8th June, 2022

Bharat Nidhi Limited was founded in 1942. The company’s line of business includes holding or owning securities of companies other than banks. Bharat Nidhi Limited is a Private Ltd. Company, which was incorporated on 21-Sep-1942 having its headquarters in Delhi . Bharat Nidhi Limited is classified as Non-govt company and is registered at Registrar of Companies located in ROC-DELHI. As regarding the financial status at the time of registration of Bharat Nidhi Limited Company its authorized share capital is Rs. 80000000 and its paid up capital is Rs. 29275923.

The last Annual General Meeting of Bharat Nidhi Ltd. Was held on 31st March, 2015 and according to the latest records of MCA (Ministry of Corporate Affairs), the last balance sheet of Bharat Nidhi Ltd. Was filed on 31st March 2016.

Bharat Nidhi Limited is a major shareholder in Bennett, Cole-man & Co. Ltd. (BCCL), publisher of India’s biggest English daily, the Times of India, and owner of Times Internet that runs popular digital platforms such as property site Magic bricks, music streaming app Gaana and restaurant reservation company Dine-out.

Bharat Nidhi Ltd. was registered as NBFC with Reserve Bank of India, but voluntarily made an application to RBI to surrender its Certificate of Registration (CoR) as NBFC as the company is engaged in the business of distribution of publications. BNL’s revenue comes mainly from distributing publications of BCCL in and around New Delhi and it is also an investment holding company. Along with this, the company also has significant investments in Bennett, Coleman & Co. Ltd, Matrix Merchandise Ltd, Bennett Property Holdings Co. Ltd and many other companies.

SWOT Analysis of Bharat Nidhi Ltd.

Strength

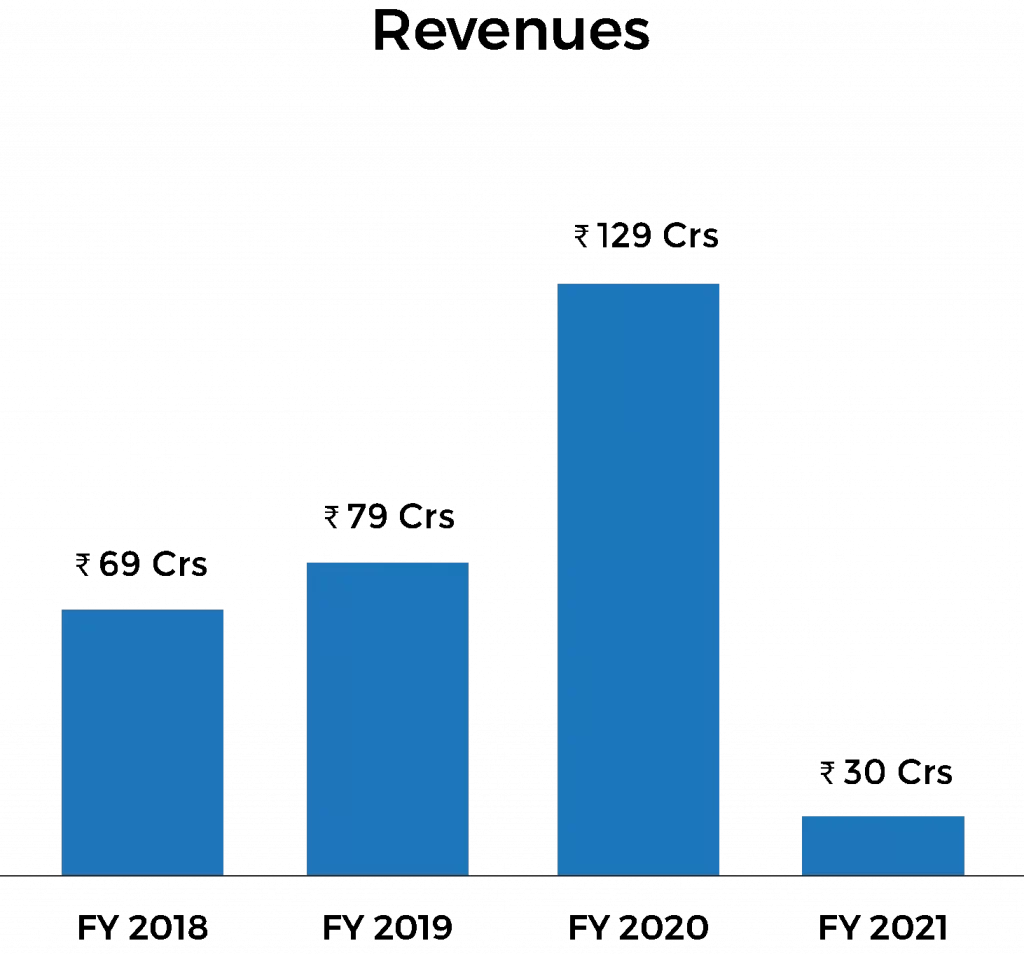

- Total income of the company has been increased from INR 70 Cr. in FY 16 to INR 130 Cr. in FY 2020, showcasing a growth rate of 16.7%.

- EBIT, EBITDA and PBT margin of the company has shown a significant growth from 2019 to 2020.

Weakness

- Companies need to look for their cash management as cash flow from operations showed a significant decline from 2019 to 2020.

Opportunities

- Increasing literacy rates across India has driven the localization of newspapers, made possible by the changes in printing technology.

Threats

- Increasing usage of digital platforms of news providers is a threat to usage of newspapers and less circulation of newspapers in near future.

PERFORMANCE OF THE COMPANY

In FY 2020, the company sold 12,02,72,886 copies of newspapers amounting to a total of Rs. 4,105.31 lakhs and 1,59,544 copies of magazines amounting to a total of Rs. 117.39 lakhs. Revenue from Operations of the company in FY 2020 was Rs. 4,599.10 lakhs as against the revenue from operations of Rs. 4,988.88 lakhs in FY 2019, registered a decline of 8% in FY 2020.

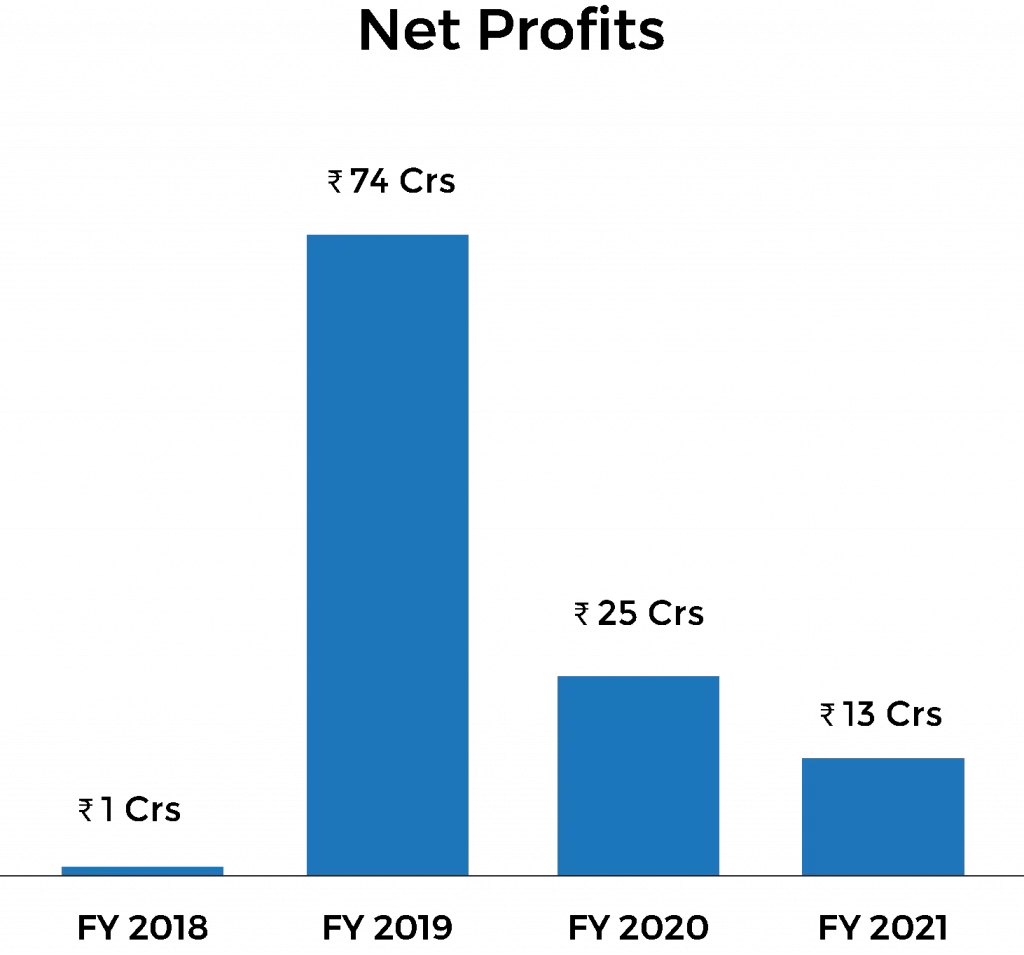

If just talking about the company’s primary business that is distributing the newspapers and periodicals, the company’s EBITDA turned from a loss of Rs. 83.20 lakhs in FY 2019 to a loss of Rs. 267.56 lakhs in FY 2020. But if we include the investment income of the company the company’s EBITDA in FY 2020 was Rs. 8,116.11 lakhs as against Rs. 2,832.12 lakhs in FY 2019, increased by 186.57%. This clearly states that the company is now focusing more on its investments rather than on its primary business.

Other Income which mainly consists of income from different investments increased from Rs. 2,915.32 lakhs in FY 2019 to Rs. 8,383.67 lakhs in FY 2020. It has increased by 188%.

Profit after Tax of the company fell by around 97% from Rs. 43,029.53 lakhs in FY 2019 to Rs. 1,093.12 lakhs in FY 2020. The main reason for this sharp fall can be attributed to the share of profit /loss from associates. Two companies in which Bharat Nidhi Limited holds a major stake, namely, Bennett Coleman & Company Limited and Bennett Property Holdings Company Limited gave a loss of Rs. 1,560.92 lakhs and Rs. 4,812.25 lakhs respectively.

Bharat Nidhi Limited does not have any long-term or short-term borrowings.

Book value per equity share of the company as of 31st March 2020 was Rs. 12,638.64.2 (Click here to know the latest share price of Bharat Nidhi)

FINANCIAL RESULTS AND THE STATE OF COMPANY’S AFFAIRS

The Company is engaged in the business of distribution of newspapers and periodicals in Delhi & NCR. Apart from this, the Company is investing its surplus funds in debt based mutual funds, banks and financial institution’s fixed deposits and other safe avenues from time to time.

The outbreak of Coronavirus (COVID-19) pandemic globally and in India is causing significant disturbance and slowdown of economic activity. In many countries, businesses are being forced to cease or limit their operations for a long period of time. While the Government of India has been taking various measures to contain the spread of the virus, including lock-downs, travel bans, quarantines, social distancing, closure of non-essential services have triggered significant disruptions to businesses within the country resulting in an economic slowdown.

As far as the Company is concerned, COVID-19 has been impacting the business operation of the companies ever since the nationwide lockdown was imposed from March 2020. The primary impact has been felt by way of decline in the demand for print publications i.e. Newspapers and Magazines on account of supply chain disruption and unavailability of personnel etc.

The decline in demand has had a pronounced impact on the revenue of the Company for the half year ended September 2020 whereby sale of print publications fell by almost 50% when compared to the average sales trends that prevailed during the year ended March 31, 2020.

The declining sales trends are still continuing due to the imposition of the nationwide 2nd lockdown in April & May 2021. However, this may not have a significant impact on the operational profitability of the Company, as the net margins on the sale of print publications is very nominal.

The net profit is derived mainly from interest and dividend earned as well as gain on sale/ switch of investment of its surplus funds deployed. As far as reduction in total revenue and profits of the Company is concerned, the other income in financial Year 2019- 20 was higher as compared to the current Financial Year, 2020-21 due to sale of long term investments and higher dividend income in the previous year.

Earnings on deployed surplus funds may decline in the coming period of time in line with the slow down and overall condition of the economy though the impact cannot be quantified as of now.

Read Our Other Blogs: