20th July, 2022

Let us first know what TATA TECHNOLOGIES are. So, Tata Technologies Limited (TTL) is a global product engineering and digital services company focused on fulfilling its mission of helping the world drive, fly, build, and farm by enabling global OEMs and their ecosystem of partners across the automotive, industrial machinery, aerospace, and adjacent verticals engineer, manufacture, and realize better products, as well as help them drive efficiencies in their businesses. This helps customers develop products which are safe, sustainable, and better for the end customer, environment, and society at large.

The vision of Tata technologies focuses on “Engineering a better world” through collaborative innovation and the adoption of sustainable technologies and processes. The focus is merely on sustainable engineering solutions, including end-to-end offerings on Electric Vehicles (EVs), that enables OEMs to transform the portfolio and reduce tailpipe emissions, thereby leading to a better environment for people around the world.

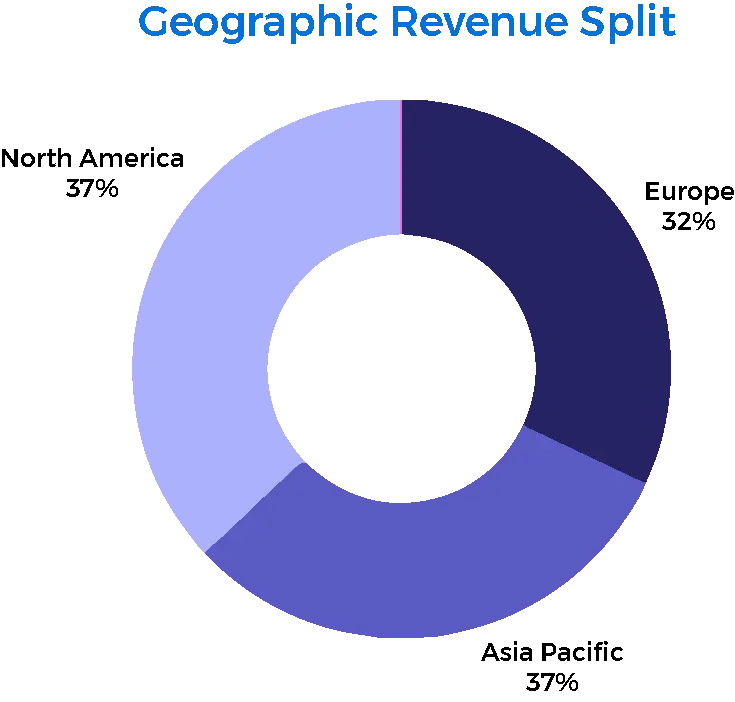

Tata Technologies has over 9300 employees serving global customers across three continents through a uniquely balanced on-shore/offshore global delivery model that enables to provide aligned on-shore customer proximity required to support the iterative nature of product development services together with the capacity and cost-effectiveness of offshore locations.

The Vision is to engineer a better world by helping clients realize better products thereby improving the quality of lives that are exposed to those products. Tata Technologies achieve this through their product engineering expertise focused on manufacturing technologies, light weighting, frugal engineering, electrical vehicle programs, and associated Digital solutions thereby helping design, develop, manufacture, and service products that are safer, have a lower carbon footprint, and deliver a better experience which in turn, contributes towards a better world for its stakeholders.

The Mission is to help the customers across industry verticals drive (Automotive), fly (Aerospace), build and farm (Industrial machinery) better products through our offerings. The Product will be better for its clients owing to the application of our competencies and solutions that help them drive efficiencies in their business and help them realize better products.

Core Values Are One Team with customers, Global Mindset, Can Do attitude.

Permission to play values are Team Player (hunger, integrity, positive attitude), High Performance, Commitment to Community, Courageous Heart, Better & Better (constantly striving to improve).

Aspirational values are Commitment to Mastery, Agile, Dare to Try and Healthy Company (People Orientation, Family, Cohesion, Empathy, Mutual Trust, Humility, Communicators).

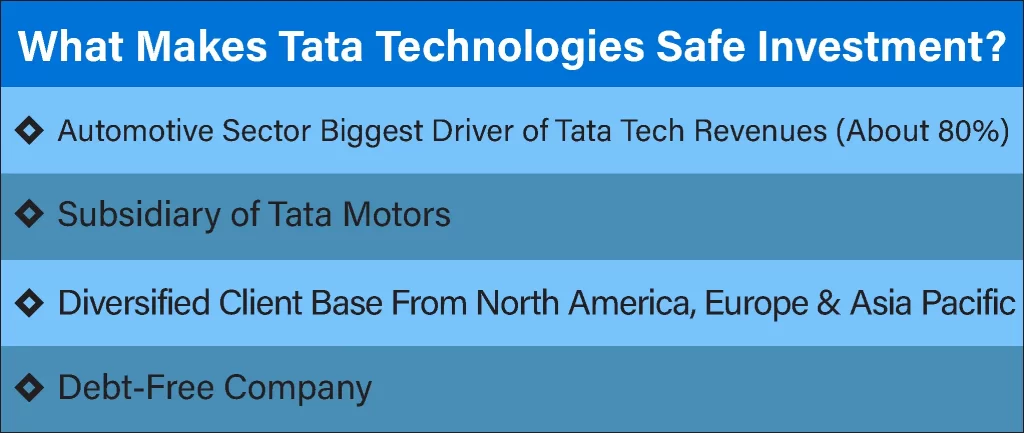

Though the same is undertaken by TCS as well, it is one of the many domains. Simply put, think of Tata Technologies as a design company with IT abilities and TCS as a IT company with design abilities. TCS, needless to say, is a huge company and TTL is in the growth stage.

Tata Consultancy Services (TCS) is most highly rated for Job security and advancement and Tata Technologies is most highly rated for Work/life balance. Tata Consultancy Services (TCS) is focusing on growth and transformation to expand revenue from existing clients by offering them more services. TCS helped Tata Communications Ltd build new products and services. The time taken for customer invoice processing was reduced from weeks to under one day. The systems integration programs across business units helped establish a single version of truth and improve accountability. These initiatives have delivered real business value and enhanced the company’s revenue, operational efficiency, and customer experience.

Analysts believe that the move is a great one for TCS, which is trying to transition from a traditional outsourcing business towards agile digital contracts “With continuous guidance from Chandra and the support of the TCS team, I am confident of continuing this great journey that TCS is on,” Gopinathan said after his elevation to the CEO post. Gopinathan is being seen as an excellent choice for the top position not just because he has been a great CFO for TCS but also because he was part of Chandra’s core team, signalling continuity in TCS’s strategy to customers, employees, and investors.

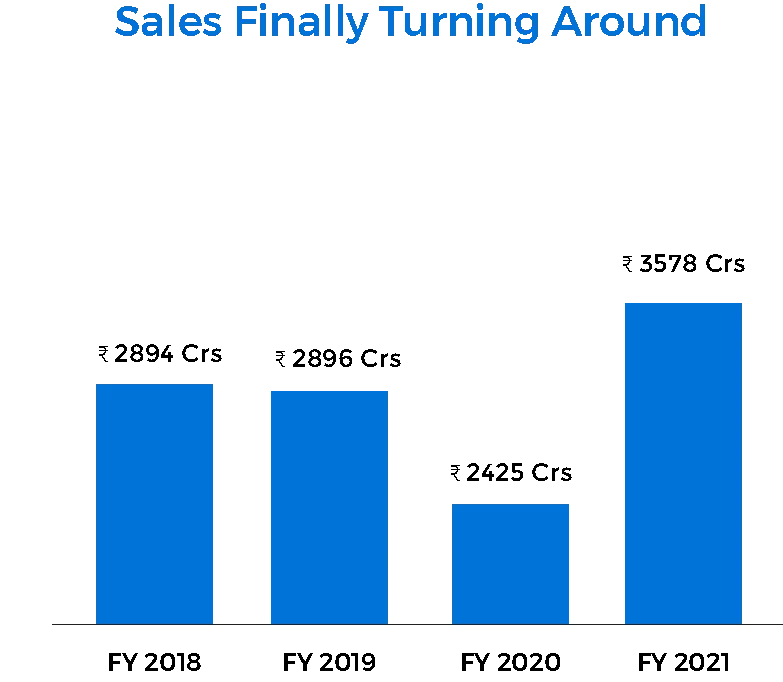

Tata Technologies is a global leader in engineering services outsourcing and product development IT services to the global automotive and manufacturing industry. While considering its annual report of 2020-2021, one could ascertain that the Operating revenue of the Company recorded a decrease of 15.6% during financial year 2020-21 over previous financial year on a standalone basis. The revenue decline on a standalone basis mainly consists of a decline of 16.9% in sale of services to 896.82 crore, while sale of products declined by 6.2% to ₹ 154.02 crore. On Consolidated basis, the Group recorded a decrease in revenue from operations by 16.5%. The Revenue from operations decreased to 2,380.91 crores during financial year 2020-21 compared to 2,852.05 crores during previous year. The revenue from sale of services decreased by 17.5% to ₹ 1,917.74 crores in financial year 2020-21 compared to ₹ 2,324.08 crores in financial year 2019-20 while product revenue decreased by 8.6% to ₹ 463.16 crore compared to ₹ 506.52 crore during previous financial year.

During the year under review, the Company did not receive any dividend from its subsidiaries. The PBT decreased by 61.8% to ₹ 146.64 crores in the financial year 2020-21 compared to 383.60 crores in the previous financial year on a standalone basis. The PAT decreased to 108.21 crore in the financial year 2020-21 compared to ₹291.92 crore during the previous financial year on a standalone basis. On Consolidated basis, the Group earned a PBT of ₹315.27 crores during financial year 2020-21 compared to ₹ 391.97 crore during previous financial year registering a decrease of 19.6% over previous financial year. The PAT decreased by 4.9% to 239.18 crore in the financial year 2020-21 compared to ₹ 251.55 crore in the previous financial year.

Tata Technologies has a strong product portfolio and has clients across diversified industries across the globe, which has benefited the Tata Technologies Limited share price. The company has delivered superb results during 9M FY 22 and the guidance for the entire year is also better. Tata Technologies has a market size which will benefit the company. It is expected to grow at a good pace at least for the next few years which may give good returns to the shareholders of the company. (Click here to know the latest share price of Tata Technologies Ltd)

Tell us in the comments section below whether you would like to invest in Tata Technologies Ltd unlisted shares.

Read our other blogs: