30th Nov,2022

Abstract: Fincare Business Services Limited (FBSL) is a Non-Banking Financial Company (NBFC). It is providing microfinance activities, with a presence primarily in the states of Karnataka, Tamil Nadu (TN), and Andhra Pradesh (AP). Fincare Small Finance Bank commenced banking operations on 21st July, 2017, after receiving the final license from the RBI under Section 22 of the Banking Regulation Act, 1949. Fincare Small Finance Bank enables financial inclusion of the underbanked base of pyramid, mass retail and micro & small enterprise segments. With 500 + banking outlets and 5000+ employees, it serves the banking needs of consumers across 13 states – Andhra Pradesh, Chattisgarh, Delhi, Gujarat, Haryana, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, Telangana, Uttar Pradesh and the Union Territory of Puducherry.

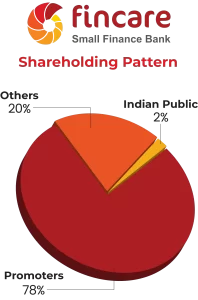

Fincare Business Services Limited, the holding company of Fincare Small Finance Bank, is backed by marquee investors like True North, TA Associates, Tata Opportunities Fund, Leapfrog Investments, SIDBI, Kotak Mahindra Life, Edelweiss Tokio Life among others.

Fincare Small Finance Bank is a new age retail bank with ‘Rurban’ focus built on trust, technology, and transparency. The Bank commenced its banking operations with a vision to enable the financial inclusion of unbanked and underbanked customers with the active participation of the more affluent segments. In the first quarter of 2020, the Bank was included in the Second Schedule of Reserve Bank of India Act, 1934 and by virtue of which the Bank is now a Scheduled Commercial Bank, a status that reflects the highest degree of trust and good governance.

Overview: Fincare Small Finance Bank(SFB) is a “digital-first” SFB with a focus on unbanked and under-banked customers, especially in rural and semi-urban areas. It operates as a retail bank in India. It operates through Treasury, Corporate/Wholesale Banking, and Retail Banking segments. The company’s deposit products include savings and current accounts, as well as fixed, recurring, and retail term deposits. Its loan portfolio comprises micro, housing, and two-wheeler loans; loans against property and gold; and institutional finance. The company also provides NRI, WhatsApp, mobile, and internet banking services.

The company follows a business model focused on financial inclusion and aims to provide individuals and businesses with affordable financial products and services that meet their needs. Their business objective is to enhance access to savings, credit and other financial products for unbanked and underbanked individuals, MSMEs and unorganized entities, especially in rural areas, by leveraging technology, last-mile distribution and by utilizing their 14 years of experience in providing microloans.

The bank has an extensive network of 528 banking outlets, 219 business correspondent outlets and 108 ATMs spread across 16 states and three union territories, covering 192 districts and 38,809 villages and which reached 2.7 million customers, as of December 31, 2020. The bank operated as an NBFC-ND under the name ‘Disha Microfin Limited’ since 2010 and was registered as an NBFC-MFI in 2013. In 2016, upon receipt of the RBI In-Principle Approval, it acquired the micro-finance operations of Future Financial Services Pvt. Ltd (FFSPL) and later changed its name to Fincare SFB.

Unlisted Shares of Fincare Small Finance Limited

Fincare Small Finance Bank(SFB) filed its DRHP on May 8, 2021. The bank’s IPO offer aggregates up to ₹13,300 million comprising a Fresh Issue of ₹3,300 million by the bank and an offer for sale of ₹10,000 million by the Promoter Selling Shareholder.

A Pre-IPO Placement may be undertaken by the Bank, in consultation with the Managers, of such a number of Equity Shares aggregating up to ₹2,000 million. If the Pre-IPO Placement is undertaken, the aggregate amount raised in the Pre-IPO Placement will be reduced from the Fresh Issue, subject to the minimum offer size constituting at least a pre-decided % of the post-Offer paid-up equity share capital of our Bank. (Click here to know the latest price of unlisted shares of Fincare Small Finance Bank)

SWOT Analysis of Fincare Small Finance Limited

Strength

- Fincare SFB is a “digital-first” bank and have been an early adopter of scalable digital solutions in order to improve customer experience and/or operational efficiencies

- They reach their customers through a diversified, extensive multi-channel network combining traditional brick-and-mortar banking outlets and digital banking. They believe this allows them to offer “last mile, doorstep connectivity” to customers while maintaining low operating costs.

- As of Dec’20, the company had a PAN – India network of 528 banking outlets, 219 business correspondent outlets and 108 ATMs of which 85 were cash recyclers, spread across 16 states and three union territories, covering 192 districts, which together covered over 38,809 villages and reached 2.7 million customers

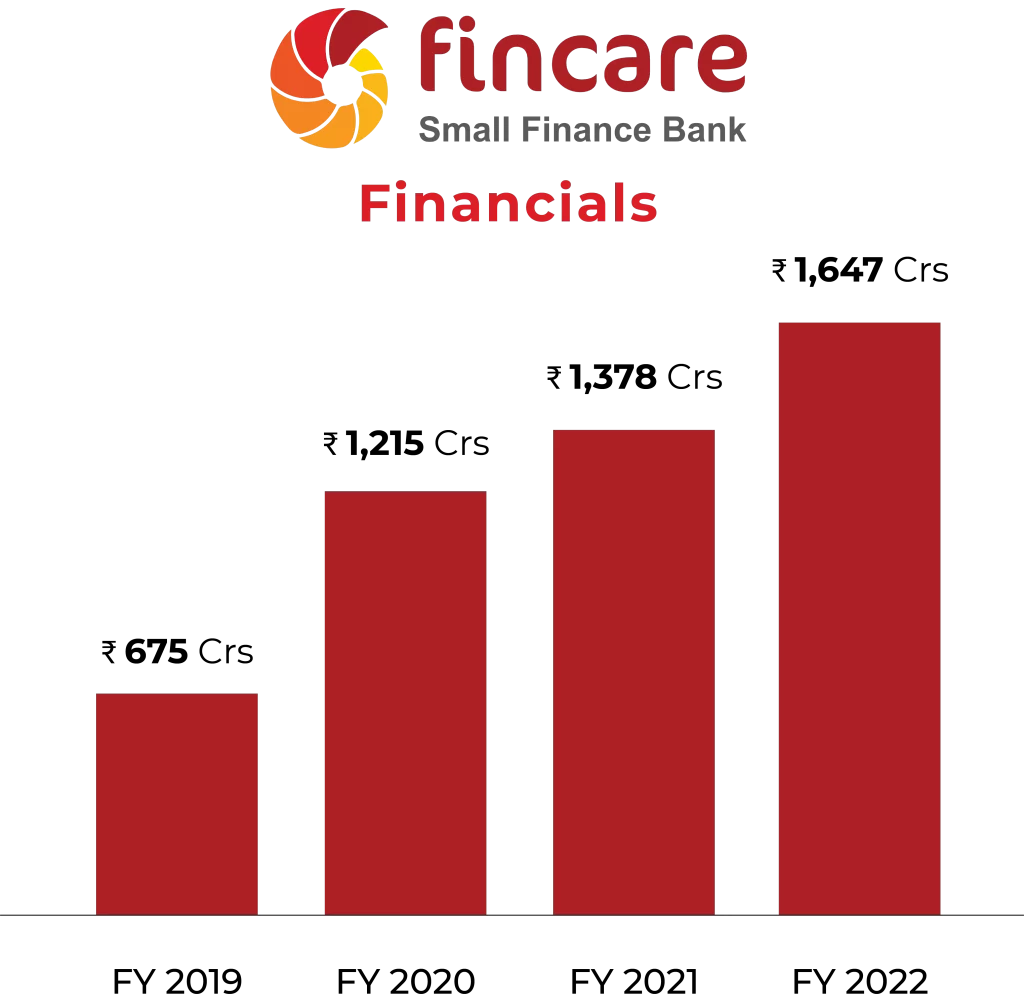

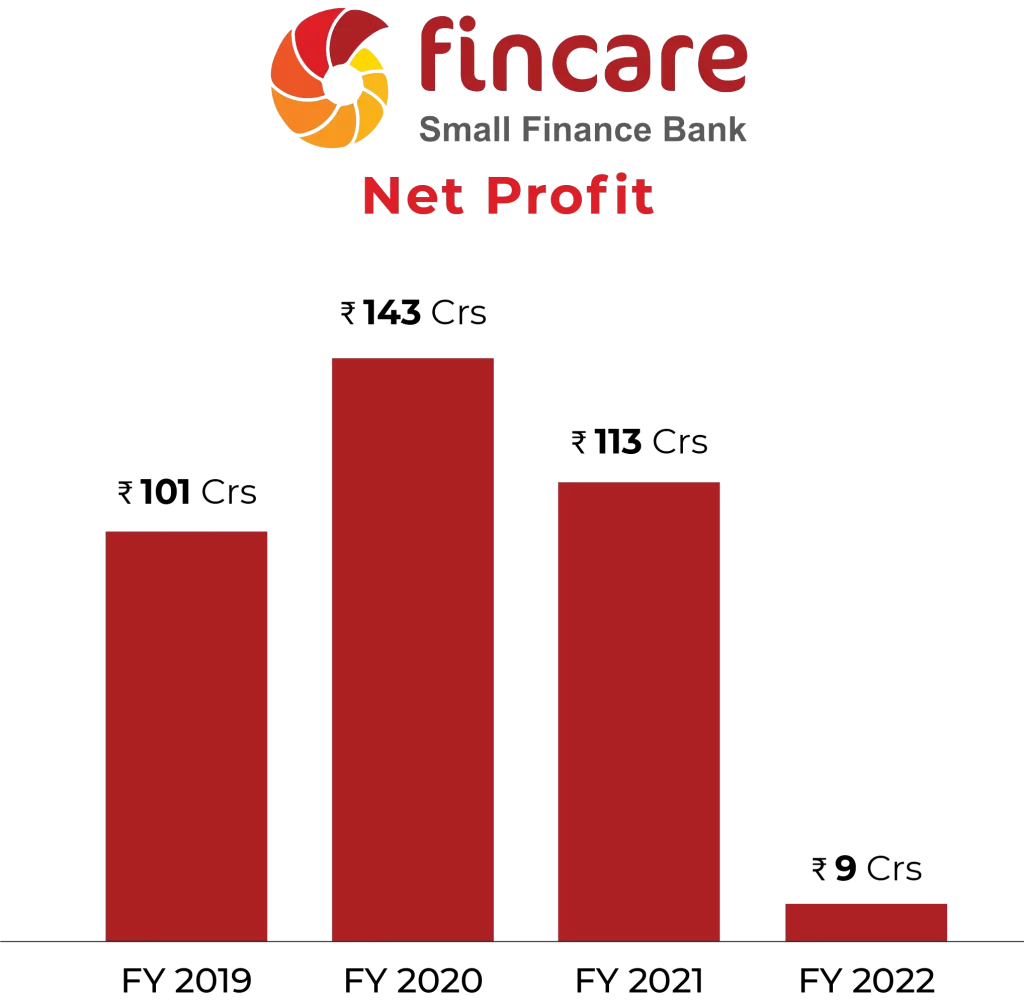

- According to CRISIL, Fincare had the highest growth rate in advances amongst comparable SFB peers in India between FY18 and FY20. Further, in FY20, the bank had the best adjusted ROA and ROE and was one of India’s most profitable SFBs, based on it.

- The bank has a vision of extending banking service to common people of rural areas, and the Government is also taking decisions to provide financial infrastructure to the rural population of the country. So the branches in rural parts of the country can yield good revenue in future.

Weakness

- A substantial portion of banking outlets of Fincare SFB are located in and a significant portion of advances are originated from four states (Tamil Nadu, Gujarat, Karnataka and Madhya Pradesh), making bank vulnerable to risks associated with having geographically concentrated operations

- The bank’s Gross Loan Portfolio consists primarily of microloans, comprising 79.50% of it. Given the high proportion of microloans, negative events that affect their microloan portfolio will have an adverse impact on the overall business and performance.

- A significant portion of the bank’s loan portfolio originated in rural areas, exposing them to risks associated with rural economies.

- Further, the agricultural industry in India depends on the success of the monsoon. Any drastic changes in weather, drought, excessive rains or floods can lead to weakness in the agricultural industry and, consequently, the ability of our borrowers to repay their loans.

Opportunities

- As per the Global Findex Database 2017, Of the world’s total unbanked adults, 415 million are from just two countries—India and China. While the majority of Indian households are located in a rural region, the banking infrastructure investment in these regions remains low.

- Bank retail credit per capita in the east of India is the lowest in the country—nearly five times lower than in the south and west. It implies a low penetration of banks in these areas. This provides an opportunity for all lending and deposit-accepting institutions to expand in these regions and also into certain areas around them.

- CRISIL research expects the rural segment to drive MFIs’ business due to burgeoning demand. With rural areas having fewer banking outlets than urban areas, the rural market in India is still under-penetrated, thereby opening up a significant opportunity for savings and loan products.

- The share of SFBs in deposits as well as credit has seen a steady rise over the years accordingly the bank is well positioned to take advantage of the tailwinds and intend to continue to grow the portfolio with focus on secured lending which we believe will provide us a competitive edge over our competitors.

Threats

- Due to inadequate technical infrastructure in rural parts of India and due to Covid-19 restrictions there is a reduction in customer footfall at the bank

- Increased cyber security threats have raised the need for protection of customers’ data.

- Penetration by existing players and emergence of newer competitors in the industry can squeeze margins for existing players.

- Sudden changes in the government & regulatory guidelines can sometimes create pressure on margins.

- This industry is highly volatile and based on the current scenario in the market there may be sudden changes in government rules and regulation which can have a high impact on the company.

Future Prospects of Fincare Small Finance Limited

- India Banking Market is projected to grow at a double digit CAGR during 2019-2024 owing to rising disposable income, growing digital payment system in the country, growing bank branch networks and entrance of the foreign banks in the Indian market.

- According to RBI, bank credit and deposits stood at Rs. 106 lakh Cr. and Rs. 146 lakh Cr. respectively, as of January 15, 2021.

- India is expected to be the fourth largest private wealth market globally by 2028.

- According to the CRISIL Research Report, the northern region is well positioned to grow with aid from the financial institutions to further support the flourishing agriculture and industrial sector.

- The deposit penetration in the northern region has maintained its share at 21% of the overall banking deposits as of FY21 which is comparatively lower than Southern and Western regions. Accordingly, there is huge scope for further penetration in the northern, eastern, north-eastern, and central region across both credit and deposits.

- As per CRISIL the share of SFBs in deposits as well as credit has seen a steady rise over the years and is expected to reach 1% and 1.5% respectively by Fiscal 2024 from the current 0.6% and 1.0% in deposits and credits in Fiscal 2021.

Tell us in the comments section below whether you would like to invest in Fincare Small Finance Bank unlisted shares.