1st June, 2022

There has been a trend of institutional investors riding the macro-economic shifts and successfully investing in it. India’s favorable demographic size, growing middle-class population, rising disposable income levels, growing e-commerce sales, growing participation of females in the workforce, increasing consumer preference for packaged food etc. are some of the factors driving changes in the consumer habits and consumption patterns.

This change in the consumption patterns is causing the emergence of new business models and emergence of new set of companies in manufacturing, e-commerce, IT, FMCG, retail, and services sectors.

Today, we present to you one such successful growth story in ethnic snack foods category which has made its IPO plans public. In February 2022, Bikaji Foods filed a draft red herring prospectus (DRHP) to raise Rs 1,000 crores at the valuation of around Rs 76,000 crores ($1 billion). The entire issue will be an offer-for-sale (OFS), where existing investors will offload their stake and the company itself will not receive fresh funds for the business.

Bikaji Foods emerged among the top-three players in the Indian ethnic snacks category with 8.7% market share, behind Haldiram and Balaji Wafers. During fiscal 2021, Bikaji was the largest manufacturer of Bikaneri Bhujia, packaged rasgulla and second largest manufacturer of handmade papad.

Aggressive product pricing, offering more at the same price and increasing availability across different distribution channels are some of the strategies that have helped Bikaji Foods to emerge as a leader in the very competitive snacks industry.

Today, Bikaji Foods has developed a product portfolio of more than 250 products from namkeen, packaged sweets, papad, western snacks, chips and cookies. Namkeen is the highest contributor to its top-line with 37% share, followed by packaged sweets (36%), papad (12%) during fiscal 2021.

Indian Snacks & Sweets Market Overview

The Indian savory snacks market can be classified broadly into two categories: western snacks like chips, extruders and traditional ethnic snacks. These traditional snacks markets include namkeens, bhujia, dry samosa-kachoris etc.

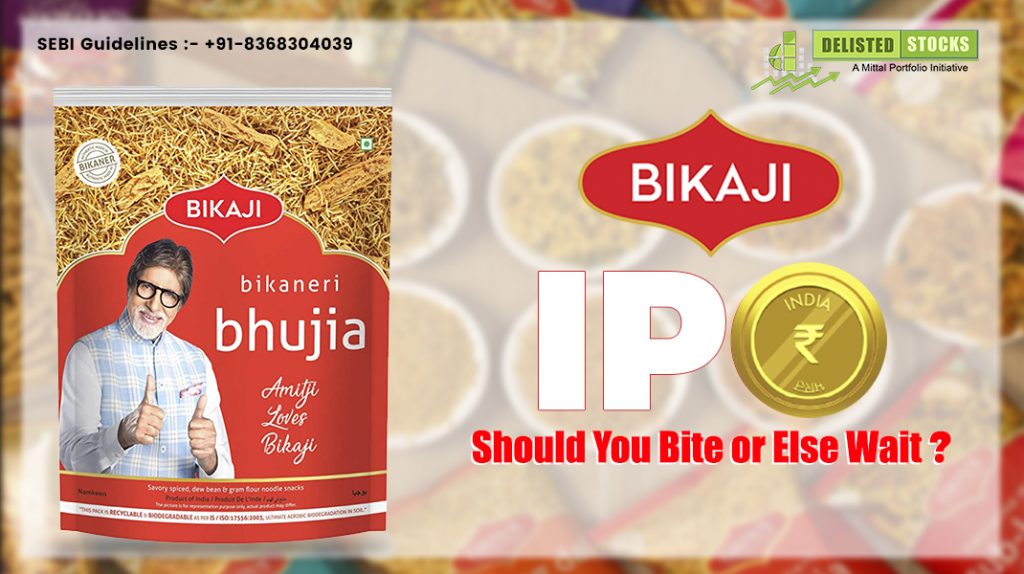

The size of the Indian savory snacks market was around Rs 72,800 crores during 2021 and this is estimated to grow to Rs 1,18,600 crores by 2025 with 13% CAGR. Of the total market, around 57% was in the organized segment while the remaining 43% of the market was serviced by a large number of unorganized players, specific to each region. The organized market is dominated by corporate players like Haldirams, Pepsico-Lays, Balaji Wafers, Bikaji, Bikanerwala etc.

Of the total organized snacks market, western snacks dominate with around 58% market share while the remaining 42% comprises ethnic snacks like bhujia, namkeen and snacks.

The organized players have been growing their market share on the strength of advertisement and promotions, new product launches, product innovations, packaging of products which were not sold as packed items before like samosas, bhel-puri, aam panna, coco-nut water etc.

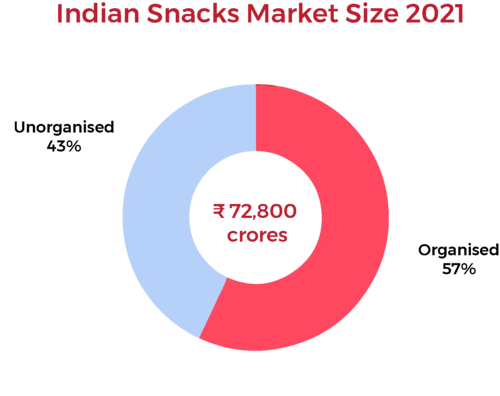

While the overall snacks market is growing, the investors are more attracted to the ethnic namkeens and snacks segment due to many reasons including high business growth and higher margins, sticky customer base, possibility to introduce new products with new tastes and variations. The ethnic snacks segment is expected to grow at 16% CAGR till 2025.

How the Story Started

Started in 1986 out of Bikaner under the name of Shivdeep Food Products, the Bikaji Foods has set up its niche in the fast growing ethnic snacks market. During the 90s, the company passed many new milestones including exports to UAE, Australia, and converted itself to a public limited company.

But it was during 2010s that it picked up great speed when it raised capital from private equity firms and invested in aggressive business expansion including building new production capacity and appointing Amitabh Bachchan as its brand ambassador.

In 2014, to fund its business growth, the company invited capital from Lighthouse, a private equity firm in exchange for 12.5% stake, valuing the company at Rs 750 crores. Today, private equity and other funds together own 12.47% of the company while the promoters own 76.48% of the equity stake.

Currently, the company has 6 manufacturing plants located across Bikaner (Rajasthan), Guwahati (Assam), Tumakuru (Karnataka), besides one contract manufacturing unit in Kolkata (West Bengal).

What does the Numbers Say

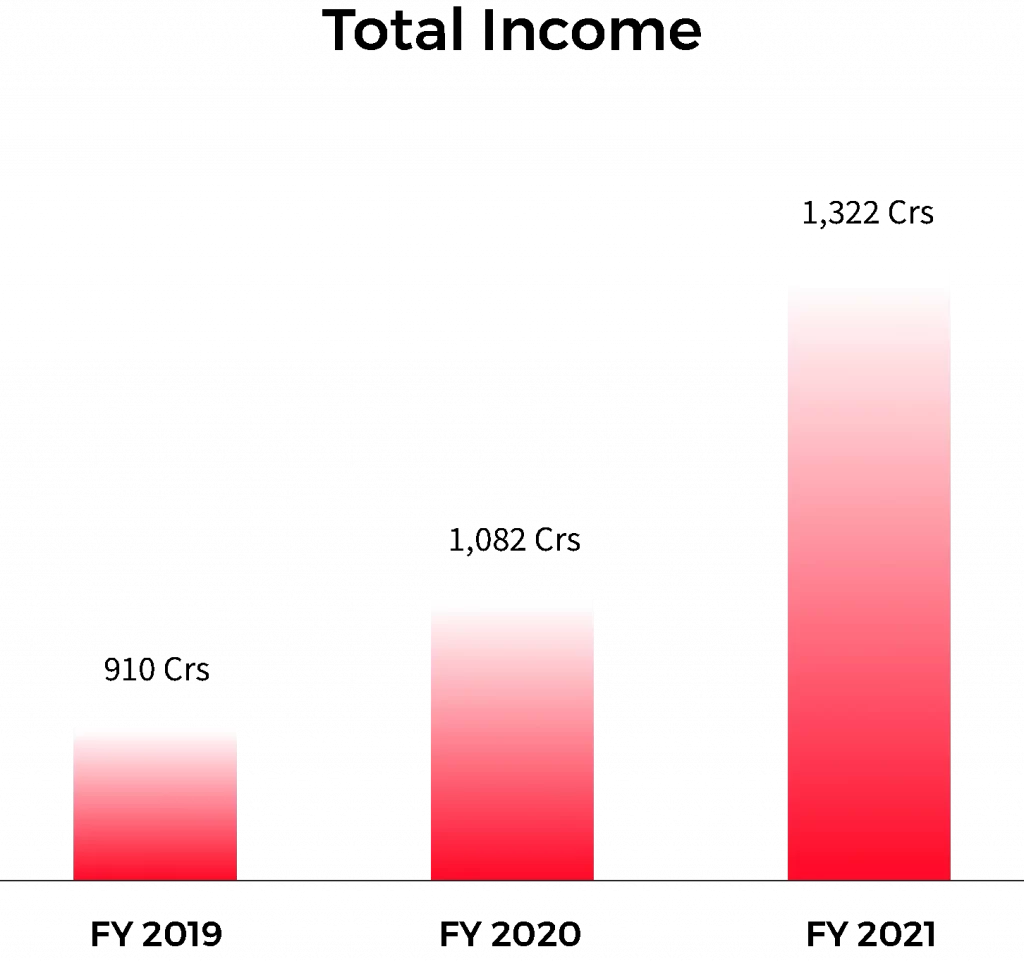

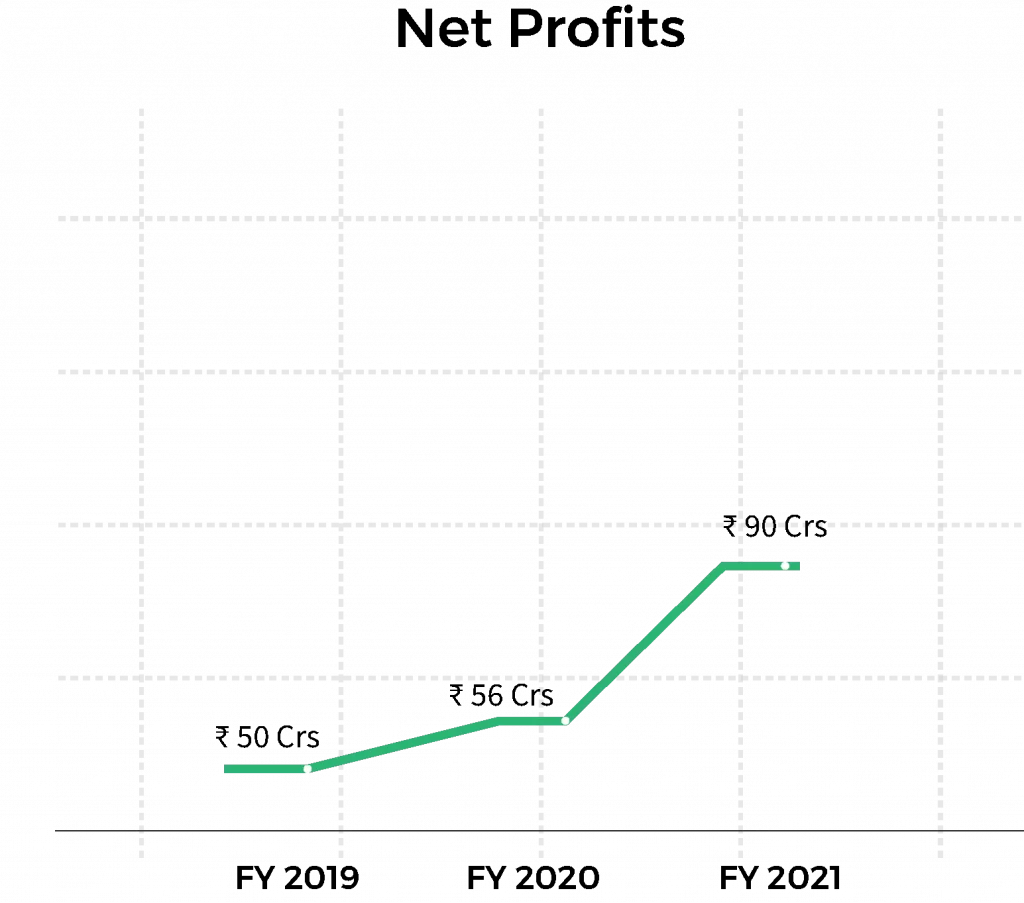

As per DRHP filed by the company with SEBI, the company grew its total income by 13% CAGR from Rs 910 crores (FY 2019) to Rs 1,322 crores (FY 2021). The company reported total income of Rs 777 crores for 6 months ending 30-Sept-2021. The company reported average operating margins of 9.8% and net margin of 5.7% during the past 3.5 years in its DRHP.

The business returned an average return on equity (ROE) and return on capital employed (ROCE) of 12% and 16% respectively. The company’s debt-equity ratio is comfortable at 0.13, as on 30-Sept-2021.

Peer Comparison

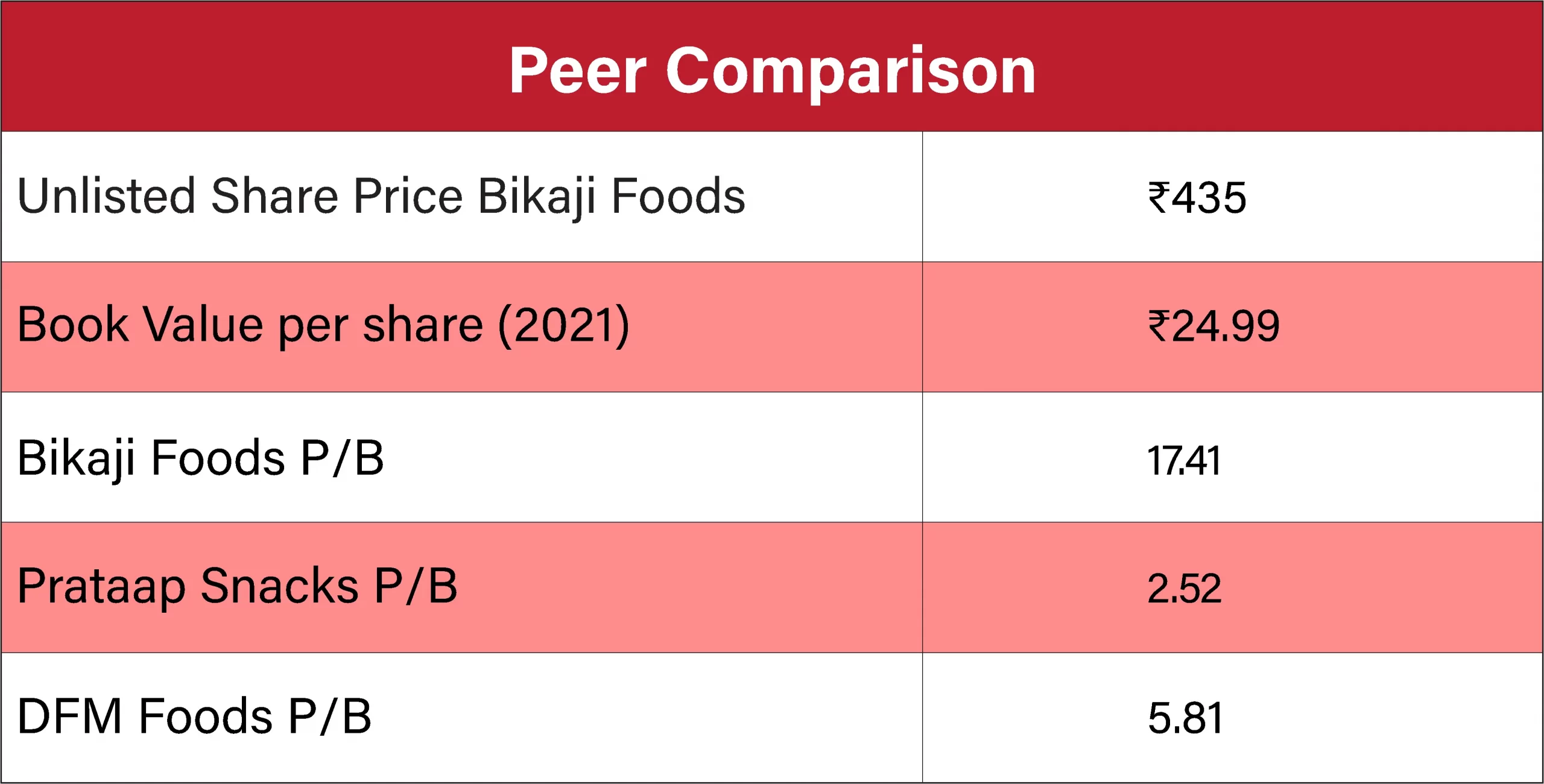

Based on the business model and similar product portfolio, Bikaji Foods can be compared with Prataap Snacks Ltd and DFM Foods Ltd, listed players in the snacks category. The listed shares of Prataap snacks and DFM Foods are currently trading at P/B of 2.52 and 5.73 respectively, while the unlisted shares of Bikaji Foods are currently trading P/B of 17.89, making them overvalued for any fresh buy. (Check the latest price of Bikaji Foods unlisted shares here)

If we also look at the average P/E of the snacks food industry, it is around 69, and the unlisted shares of Bikaji Foods are currently trading at a P/E of 117 in the private market. Post IPO plans, there seems to be an overpricing in the unlisted market for this share.

So, investors can wait till the price in the unlisted market corrects to a more meaningful level before assuming exposure to this share.

Read Our Other Blogs:

Why Investing in IXIGO Remains a High-Risk High-Return Bet for Growth Investors