24th Sep, 2022

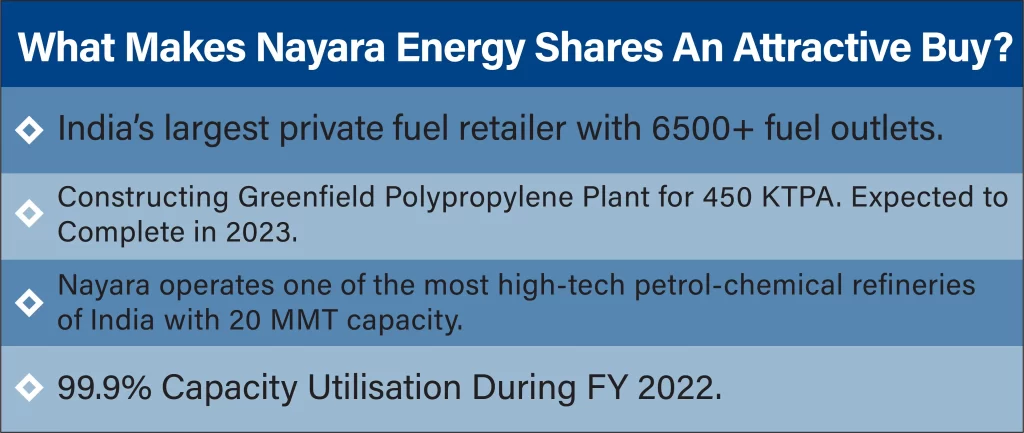

Nayara Energy Limited is considered a privately held downstream oil company that is based in Mumbai, India, which encompasses refining, marketing, production, and a network of over 6,000+ retail fuel outlets in India. It operates India’s second-largest oil refinery in Vadinar, Gujarat.

In 2017, Essar Oil was acquired by Rosneft, an investment consortium led by Trafigura & UCP Investment Group. Essar Oil was initially a part of the Essar Group based in Mumbai.

At Nayara Energy, its people are committed to sustainable development by delivering economic, social and environmental benefits to the communities in which they actually operate. They leverage experience and expertise to build holistic programs that deliver stronger and more inclusive impact.

Overview of NAYARA ENERGY LIMITED

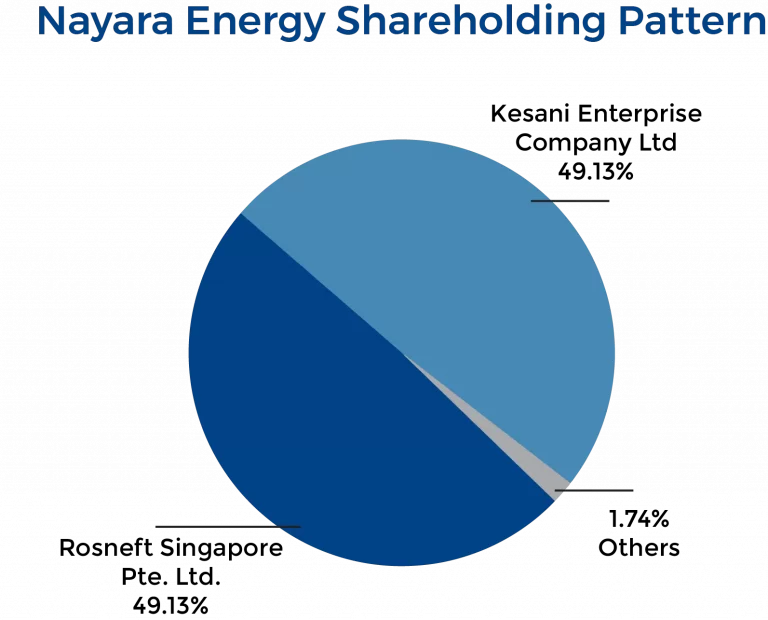

Nayara Energy is a new aged petrochemicals company of International scale with a unique combination of young and experienced minds along with a robust foundation of best-in-class infrastructure along with a desire to deliver excellence. It is powering India’s growing energy demands Nayara Energy Limited initially known as Indian Essar Oil Limited is engaged in the refining of crude oil and marketing of petroleum products in India and internationally. It was rebranded as Nayara Energy Limited, Rosneft PJSC, thereby holding the majority 49.13 % shareholders.

Essar Oil operates a major refinery in Vadinar, Gujarat. The refinery is India’s second-largest single-site, state of the art refinery, which constitutes approximately 8% of India’s refining capacity. The refinery is considered more modern and complex, with the Nelson complexity index at 11.8, compared to others around the world. With business across the hydrocarbon value chain from refining in detail, this refinery is geared up to accomplish the vision of delivering crude to chemicals. The refinery is strategically located on the west coast of India, which provides close proximity to the Middle East and Africa, which also facilitates access to high consumption domestic as well as an export market, which benefits the Nayara Energy Share Value.

The company has a pan- India presence across 5,600 retail stations. Rosneft along with an investment consortium comprising global commodity trading firm Trafigura and Russia’s investment fund United Capital Partners bought a 49.13% stake in Essar Oil for $12.9 billion, in August 2017. The company was renamed to Nayara Energy, which was inspired from the Hindi word (new) and the English word ‘era.’

Also the company announced that Essar Oil’s development strategy would include a new brand and corporate identity positioning. Nayara Energy Limited strongly signifies the shareholders’ vision of bringing the asset to a new era of development. The Essar retail network, amounting to 4,500 fuel stations in India, will keep its name after the rebranding of the parent entity. The majority stake in Essar Oil was acquired by Rosneft and a consortium led by Trafigura and UCP in August 2017.

Nayara Energy Limited Unlisted Shares

The share price of Nayara Energy Limited today is 262.6. Its current market capitalisation stands at Rs 38094.55 Cr. In the latest quarter, the company has reported Gross Sales of Rs. 855114.7 Cr and Total Income of Rs.721490.4 Cr. The company’s management includes Elena Sapozhnikova, Alexander Romanov, Krzysztof Zielicki, Chin Hwee Tan, Andrew Balgarnie, Jonathan Kollek, Didier Casimiro, Charles Anthony, Mayank Bhargava, R Sudarsan, Naina Lal Kidwai, Deepak Kapoor, C Manoharan.

The company is listed on the BSE with a BSE Code of 500134, NSE with an NSE Symbol of ESSAR OIL and ISIN of INE011A01019. Its Registered office is at Khambhalia Post, Post Box No. 24, Dist. Devbhumi DwarkaKhambhalia-361305, Gujarat. Their Registrars are ACC Ltd. Its auditors are Deloitte Haskins & Sells, Deloittee Haskins & Sells, SR Batliboi & Co LLP.

FY 2019-2020 Business Performance

Retail Business

1. The Retail segment yet again delivered a stupendous performance in FY 2020. The year-over-year volume growth was 18% against the industry’s year-over-year volume growth of 1%.

2. This year they have added 574 new petrol pumps. With 574 new outlets added last fiscal year, Nayara Energy stood at 5,702 fuel stations at the end of FY 2020 with a Pan-India presence.

Supply and Distribution

1. The Company continues to focus on improving domestic supply infrastructure and hired a coastal terminal at Mangalore and Ennore for ensuring supply in Karnataka and Tamil Nadu.

2. It also commenced supplies from Bina and Kanpur hospitality locations to improve local product availability in Madhya Pradesh and Uttar Pradesh respectively.

3. Commissioned in 2019, the Company’s rail-fed Wardha depot uniquely caters to Nayara Energy’s retail outlets as well as product requirements from other oil companies in and around the Vidarbha region of Maharashtra. The Company finalized another rail-fed smart automated depot in Pali, which is expected to be completed by 2021.

4. Nayara Energy did the complete conversion of its own locations to BSVI grades in January 2020, ahead of the mandatory guidelines.

Institutional Business

1. Right channeling in priority markets resulted in increased sales for Petcoke. The Company also augmented new geographies of Orissa and Nepal for the Petcoke supply.

2. The Company recorded the highest-ever Sulphur sales in a year since the inception of the refinery and re-entered the Bitumen business after moving out last year.

FY 2019-2020 Financial Performance

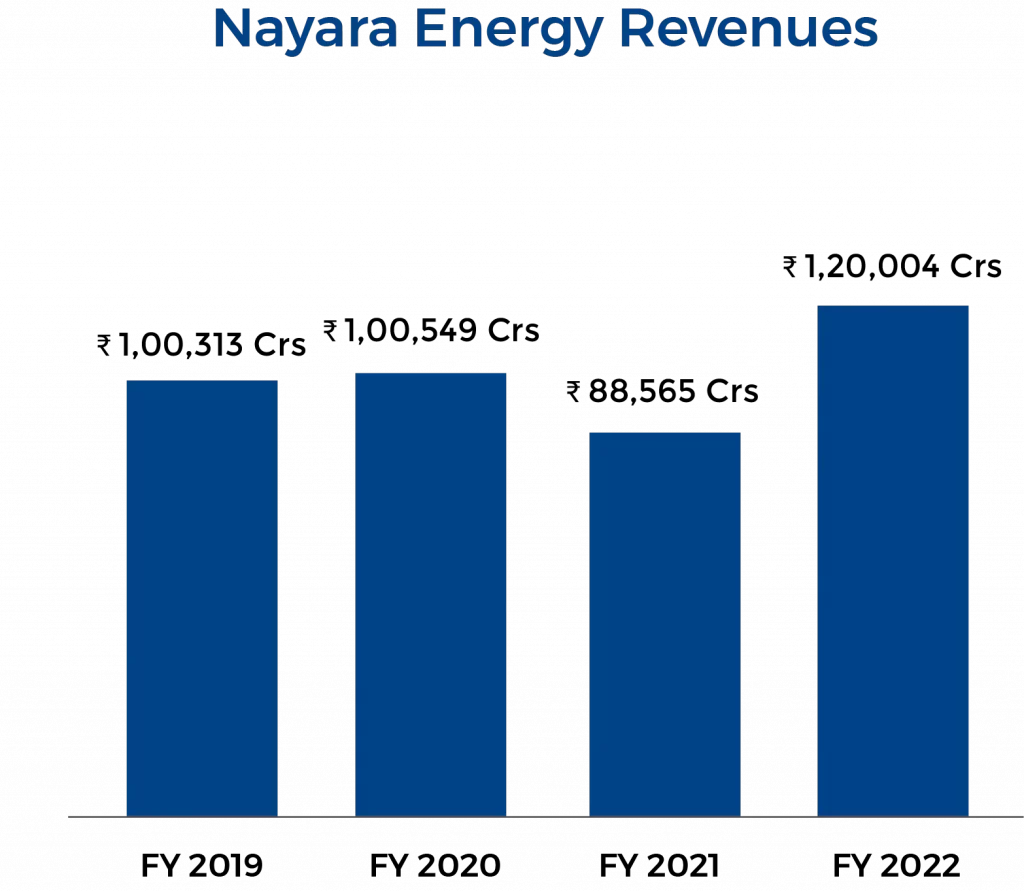

- Revenue from operations was at ₹ 1,00,641 Crores for the financial year ended March 31, 2020, as compared to ₹1,00,313 Crores for the financial year ended March 31, 2019.]

- Current Price Gross Refinery Margin (CP GRM) was lower at USD 5.88/bbl in FY 2019-20 as against USD 6.97/bbl in FY 2018-19

- Total Debt has been reduced from 17566 Crores in FY19 to 10757 Crores.

- D/E Stands at 0.55x.

- Trade receivables have also come down from 3689 Crores to 1270 Crores. This has helped Nayara Energy to clock 12612 Crores of Cash-flow from operations.

Future Prospects of Nayara Energy Limited

- India is planning to double its refining capacity to 450-500 MT by 2030.

- Energy demand of India is anticipated to grow faster than the energy demand of all major economies on the back of continuous robust economic growth. India’s energy demand is expected to double to 1,516 MT by 2035 from 754 MT in 2017. Moreover, the country’s share in global primary energy consumption is projected to increase by two-fold by 2035.

- Crude oil consumption is expected to grow at a CAGR of 4.66% to 500 MT by 2040 from 201.26 MT in 2021.

- India’s oil demand is projected to increase at the fastest pace in the world to reach 10 million barrels per day by 2030, from 4.9 million barrels per day in 2021.

- India’s diesel demand is expected to double to 163 MT by 2029-30 with diesel and gasoline covering 58% of India’s oil demand by 2045.

Tell us in the comments section below whether you would like to invest in Nayara Energy Ltd unlisted shares.

Read our other blogs:

Why Investing in IXIGO Remains a High-Risk High-Return Bet for Growth Investors