8th Nov,2022

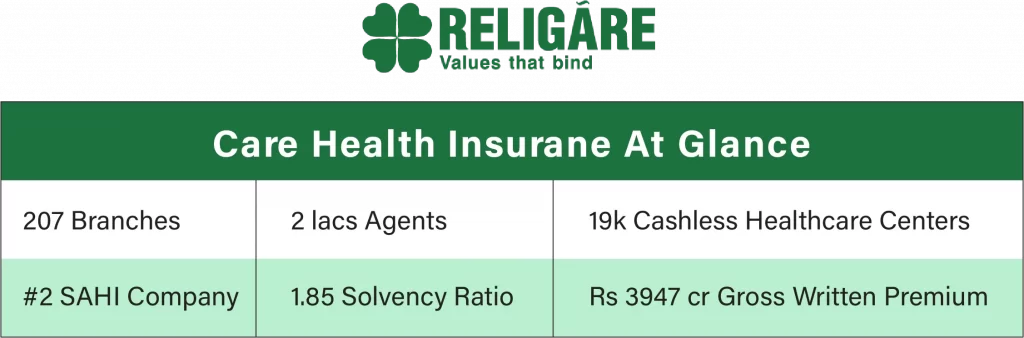

Care Health Insurance Ltd (formerly Religare Health Insurance Company Ltd) is India’s second largest standalone health insurance company. The Gurgaon-based company sells over thirty health-insurance, personal accident, critical illness focussed products across group, travel, fixed benefit and indemnity categories. The company has tie-ups with over 19k cashless healthcare providers at 1400 locations across the country and built a network of 207 branches, 14k permanent employees and 2 lacs agents to distribute its products through various channels like agency, banks, brokers, digital etc.

Indian Health Insurance Industry

The Indian health insurance industry is on the cusp of change. Aided by the favourable macro factors including hosting world’s second largest population, relatively younger demography, rising urbanisation, increasing per capita GDP etc, are playing a role in increasing health awareness among the population.

While the life-insurance companies are limited in selling only fixed-benefit health plans, non-life and standalone health insurers (SAHIs) can sell both fixed-benefit and indemnity-based plans where they can reimburse the full cost of the medical treatment incurred by the customers (subject to policy cover, exclusions, co-pay etc).

Standalone health insurance companies (SAHIs) are growing at much faster pace than the overall industry due to low base and concentrated business focus on the retail segment.

During fiscal 2021, SAHIs accounted for around 26% of the total health insurance business in India but they cornered 46% market share in the retail segment. The public sector insurers dominate the government and group business with market share of 84% and 57% respectively.

Business Performance

Care Health more than tripled its Gross Direct Premium during the last four years from Rs 1,110 crores in 2017-18 to Rs 3,880 crores in 2021-22.

During FY 2022, the company wrote gross-written premium of Rs 3,900 crores, a growth of 53% over the previous year while maintaining a healthy post-tax profit and solvency ratio of Rs 11.5 crores and 1.85 respectively. Care Health has one of the highest solvency levels in the industry. Care Health is also the only standalone health insurer to record a profitable growth during this fiscal notwithstanding the fact that the first quarter was acutely impacted by the covid-related claims.

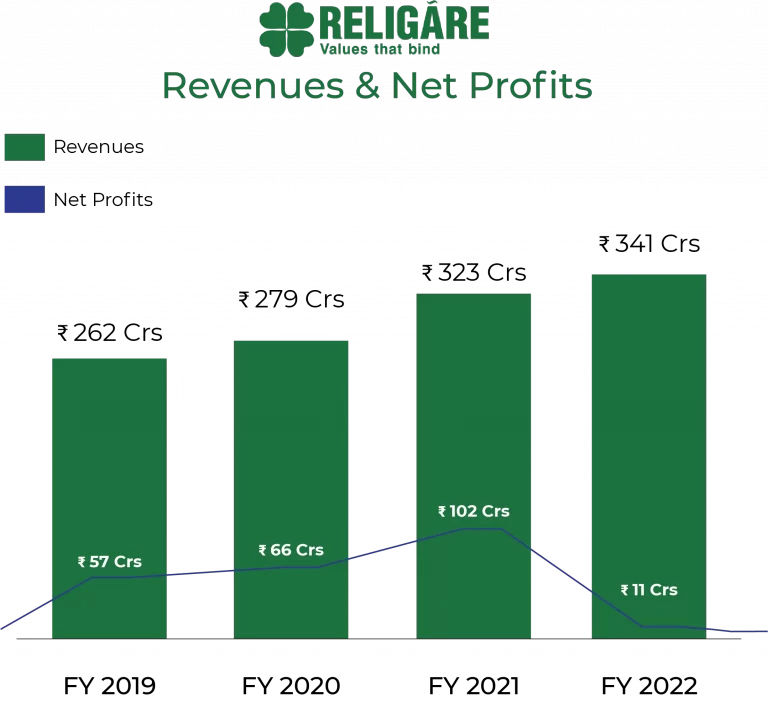

The company settled over 30 lacs claims amounting to Rs 1,633 crores during the year. The company’s solvency ratio was at 1.85, one of the highest in the industry. The company reported total income of Rs 341 crores with net profit of Rs 11 crores.The company also added new products namely Care Advantage, Aarogya Sanjeevani, Corona Kavach, Covid Care, Group Care 360, Care Shield Add-on to its bouquot of products. During the last year, 50 new branches were opened and the company increased its agents strength from 1,69,183 to 1,97,806 as compared to last financial year.

During the FY 2022, Care Health Insurance also won awards for India’s Best Health Insurance Product and India’s Best Insurance Agent at Insurance Alerts Awards.

Valuation

As on 31-March-2022, there were 90,85,67,736 equity shares outstanding of Care Health Insurance of face value of Rs 10 each. At Rs 150 share price, the total market capitalisation of the company stands at Rs 13,600 crores. (Click here to know the latest price of unlisted shares of Care Health Insurance)

As compared to listed peer company: Star Health & Allied Insurance Company, Care Health is operationally profitable and ranks #2 among standalone health insurance companies and has industry best 95% claim settlement ratio.

Key Risk Factors

Care Health Insurance operates in a highly competitive industry with facing competition from both non-life and standalone health insurers. The public sector insurance companies together control over 47% of the health insurance industry while the remaining healthcare insurance business is equally split between private insurers and standalone health insurers (SAHIs).

Further, health insurance business comes from government (7%), group business (48%)and retail customers (45%). While government insurers dominate the government and group business with 84% and 57% market share respectively, SAHIs account for 46% of the retail healthcare insurance business. Besides, the company’s investment portfolio is also subject to the significant interest rate risk. Since the globally interest rates are increasing, the company is likely to book significant mark-to-market losses on its fixed-income bonds portfolio which may lead the company to book non-operational losses.

For any questions related to investment in Care Health Insurance Ltd unlisted shares, let us know in the comments below.