4th Nov,2022

Nowadays, savings are usually not enough for absolute financial security. Money benefits from healthy circulation; assets are better off being invested so they can grow than left to stagnate. That said, investment does come with its own set of risks and one has to be savvy with their investment choices to make sure they see high and secure returns. Investing is also important to develop as a skill because it builds a sense of financial discipline as people consciously start setting aside a particular amount at regular intervals towards bigger investment goals.

Shares of unlisted companies may get listed in future on the stock exchanges. We facilitate trades in such unlisted shares by matching buyers and sellers thereby enabling liquidity to current shareholders and enabling new investors to participate in future growth of the company.

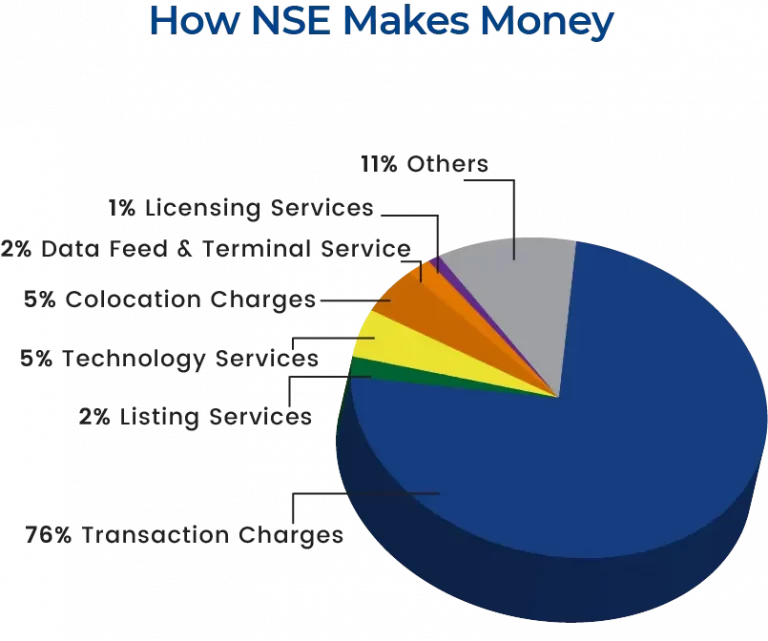

Talking about NSE, National Stock Exchange has been playing the role of a catalytic agent in reforming the market in terms of microstructure and market practices. Right from its inception, the exchange has adopted the purest form of demutualized set up whereby the ownership, management and trading rights are in the hands of three different sets of people. NSE shares in the unlisted market rallied sharply over the last six to eight months following excellent numbers the stock exchange has reported in the last few quarters. (Click here to know the latest share price of NSE Ltd)

Settlement risks have been eliminated with NSE’s innovative endeavors in the area of clearing and settlement viz., reduction of settlement cycle, professionalization of the trading members, fine-tuned risk management system, dematerialization and electronic transfer of securities and establishment of clearing corporation. As a consequence, the market today uses the state-of-art information technology to provide an efficient and transparent trading, clearing and settlement mechanism.

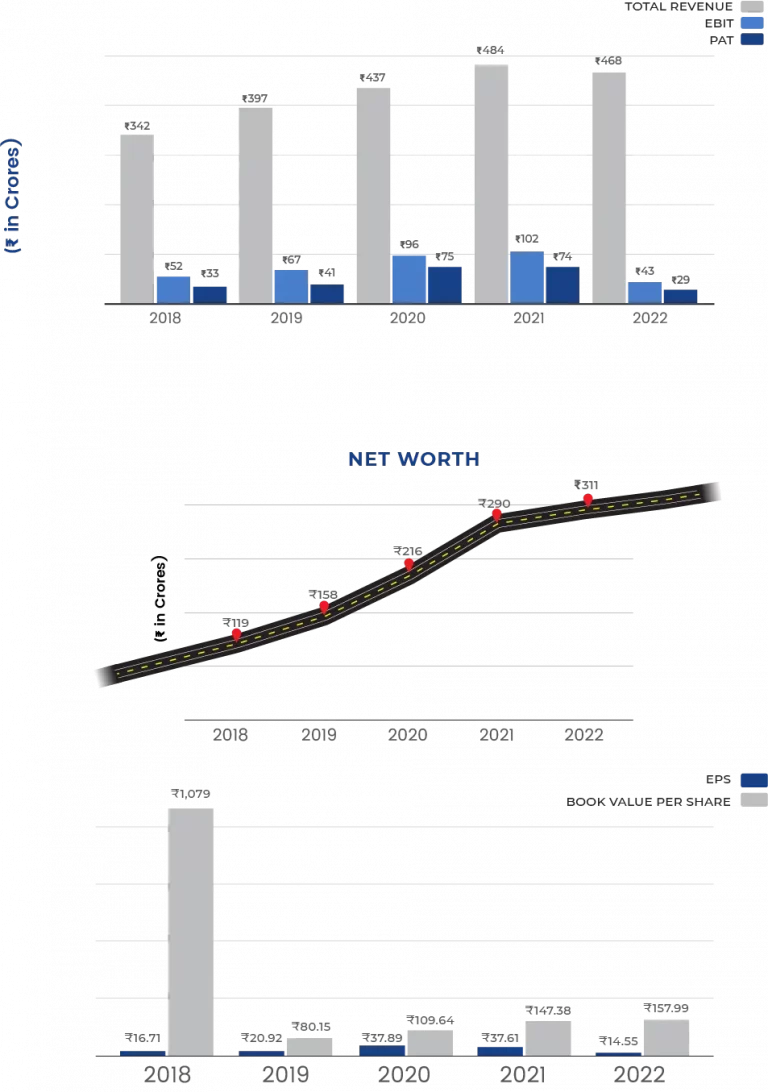

HDFC Securities Limited, a stock broking company, provides brokerage services in the capital markets in India. Its product portfolio includes various asset classes, such as stocks, derivatives, mutual funds, fixed deposits, NCDs, insurance, bonds, and currency derivatives. It also provides home, personal, auto, and education loans, as well as loans against shares. In addition, the company offers life and general insurance products. The company is a stockbroking and distribution arm of the HDFC group. It is a corporate member of both the BSE and the NSE. It has a customer base of 27.26 lakh to whom it offers an exhaustive range of investment and protection products.

HDFC Securities started with equity trading and later rolled out derivatives trading. Now the company provides the option to trade with via multiple platforms, namely online, mobile, telephone or through any of company branches. In India’s capital markets, HDFC Securities Limited, a stock brokerage firm, provides brokerage services. Its product offering comprises equities, derivatives, mutual funds, fixed deposits, NCDs, insurance, bonds, and currency derivatives, among other asset classes. It also offers mortgages, personal loans, auto loans, and school loans, as well as stock loans. In addition, the firm provides life and general insurance. (Click here to know the latest share price of HDFC Securities Ltd)

Throughout the company’s 21-year history, the goal has been to be on the bleeding edge of technology and give consumers with tools and products that assist them manage their investments.

Five Star Business Finance passionately believes in the fact that “un-banked” does not necessarily mean “unbankable”. In a country as large and as diverse, it takes efforts to access, understand and extend appropriate and responsible credit services to this segment. Over the last three decades, Five Star Business Finance has been working as a specialized financial services company in addressing the needs of this segment, funding the people who were perceived to be non-fundable. The businesses that they work with can be touched and felt in our everyday lives and are businesses that create real impact on the ground. Their customers include all the way from small shop owners, flower vendors, maids, masons to small and medium enterprises that form the backbone of India’s economy. (Click here to know the latest share price of Five Star Business Finance)

Five Star Business Finance provides Small business loans to meet borrower requirements for commencing new businesses, expansion of his/ her existing businesses and to settle any unorganized dues he/ she has taken to further their businesses. The loans are given based on the company’s evaluation of the borrower household cash flows coupled against the security of the borrower’s house collateral. The typical loan ticket ranges between Rs 1 lakh to Rs 10 lakhs for a tenure between 24 and 84 months. The repayments are to be made on a monthly equated basis.

Vision: Reaching the Unreached through suitable credit solutions

Mission: Provide appropriate credit solutions to the hitherto unreached segment of the market by developing a niche underwriting model, built towards evaluating the twin strengths of the borrowers’ intention to repay and ability to repay, with the ultimate objectives of increasing customer satisfaction and maximizing stakeholder returns.

Last but not least, Studds accessories Limited holds its presence in more than 40 countries. Studds, being the world’s largest two-wheeler manufacturing company creates a safe riding experience for millions of customers by unlocking new opportunities in terms of a new and improved product that is offered across 39 countries it operates and by venturing in new geographies. The company innovates and develops world-changing products with the highest safety standards by fostering a culture of innovation. The revenue of the company has grown at a rate of 28.4% from 2009-10 to 2018-19, which has highly benefited the Studds Accessories Limited Share Value. (Click here to know the latest share price of Studds Accessories Ltd)

Studds accessories are continuously ramping up their R&D capabilities, leveraging latest technology and their industry expertise to fulfil customer expectations. They Have 25% Market Shares in India, and with these Percentage of Market Shares They Are Leading Players of Helmet Providers in India. Since 1983, They Have Proved They Are the Best with Their Growth in Business or Market Place. They Have Witnessed to Sustain the Largest Help Providers of the World.

Conclusion: One must gain exposure towards unlisted shares only to the extent that complements the existing portfolio. Going overboard can increase the risk substantially. It is pertinent to evaluate the risk potential of oneself and ascertain the risk of the investment and accordingly choose one that is conducive to one’s risk profile. The magnitude of downside in unlisted stocks is substantially high, hence it is important to avail only as much which aligns well with one’s risk appetite.

Tell us in the comments section below whether you would like to invest in these high-quality unlisted shares.