1st Nov,2022

NCL Holdings (A&S) Limited was established so as to acquire all of its non-building materials of NCL Alltek and Seccolor under the approved NCLT (National company Law tribunal) scheme. The building materials were transferred to NCL Buildtek. The main objective of the company is to make and hold certain investments in corporate and non-corporate companies engaged in manufacturing, marketing and services. NCL is considered as the sole licensee in India for ICP Plasters.

NCL Holdings is an investment holding company that was formed on 5th Jan, 2018. NCL Holdings is a Telangana based company having majorly three subsidiaries i.e. NCL Green Habitats Pvt. Ltd and Eastern Ghat Renewable Energy Limited and Suncrop Science. Its main products are Hydro Power, Real estate & Construction, Seeds, and Chemicals. Its main revenue comes from their subsidiaries companies.

NCL Holdings Limited operates an investment company to make the investment in majorly, building materials, construction, agro, chemicals and renewable power projects (majorly hydro). Moreover, the company was incorporated too acquire non-building materials assets held by NCL Buildtek Limited along with equivalent reserves vide NCLT Demerger order dated 24th January 2019.

Main objectives of this company are to make and hold investment in corporate and non-corporate entities engaged in manufacturing, trading or provision of services, either as pure investment with the right to participate in management of such facilities.

NCL Holdings (A&S) Limited Acquisition

- NCL Holdings acquired NCL Green Habitats Pvt. Ltd by purchasing 100% stake and making it a subsidiary of NCL Holdings in the FY 2019-2020.

- NCL Holdings acquired Eastern Ghat Renewable Energy Limited by purchasing 100% stake and making it a subsidiary of NCL Holdings in the FY 2019- 2020.

NCL Holdings (A&S) Limited Business Model

- Eastern Ghat renewable energy ltd. deals in Hydro power business.

- Sun crop science deals in producing seeds of the crops.

- NCL Green habitats deals in building of complete constructions or parts.

NCL Holdings (A&S) Limited Product and Services

- Hydro Power

- Real estate & Construction

- Seeds

- Chemicals

NCL Holdings (A&S) Limited Industry Overview

- With the improving economic scenario, there have been quite a few investments in various sectors along with few M&A.

- Construction: The Construction industry is expected to record a CAGR of 15.7% to reach $ 738.5 billion by 2022. In March 2021, the construction sector in India saw a foreign direct investment equity inflow of approximately 420 mnn USD. This was a significant decrease compared to the equity inflows in the previous year, valued at over 600 Mn USD. The outbreak of the Coronavirus (COVID-19) pandemic and subsequent lockdown restrictions weighed on the industry’s output in 2020, though the respective sector is a promising avenue to male investments.

- Real estate sector in India is expected to reach US$ 1 trillion by 2030. By 2025, it will contribute 13% to the country’s GDP.

- Hydro: India’s hydroelectric power potential is estimated at 148,700 MW at 60% load factor. In the fiscal year 2019–20, the total hydroelectric power generated in India was 156 TWh (excluding small hydro) with an average capacity factor of 38.71%. The public sector accounts for 92.5% of India’s hydroelectric power production.

- 100% FDI allowed under the power sector.

- Chemicals: The Indian chemicals industry, which employs more than 2 Mn people, is projected to reach $300 bn by 2025. India is a robust global dye supplier, accounting for approximately 16% of the world’s dyestuff and dye intermediates. 100% FDI Chemical Industry in India is allowed under the automatic route (except in certain hazardous chemicals).

- Agro: Agricultural commodity exports increased by 23.24% from March to June 2020, with a total of INR. 25,552.7 crore compared to INR. 20,734.8 crores in the same period last year. Agriculture also accounts for 16.5 percent of India’s GDP and employs 43 percent of the country’s workers.

- The Gross Value Added by agriculture, forestry, and fishing is estimated at $276.37 bn in FY20. Indian Agriculture exports is likely to reach US$ 60 billion by 2022, Which will increase seed demand.

- Population growth, urbanization, industrialization and rise in disposable income are key growth drivers of the industry.

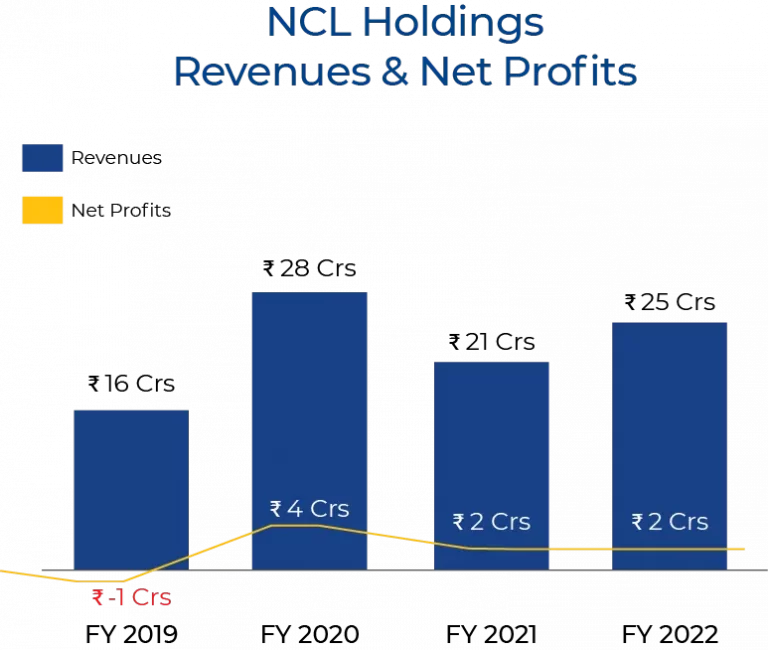

NCL Holdings (A&S) Ltd Business Performance

The Current Year (C.Y) revenues, including other income is Rs. 472.85 lakhs as against P.Y of Rs. 660.07 Lakhs. The decline in the C. Y’s revenue was mainly because of “other income”. Other Income for the C.Y was Rs. 283.14 as compared to the Previous Year (PY) Rs. 519.95 lakhs, sale of NCL Industries Shares contributed to a significant portion of Other Income in both years. C.Y PBT stood at Rs. 232.18 lakhs as against P.Y PBT of Rs. 828.20 lakhs. The reason for decline was increase of finance cost by Rs. 79.45 lakhs, administrative cost of Rs. 42.11 lakhs. In addition, there was a onetime reversal of provisions of Rs. 300 lakhs in PY.

NCL Holdings (A&S) Limited, an investment arm of NCL group was incorporated in January, 2018 to acquire the investments in the non- building material assets currently held by NCL Alltek & Secular limited, a scheme of arrangement sanctioned by National Company Law Tribunal.

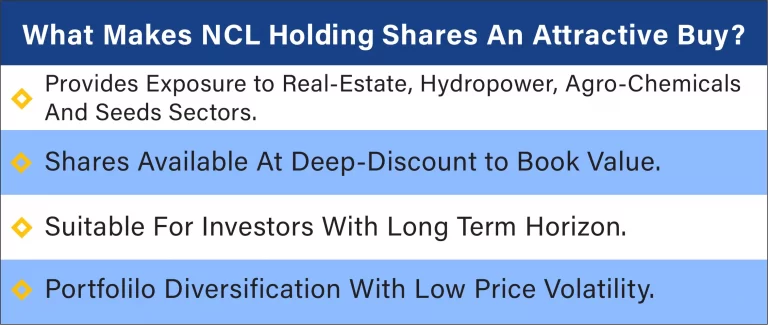

Its purpose is to make and hold investments in corporate and non-corporate entities that are engaged in manufacturing, trading or provision of services with a view to manage such facilities or as pure investments. It was also incorporated with the object of carrying on the business as financial advisors and assist in all financial, costing, accounting internal controls and other similar matters. NCL Holdings Unlisted Shares are available in market.

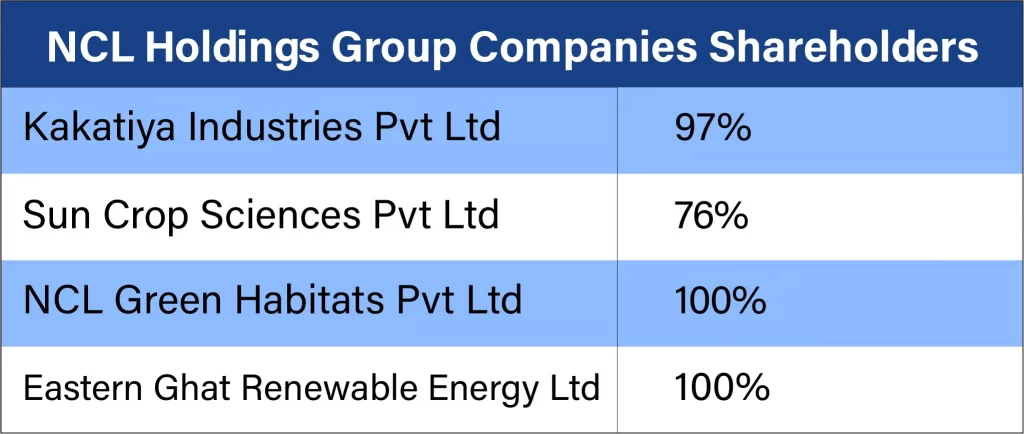

NCL Holdings Unlisted Shares has four Subsidiaries -Sun Crop Science Private Limited, Kakatiya Industries Private Limited (KIPL), Eastern Ghat Renewable Energy Limited and NGL Green Habitats Private Limited.

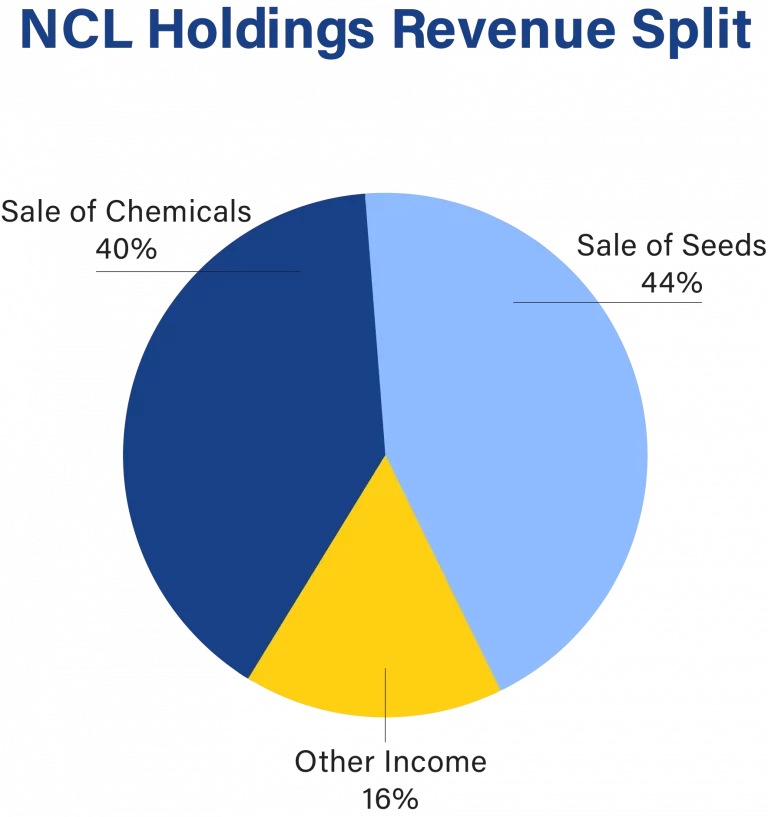

- Sun Crop Sciences Pvt Ltd: The Company is within side the enterprise of seeds improvement of Maize and Rice crops. In FY 2021, this company generated sales of Rs 11.10 crores. The keeping company has 76% stake in this employer.

- Kakatiya Industries Pvt Ltd: The Company has 2 divisions: chemical substances and hydropower. The agency is imposing a 9MW hydropower challenge in Orissa. The agency is within the procedure of demerger of its chemical division. During FY 2021, this agency generated sales of Rs 6.39 crores. The protecting agency has 97.06% stake in this agency.

- Eastern Ghat Renewable Energy Ltd: The authentic motive of this corporation become to generate hydro strength however now this corporation is proposed to be merged with any other institution corporation, Kakatiya Industries Pvt Ltd. This corporation is to begin its operations and did now no longer generate any sales throughout FY 2021. The retaining corporation has 100% stake on this corporation.

- NCL Green Habitats Pvt Ltd: The business enterprise has actual property property in Hosur (Tamil Nadu), Nellore & Vijayawada (Andhra Pradesh) and Hyderabad (Telangana). While the business enterprise plans to promote its actual property in Andhra Pradesh and Tamil Nadu within the close to future, it plans to broaden the residences on its belongings in Hyderabad. During FY 2021, this business enterprise generated forty-one crores. The maintaining business enterprise has 100% stake in this business enterprise. (Click here to know the latest share price of NCL Holdings Ltd)

Tell us in the comments section below whether you would like to invest in NCL Holdings (A&S) Ltd unlisted shares.

Read our other blogs: