11th March 2022

API Holdings Ltd, the parent company of online pharmacy giant PharmEasy, recently received a go-ahead from markets regulator, Securities and Exchange Board of India (Sebi) to raise Rs 6,250 crore through an initial public offering (IPO).

Though the company has not announced any date for its IPO, it is likely to come only when market situation improves as it might not get enough interest from investors as of now. Checkout API Holdings share price and other details before you make in decisions on investing in this unlisted stock.

We list 10 key points for you to know about the upcoming issue:

What does it do?

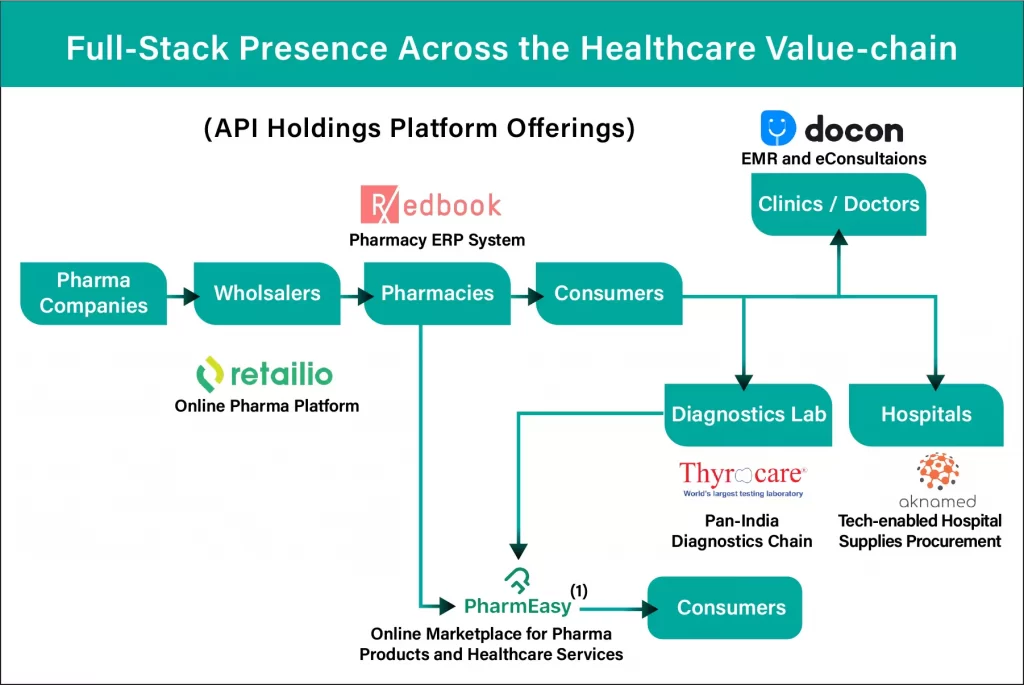

For practical purposes, it is a holding company which owns some of the most renowned brands in the healthtech segment.

The company claims to be India’s largest digital healthcare platform based on gross merchandise value (GMV) of products and services. It operates its services under PharmEasy, docon, Thyrocare Technologies, aknamed and retailio brands.

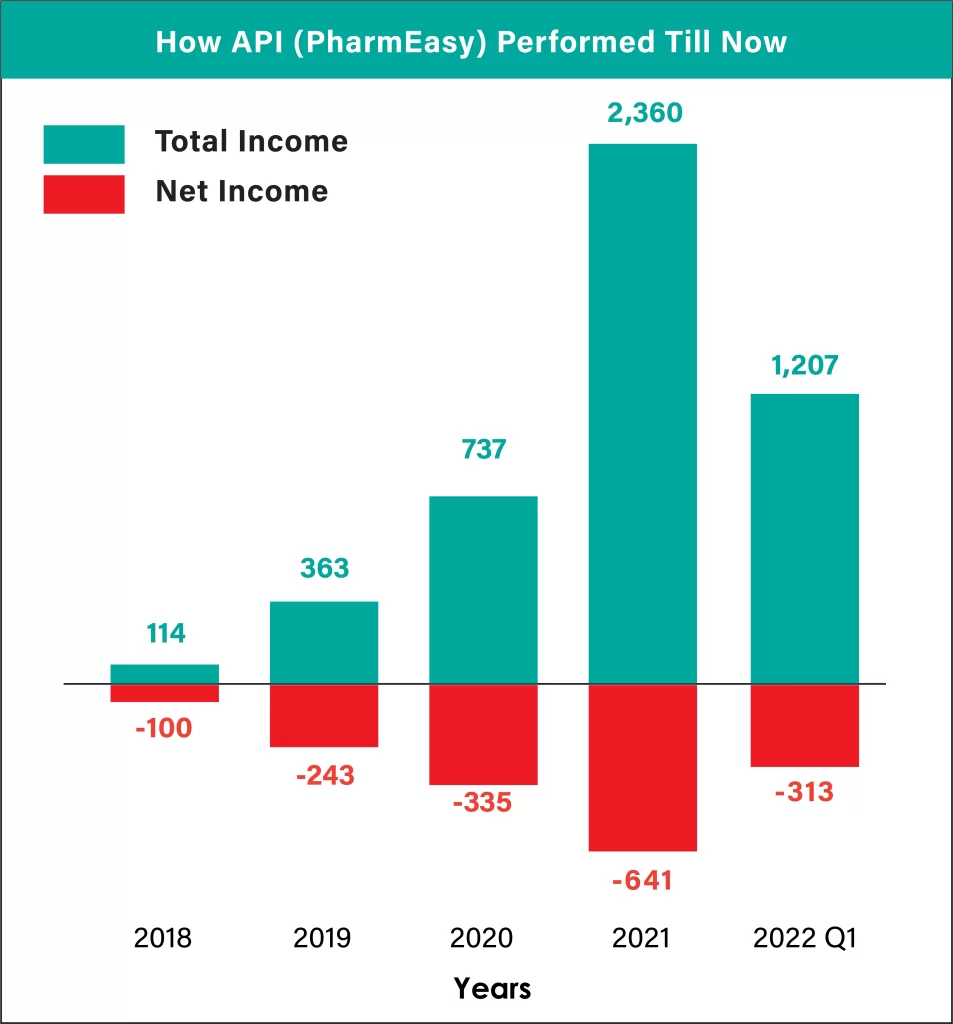

Financial performance

The company has reported losses in the last three years. According to DRHP, API Holdings reported losses of Rs 335 crore, Rs 640 crore and Rs 324 crore for the period of FY20, FY21 and first three months of FY22. This shows, the losses have increased for the company every year (if we annualise the losses for FY22).

Though keep in mind that this data may not reflect profit or losses at Thyrocare Technologies, the acquisition of which was announced in June 2021. The lab operator is a profitable company and will likely cushion losses from API Holding’s other ventures.

Growth opportunities

It said the company has a target addressable market (TAM) of Rs 10.4 lakh crore ($139 billion) as of 2020, corresponding to the size of the entire Indian Healthcare market in 2020. The TAM is expected to grow at 14% CAGR to reach Rs 20 lakh crore ($266 billion) by 2025.

The company in its DRHP said, based on the company’s current suite of product and service offerings, the serviceable addressable portion of the TAM is expected to be Rs 7.5 lakh crore ($100 billion) in 2025, which includes the pharma, diagnostics, OTC, consultation and hospital supplies segments of the Indian healthcare market.

Fresh Issue or OFS?

The IPO will only be a fresh issue of shares worth Rs 6,250 crore. API Holdings, in consultation with the merchant bankers, may consider a private placement aggregating up to Rs 1,250 crore. If such placement is completed, the fresh issue size will be reduced by that amount.

A pre-IPO placement refers to sale of large blocks of stock in a company in advance of its listing. It is different from allotment during the anchor round, which is usually announced a day before public bidding for shares begins.

Use of IPO funds

There is no share sale by existing investors, and the entire proceeds from the IPO will go to the company. The company plans to use Rs 1,929 crore from the IPO proceeds for prepayment or repayment of all or a portion of certain outstanding borrowings availed by the company and subsidiaries. It will use Rs 1,259 crore to fund organic growth initiatives, and allocate Rs 1,500 crore on pursuing inorganic growth opportunities through acquisitions and other strategic initiatives.

Existing investors

The company is backed by some of the marquee names. Naspers Ventures, which usually invests in tech startups, holds 12.04%, followed by Macritchie Investments (Temasek) that has 10.84% stake.

Among other big names that hold at least 1% in API Holdings are TPG Growth, Lightstone Fund, CDPQ (Canadian pension fund), A Velumani (founder of Thyrocare), JM Financials and TIMF Holdings.

Most of these investors joined the company in the last two years. Before that founders held the entire stake in the firm.

Thyrocare Acquisition

In a surprising announcement last year, API Holdings—a startup incorporated in 2019 and run by a couple of youngsters—said it was acquiring Thyrocare Technologies, which had established a chain of laboratories across India in its over two decades of existence.

The acquisition, which gives API Holdings a controlling stake in the firm, would bolster its books as Thyrocare is a profitable company. Plus, its business will also complement its other businesses making it a comprehensive healthcare player.

API Holdings has also acquired Medlife recently, which was also an online pharmacy.

Risk factors

Among the key risk factors for the API Holdings (PharmEasy) investors are a track record of losses, and no certainty when the company will be profitable.

Also, the pharmacy industry is getting more competitive with the entry of Reliance Industries (Netmeds), Tata (1mg), Apollo Pharmacy and Flipkart (SastaSunder).

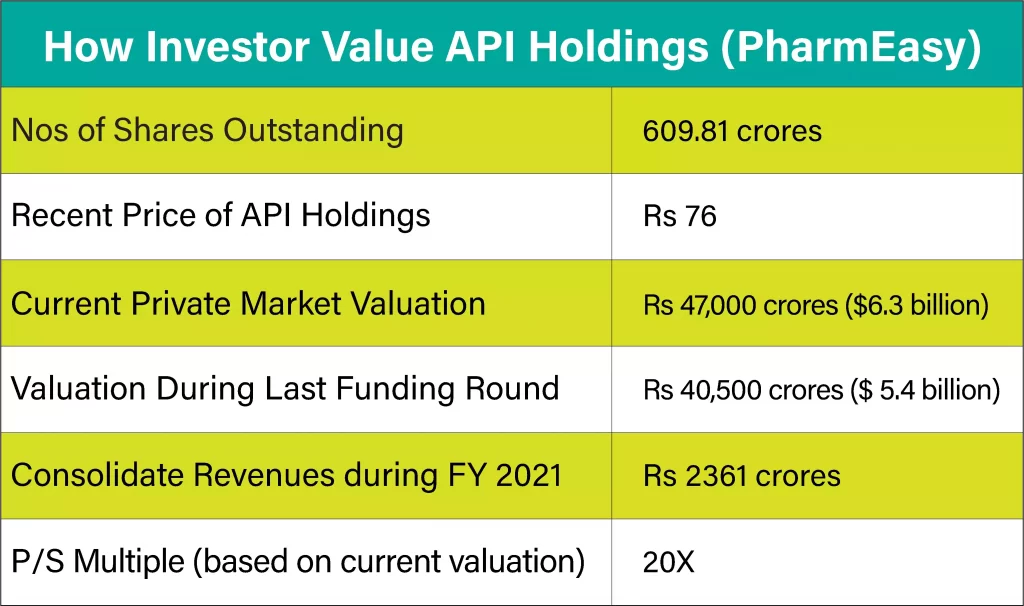

Unlisted price movement

In the last few months, the price of API Holdings shares have tanked significantly. From Rs 135-140 a quarter ago, it is now trading at around Rs 72-77, meaning a drop of 50% in the period. The correction is likely because of uncertainty about the timing of the IPO. But it also presents a good opportunity to buy. [Click here to know the latest price of API Holdings (PharmEasy unlisted share price]

Valuation

Going by the current price in the unlisted market at Rs 72-77, it is valued at Rs 47,000 crore or about $6.3 billion. It generated consolidated sales of Rs 3.87 per share during FY21. That means, investors are currently willing to pay Rs 20 for every rupee of sales it generated during FY21. Though the actual valuation looks ‘cheaper’ based on the FY 2021 sales data, it does not capture figures of Medlife and Thyrocare, the companies API Holdings acquired during FY 22.

Read our other blogs: