28th Oct,2022

Capital Small Finance Bank (earlier known as Capital Local Area Bank) is the India’s first small finance bank founded in April 2016 having its headquarters in Jalandhar, India. Capital Small finance banks are a type of niche banks in India. Banks with a small finance bank license can provide basic banking service of acceptance of deposits and lending. The aim behind these is to provide financial inclusion to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganized sector entities.

Capital Small Finance Bank pioneered in bringing modern banking facilities to the rural areas at low cost. The Bank introduced 7-Day branch banking with extended banking hours since its first day of operations. The focus to serve common man and the local touch advantage has given the Bank a competitive edge over other banks operating in the region. Within a short period, most of the branches become market leaders of their respective centers. The Bank is providing safe, efficient and service oriented repository of savings to the local community while reducing their dependence on moneylenders by making need based credit easily available.

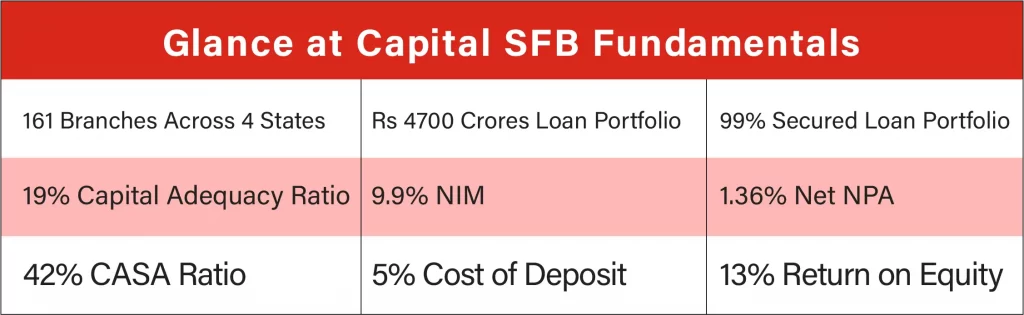

Capital Small Finance Bank transitioned from a Local Area Bank to Small Finance Bank with 47 Branches. In a short span, 118 new Branches have become operational, taking the total number of Branches to 165. After establishing a strong footprint in the state of Punjab, the Bank has now started expansion to the states of Delhi, Haryana, Rajasthan, Himachal Pradesh along with Union Territory of Chandigarh. This bank has been granted Scheduled Status by the Reserve Bank of India vide Notification dated February 16, 2017.

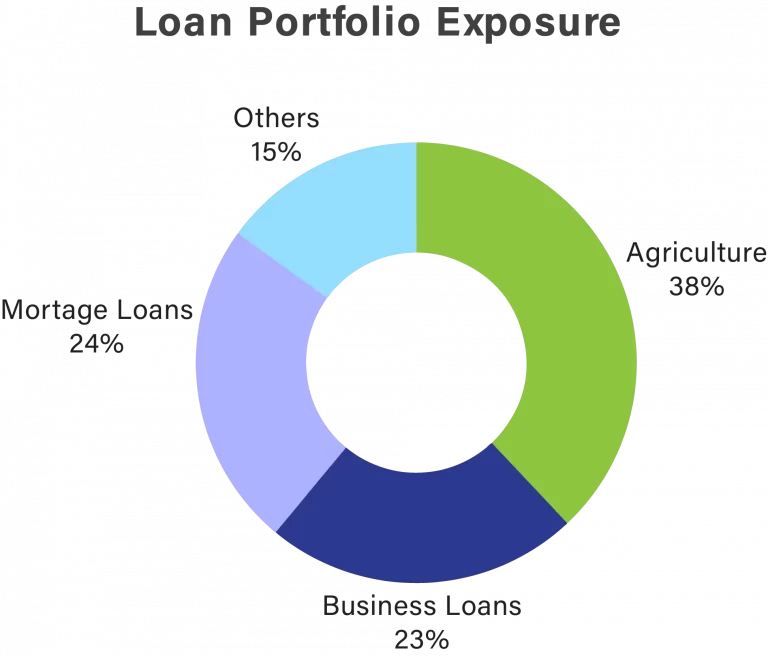

The total business of the Capital Small Finance Bank has crossed Rs. 10,680 crores with over 8,88,000 accounts. The Bank has 70% of its business in rural and semi urban areas, with priority sector lending of 78.85% of the Adjusted Net Bank Credit as on March 31, 2022. The Bank is extending loans primarily to small borrowers. As on March 31, 2022, 65.49% of the total advances are up to the ticket size of Rs. 25 lacs. Conversion of the Bank to Small Finance Bank has removed the geographical barriers for expansion, resulting in exponential growth of the Bank in all spheres.

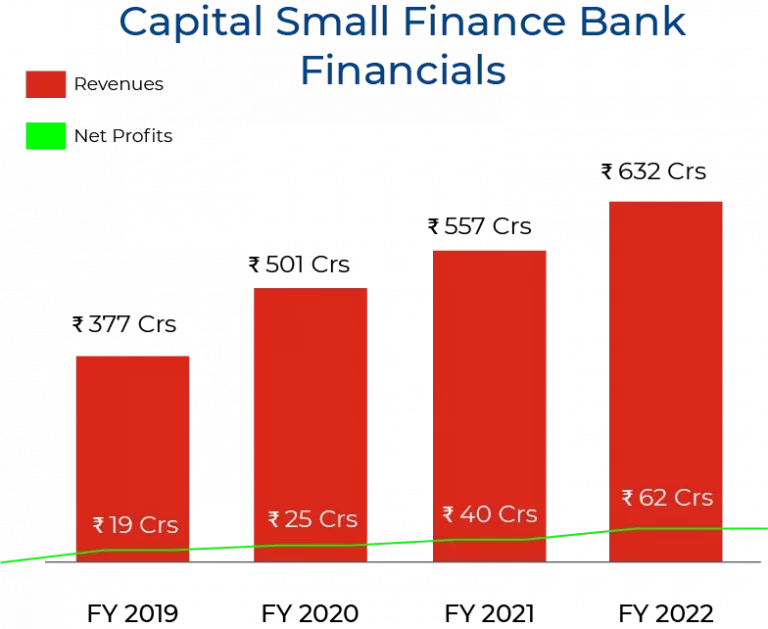

Capital Small Finance Bank Limited’s operating revenues range is INR 100 cr – 500 cr for the financial year ending on 31 March, 2017. It’s EBITDA has increased by 15.70 % over the previous year. At the same time, it’s book net worth has increased by 65.64 %.

Features of Capital Small Finance Bank are as follows:

- Uninterrupted & Extended Banking Hours

- Monday to Saturday (10:00 a.m. to 5:00 p.m.)

- 2nd & 4th Saturday Holiday

- RuPay Debit Card acceptance across more than 2.49 Lac ATMs, over 50 Lac POS Terminals and on all e-commerce sites

- Internet Banking

- Mobile Banking

- Safe Deposit Lockers

- All kinds of Loans at competitive Interest Rates

Capital Small Finance Bank transitioned to Small Finance Bank with merely 47 branches and has now surpassed over 150 branches, within 4 years of operations, which is further expected to grow to 265 branches by 31st March 2023. The bank currently operates from Punjab, Delhi, Haryana, Rajasthan and Chandigarh.

The total business of the Bank has crossed INR 7,350 crores with over 6,90,000 accounts which is expected to grow to INR 18,000 Crores by 31st March 2023. The Bank has 80% of its business in rural and semi-urban areas, with priority sector lending of 81.28% of the Adjusted Net Bank Credit as on March 31, 2019. The Bank is extending loans primarily to small borrowers. As on March 31, 2019, 54.10% of the total advances are up to the ticket size of INR 25 lacs. The bank is a corporate agent of ICICI prudential life insurance company limited and HDFC life insurance company limited and offers insurance solutions to its clients.

Achievements of Capital Small Finance Bank are as follows:

- Pioneer in bringing state-of-the-art banking facilities in rural areas at a low cost

- Promoting Financial Inclusion by penetrating into rural and semi-urban areas

- Extension of banking services to the unbanked rural villages

- One-Stop Financial Hub for our customers

- Contribution to economic development in the area

- Average Business per branch of Rs. 48 Crores

- Accredited with ‘ICAI Award for Excellence in Financial Reporting’ for two consecutive years

- Ranked amongst India’s 100 Best Companies to work for 5 consecutive years

- RuPay Debit Card acceptance across more than 2.40 lac ATMs, over 27 lac POS Terminals and on all e-commerce sites

Key Highlights of Capital Small Finance Bank are as follows:

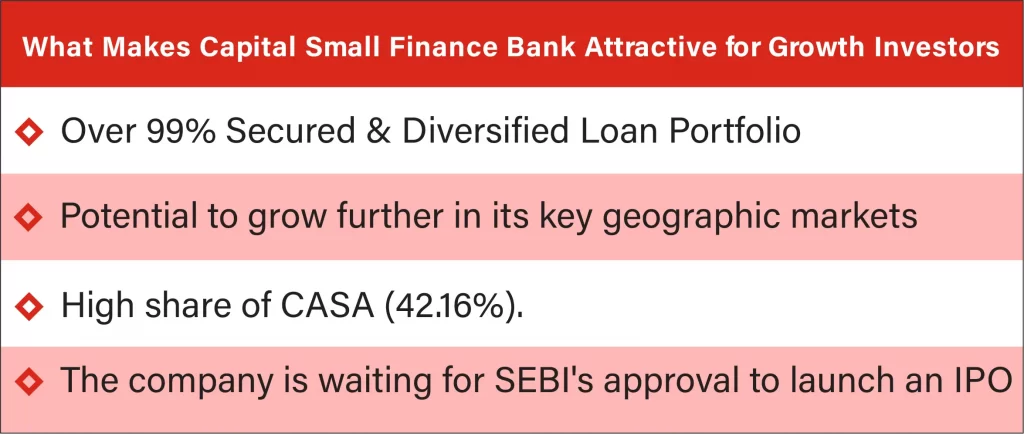

- Company’s IPO was approved by SEBI on 15th February, 2022

- It has crossed total business worth Rs. 10 crores in December 2021

- Top line increased by 13.48% for the FY 2022

- Gross NPA stood at 2.50% and Net NPA stood at 1.36% for FY 2022

- Company’s Debt equity ratio is 0.97 times which shows its strong financials

Capital small finance bank limited has been the name of interest and curiosity for a while now, despite the company’s extremely rooted connections and various investments, the company is seen to be completing its profitability promises with full commitment. If seen in the company’s profit and loss statement the industry is maintaining a very subtle ratio between investment and profit, which has been working great in the company and its employee’s favour, resulting in putting more weight towards Capital Small Finance Bank Limited’s Unlisted share prices.

Capital small finance bank limited has been one of those very few companies which have been staying true to this virtue and has been making significant growth in that very factor.

Speaking on the point, taking into consideration the few major and game-changing factors of the company, capital small finance bank limited’s IPO shares are definitely a good investment for a long-term period. The company has also been praised numerous times because of their clean and trustworthy account practice followed by their helping, outstanding, and highly experienced management segment. (Click here to know the latest share price of Capital Small Finance Bank)

Tell us in the comments section below whether you would like to invest in Capital Small Finance Bank Ltd unlisted shares.

Read our other blogs: