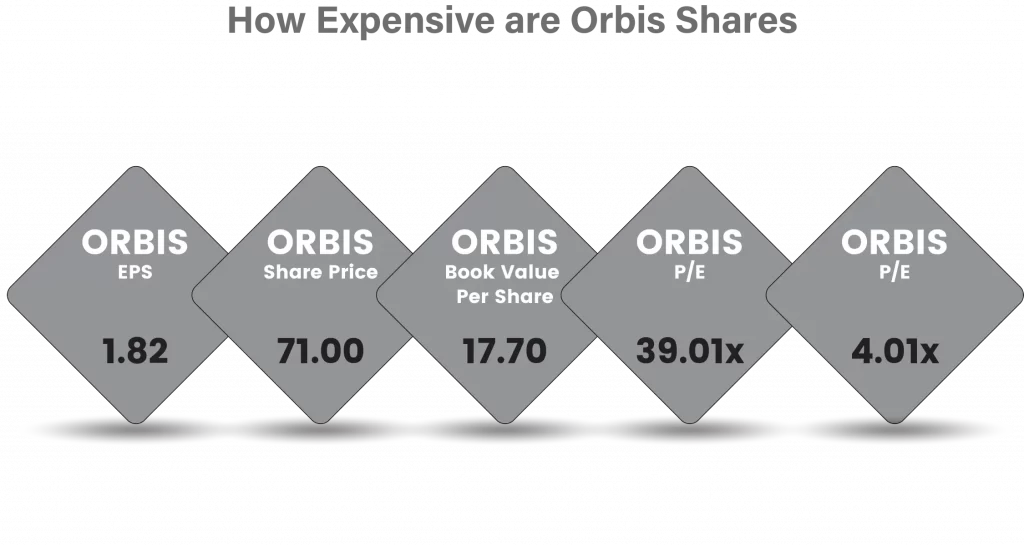

The last reported AGM (Annual General Meeting) of Orbis Financial Corporation Limited, per our records, was held on 30 September, 2021. The authorized share capital of Orbis is duly estimated at INR 133.00 crores and the total paid-up capital is INR 94.34 crores respectively. Orbis Financial Corporation Limited’s operating revenues range is INR 1 crores – 100 crores for the financial year ending on 31 March, 2021. It’s EBITDA has decreased by -25.64 % over the previous year. At the same time, it’s book net worth has increased by 94.45 %.

Description: This company provides margin lending facilities, outbound investments & inbound investments

Products & Services: Margin Lending Facilities, Inbound Investments, Clearing & Settlement Services, Inbound Investments, Outbound Investments, Custody, Margin Lending Facilities etc

Category: Service Provider

Orbis entered the financial markets as a Custodian in 2009 conceptualizing and offering a range of forward looking services designed and customized to equip the investors across segments to efficiently manage their investing operations securely.

Over this short period of operations, Orbis has established formidable goodwill specially in the Broker dealer segment focused towards brokers, portfolio managers, wealth managers, hedge funds and private equity funds staying positioned as a Custodian wholly dedicated to “Custodial Services”.

Orbis is equipped with the ability to support investors in this rapidly changing environment through professionals and systems which are accessible, prompt, responsive, friendly and provide customer-focused services and solutions which are economical, accurate, effective and innovative.

Orbis work towards a high level of transaction reliability with minimal counter-party settlement risk that often tend to get ignored until frauds impact.

As Clearing Members on BSE (Cash/ Currency Derivatives Segment), NSE (Cash/Debt/Equity & Currency Derivatives Segment) and MSEI (Currency Segment) and as Depository Participants on NSDL & CDSL, Orbis combines its technology, processes and experienced team to offer the value added Custody services to its clients.

Over this short period of operations, Orbis has established formidable goodwill specially in the Broker dealer segment focused towards brokers, portfolio managers, wealth managers, hedge funds and private equity funds staying positioned as a Non Competing Custodian wholly dedicated to “Investor Servicing” as Non – Brokers and Non – Fund Managers. Being a Non – Bank, many Non – Custodian banks are finalising appointment of Orbis as their Custodian. Due to our Non – Bank status, we can work with all banks and avail the Best of services though we do have a Special Banking relationship in place with a couple of leading banks.

In terms of the age in this business, Orbis commenced its full bouquet of Custody services in May 2009. Due to the age factor, it also carries advantage on stature of our technology & applications! Orbis can claim to be the only Custodian in India that is wholly ERP driven with all Custody processes including Clearing, Settlement, Risk management, Fund Accounting, etc. running on this integrated ERP platform. Orbis takes pride in its integrated robust ERP based Fund Accounting Solution. The reporting solution that is wholly customised for HNI’s is found to be of immense utility to the Investor.

As a part of backward integration, as a facilitator, Orbis is working towards addressing Inbound and Outbound Investments to / from India. On the Outbound front we have established a relationship with Pershing. Pershing is a subsidiary of Bank of New York, Mellon Corporation, USA. It is a leading provider of financial business solutions. It serves over 300 international financial organizations and has been doing business in over 60 markets globally.

Business Model

Orbis Financial provides the following services to its clients:

- Custody/Safekeeping services including fund accounting, clearing, derivatives clearing to clients like domestic and foreign investors, and high net-worth individuals.

- Registrar and share transfer services to listed and unlisted companies, mutual fund houses.

- Trustee services to various institutional clients including NBFCs, insurance companies, private equity, pension and mutual fund houses, asset reconstruction companies.

- Orbis is a depository participant with both the depositories, viz NSDL and CDSL.

Secure Investments

Eliminate the inefficiencies of moving assets & securities by simply buying services from domain experts in the procedures of safekeeping, market practices and management of securities holders’ rights and entitlements.

Receive accurate and customized reports on high trading volumes through our fast and easy ‘Orbis Online’ portal.

Enhance your portfolio’s ROI via our services with customized reporting, compliance monitoring, securities lending, forex and cash management.

Conclusion

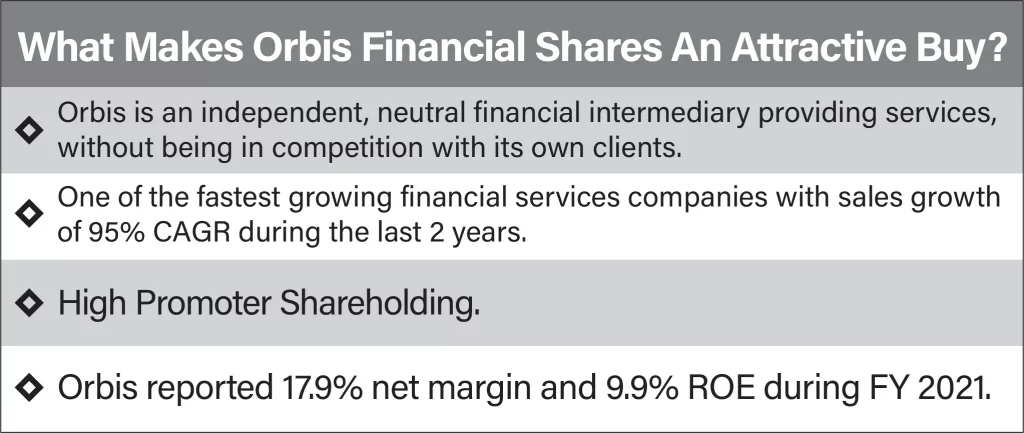

- Orbis is one of the fastest growing financial services companies with sales growth of 42% CAGR during the last 6 years. The company reported 26% average net margin and 20% average ROCE during the last 3 years.

- Orbis consistently distributed dividends to its investors during the last 3 financial years.

- Orbis is an independent, neutral financial intermediary providing services, without being in competition with its own clients.

Tell us in the comments section below whether you would like to invest in Orbis Financial unlisted shares.

Read our Other Blogs: